By: Todd Glider, Chief Business Development Officer, MobiusPay Inc.

Contributing Authors: Paul Dunford, Green Check Verified | Shawn Kruger, Avivatech | Kameron Richards, Kameron Richards Esq.

Produced by: NCIA’s Banking & Financial Services Committee

If you are a cannabis-related business, and are looking to accept credit cards, it is only possible to do so if you are selling a product that is defined as legal hemp by the 2018 Farm Bill.

The 2018 Farm Bill provides that:

“The term ‘hemp’ means the plant Cannabis sativa L. and any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis.”

For the most part, it’s pretty cut-and-dry. Marijuana is a schedule 1 drug. Hemp is not. If your product has less than .3% Delta-9 on a dry weight basis, it’s not marijuana, it’s hemp. And since it’s hemp, it’s federally legal. And since it’s federally legal, it can be purchased with checks, credit cards, or debit cards. Hemp products are, reductively, as incendiary as a stick of butter.

Of course, there is the law and there is how acquiring banks—banks that offer merchant accounts—interpret the law. Across the U.S., there are hundreds of acquiring banks. Of those, only six or seven offer merchant accounts to hemp businesses.

That’s it, plus payment service provider Square.

The immediate problem for the few acquiring banks that have, laudably, said, “Yes,” to hemp is, “how do we distinguish products that are .3% Delta-9 or less (and therefore, yawningly legal) from those that are over .3% Delta-9 (and therefore, illegal as angel dust)?”

Enter the Certificate of Analysis, or COA, or lab report. While there is nothing in the law stating that COAs are required to prove that a product is within the federally legal limit, their role is sacrosanct during the boarding process. For every hemp-derived product, there must be a corresponding COA proving that the product being sold is hemp, and not marijuana.

Fortunately, there are labs across the nation. The U.S. Department of Agriculture website lists 85, as of May 2023. Manufacturers and businesses ship their samples to these labs. The labs run their tests and the COAs are issued.

Simple, right?

Not really.

There are no standards in place for these reports. No templates. Every laboratory’s COAs—while substantively providing the same information—look a little different. Furthermore, most bankers haven’t seen a lab report since high school chemistry, and you’ve got a recipe for confusion or misunderstanding (frequently both).

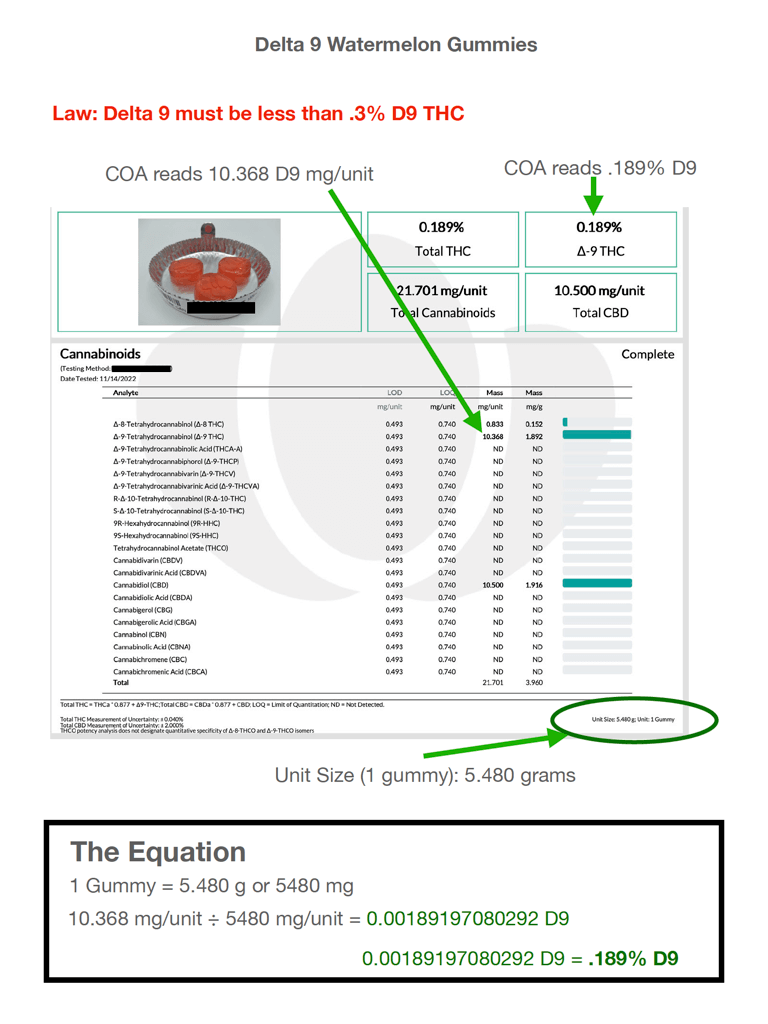

This COA, when it was initially presented to the bank, was rejected. To the underwriter, it was an open and shut case.

When the bank opened its door to offering acquiring to hemp businesses, its policy was to reject anything with greater than .3% Delta-9 by weight.

The top of this COA showed an instance of Delta 9 that read .189%. That passed muster, certainly. However, when he delved further into the analyte detail, he noted additional Delta-9 figures in excess of the .3% limit:

- 10.368 in the mg/unit cell

- 1.892 in the mg/g cell

It was not clear to the bank’s underwriter which of the two—per-unit or per-gram—corresponded with the by-weight percentage he was to be mindful of, but both were certainly over the .3% limit.

So, open and shut case: DECLINED

The salesperson that brought the merchant to this bank was surprised by the rejection. He hadn’t looked at the COAs very closely, but it seemed unlikely that this merchant had been selling products on her website that were in excess of .3% Delta-9.

Why? Because if the merchant had been selling products on its website in excess of .3% Delta-9, it would have been engaging in egregious felony drug trafficking. The salesperson doubted that was the case.

The salesperson did something he didn’t normally do: he took out his calculator.

He wanted to know why it read .189% Delta 9 at the top, but 10.368 in the analyte table. He noted the unit size at the bottom of the page was a gummy weighing 5.480g.

For the sake of simplicity, he multiplied that by 1000 to convert it to milligrams. That made it 5480 mg

Then he entered the onerous 10.368mg from the mg/unit figure in the analyte table and divided it by 5480mg. The resulting calculation netted the following total: .0018919.

Next, he converted it to a percent, and found that the result was .189%, which matched the figure at the top of the COA, exactly.

The next day, the salesperson presented the COA to the bank, with the markings and The Equation just as shown here.

It was an open and shut case: ACCEPTED

This situation is an example of why banks and credit unions unknowingly reject compliant hemp businesses from merchant processing solutions. As stated, a simple mathematical calculation was the difference between being accepted or rejected for necessary merchant processing services. Without proper merchant servicing not only are cannabis businesses’ profitability affected because they can only take cash; cash is also not as traceable or auditable as electronic transactions.

In general, businesses providing services to the cannabis industry are often challenged with disentangling legal risks with the benefits of their necessary services providing more transparency. With enhanced knowledge of the cannabis industry and its parameters, the cannabis industry will recognize a greater participation by all businesses necessary for the life of the industry thereby enhancing cannabis businesses’ likelihood to succeed but also enhancing the legitimacy and regulation of the industry.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–