by Beau R Whitney, NCIA’s Chief Economist

by Beau R Whitney, NCIA’s Chief Economist

The first half of the year was a strong one for cannabis revenues. After a strong first quarter, with $5.9 billion in revenue, cannabis retailers are experiencing continued growth in Q2 with preliminary results coming in at $6.2 billion to $6.5 billion.

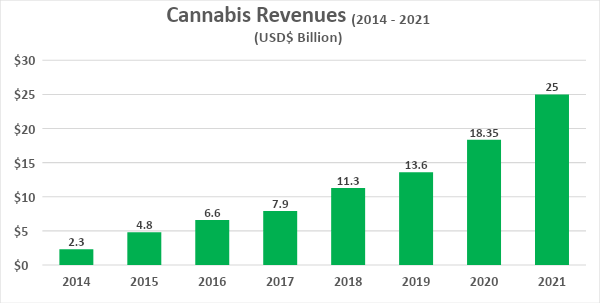

If this trend remains in the second half of the year, the cannabis retail sales are projected to be $24.5 to $25 billion for the year. This would reflect another cycle of 35% year-over-year growth.

Source: Whitney Economics, Leafly

Strong growth in the first half of the year, does not necessarily mean huge profits for the cannabis industry.

While the industry has seen strong growth over the past year, this does not necessarily mean that the industry as a whole is in good shape. Retailers are struggling to make profits due in a large part to federal taxation. IRC 280E does not allow entities conducting business in federally illicit trade, such as cannabis, to write off common and ordinary deductions from their federal taxes. As a result, cannabis operators pay significantly more taxes than other businesses. This has long been an issue with the cannabis industry and organizations such as NCIA has been working tirelessly to address this, but as long as it remains a federal policy it will be negatively impacting the industry.

Cannabis retailers are taking the brunt of federal tax policy.

With over $12 billion in first-half revenues, cannabis retailers will be on the hook for $1.2 billion in federal taxes for the first half of the year alone. This is $756 million more than what “normal” businesses would pay. Cannabis retailers are forecasted to pay over $1.5 billion more in taxes in 2021 and, when combined with the rest of the supply chain, will pay over $2.2 billion in additional taxes in 2021.

| 280e Example of Impact on Retail | Normal Business | 280E Business | Comment | |

| Retail mid-Year Revenue | $12,000,000,000 | $12,000,000,000 | Based on data from Whitney Economics | |

| Cost of Goods Sold (COGS = 50%) | $6,000,000,000 | $6,000,000,000 | ||

| Ordinary and Necessary Expenses (30%) | $3,600,000,000 | $3,600,000,000 | Not allowed under 280e | |

| Real Pre-Tax Profit w/o 280e | $2,400,000,000 | $2,400,000,000 | ||

| Taxable Profit | $2,400,000,000 | $6,000,000,000 | Big difference in taxable rates | |

| Fed Tax @21% * | $504,000,000 | $1,260,000,000 | Retailers pay 150% more | |

| Effective tax rate | 21.0% | 52.5% | Some effective tax rates approach 60%-70% | |

| Net Annual Profit (Before State Tax and Debt Service) | $1,896,000,000 | $1,140,000,000 | A difference of $201,000 per year per retailer |

Source: Whitney Economics

*Assumes taxed at C-corporation rates

The effective tax rate is forecasted to increase with corporate tax increases.

The effective tax rate increases significantly for retailers and in many cases exceeds 60% to 70%. The level of additional taxes that cannabis operators pay, over the course of the next five years, will increase by an average of $630 million per year for the industry if the business tax rates increase from 21% to 28%. Depending on how corporate tax policy negotiations are settled, things may go from bad to worse for cannabis retailers.

Cannabis retailers are struggling to make ends meet.

Based on sales data from 2020, there were over 7,550 licensed cannabis retailers in the U.S. with each retailer generating an average of $2.4 million per year. This is right around the amount of revenue required to be a sustainable retail business. In 2021, there have been roughly 1,000 more retailers licensed and even with an increase in sales, retailers are only forecasted to average $2.7 million per year.in sales. In fact, in 13 states, retailers are not projected to average the $2.4 million per year to remain viable. While retailers in some states may be OK, other retailers are not able to make ends meet.

What do these numbers tell us?

IRC 280E will reduce cannabis retailers cash flow by $200,000 in 2021 and that $200,000 would go a long way in shoring up the finances and provide retailers with the breathing room they need to remain viable. 280E reform would allow retailers to pay for health care for more employees, hire more workers and expand their business. However, in the current environment, many cannabis operators will continue to struggle.

The key message here is that retailers are under duress due to 280E and policy reform in the area of federal taxes may make the difference between success and failure. The time for reform is now, before it is too late.

Learn more in a recent NCIA Fireside Chat webinar with an all-star panel of accounting experts and operators to dive deep into all things 280E.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–