Member Blog: A Fire Under Cuomo Lights the Way — 5 Things To Know About Adult-Use Cannabis in New York

By Charles J. Messina, Esq., Jennifer Roselle, Esq. and Donald W. Clarke, Esq. of Genova Burns LLC

After several failed attempts, and seemingly the result of catching significant political heat as of late, Governor Cuomo is allowing the adult-use cannabis industry to blaze forward in New York.

With Gov. Cuomo’s signature, the bill (S.854-A), known as the “Marihuana Regulation and Taxation Act” (MRTA), establishes the legislative foundation upon which a regulatory infrastructure will be built to host a network of licensed operators to cultivate, process, distribute, sell, and host cannabis consumers. In addition to regulating adult use of cannabis, MRTA also amends the state’s existing medical use law (the New York Compassionate Care Act) and provides, among other things, rules for hemp, CBD, and other cannabis extracts.

What does MRTA mean for New Yorkers?

First, adults may personally possess up to 3 ounces of plant cannabis (and 24 grams of “concentrated cannabis”) without being prosecuted or arrested. In addition to decriminalization, the law also expunges convictions based on conduct which is now authorized under MRTA.

Unlike New Jersey’s recently approved cannabis legislation, consumption of cannabis will be permitted in the same (or similar) places as vaping and cigarettes. Also, New Yorkers will be able to grow their own cannabis. Although “home grow” will be delayed for months until after more rules are promulgated and retail sales commence, a household will be able to grow a maximum of up to twelve plants (six mature, and six immature), with a five-pound possession limit for adults.

Throughout MRTA, there is a heavy focus on social and economic equity. This is integrated in the application process, apportionment of tax revenue, and adjustments made to the penal code. Certain applicants can qualify as a “social and economic equity applicant” to help the Office of Cannabis Management reach its goal of awarding 50% of licenses to minority or woman-owned business enterprises, distressed farmers, or service-disabled veterans.

What is the Office of Cannabis Management?

Similar to New Jersey, the law’s terms will be supplemented by not-yet-created regulations. The regulatory framework will be created by a cannabis Advisory Board and carried out by the newly established Office of Cannabis Management (OCM). The OCM will be an independent office operating as part of the New York State Liquor Authority. It will have a five-member board, with three members appointed by the Governor and one appointed by each house.

What types of licenses are there and when will sales get rolling?

Because much of the regulatory licensing framework does not yet exist, there is no established start date. Reports suggest sales could commence as early as December 2022. Home-growers for recreational use must wait no less than 18 months after the initial retail sales to plant their seeds. The tiered licensing structure prohibits those upstream in the production process from selling to the general public.

The available licenses include:

*Cultivator License—includes the agricultural production of cannabis and minimal processing and preparation.

*Processor License—includes blending, extracting, infusing, packaging, and preparing cannabis for sale. There is a limit of one license per processor, but each license can authorize multiple locations.

*Distributor License—authorizes the acquisition, possession, distribution, and sale of cannabis from a licensed cultivator or processor to retail dispensaries and on-site consumption sites.

*Retail Dispensary License—authorizes the sale of cannabis to consumers, with a limit of three retail dispensary licenses per person. A retail licensee may not also hold a Cultivator, Processor, Microbusiness, Cooperative, or Distributor License.

*Cooperative License—authorizes the acquisition, possession, cultivation, processing, distribution, and sale from the licensed premises of the cooperative to distributors, on-site consumption sites, and retail dispensaries, but not directly to consumers.

*Microbusiness License—authorizes limited cultivation, processing, distribution, delivery, and dispensing of the licensee’s own adult use cannabis and cannabis products. A microbusiness licensee may not hold any other license, and may only distribute its own products to dispensaries.

*Delivery License—authorizes the delivery of products by licensees independent of another license.

*Nursery License—authorizes the production, sale, and distribution of clones, immature plants, seeds, and other agricultural products used specifically for the planting, propagation, and cultivation of cannabis by cultivators, cooperatives, and microbusinesses.

*On-Site Consumption License—authorizes the establishment of a location for the on-site consumption of cannabis.

How will cannabis be taxed in NY and where is the revenue going?

MRTA places the tax on cannabis based upon the amount of the chemical compound that delivers effects to users (THC). There will be a 9% state tax at the retail level. A local excise tax will be 4% of the retail price. Counties will receive 25% of the local retail tax revenue, and 75% will go to the municipality. Municipalities can, however, enact legislation to opt out of permitting retail dispensaries or on-site consumption licenses within its borders.

MRTA mandates that 40% of the estimated $350 million in tax revenues will go to community grants and reinvestment, and 20% will go to drug treatment and education. The final 40% is earmarked for schools as of now.

What will be the impact on NY employers and employees?

Employers have no legal obligation to permit adult-use cannabis in their workplace. In addition, while offsite usage is protected, the law includes provisions that allow employers to take action against employees who are impaired at work if their performance is lessened, or the employee’s conduct interferes with the ability to provide a safe and healthy workplace. Employers may likewise act to comply with local, state, or federal laws or allow conduct that would result in loss of a federal contract or federal funding.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

For over 30 years, Genova Burns LLC has partnered with companies, businesses, trade associations, and government entities, from around the globe, on matters in New Jersey and the greater northeast corridor between New York City and Washington, D.C. We distinguish ourselves with unparalleled responsiveness and provide an array of exceptional legal services across multiple practice areas with the quality expected of big law, but absent the big law economics by embracing technology and offering out of the box problem-solving advice and pragmatic solutions.

Given Genova Burns’ significant experience representing clients in the cannabis, hemp and CBD industries from the earliest stages of development in the region, the firm is uniquely qualified to advise investors, cultivators, processors, distributors, retailers and ancillary businesses.

Member Blog: It’s Still Snowing – But is Jersey’s Grass Finally Green?

by Charles J. Messina, Esq., Jennifer Roselle, Esq., and Daniel Pierre, Esq. of Genova Burns LLC

The seeds are planted: Earlier this week, Governor Murphy finally signed the enabling legislation for adult use into law. Although voters approved a referendum to legalize adult use of cannabis back in November, lawmakers’ efforts to draft the enabling legislation often went up in smoke. Until recently, the governor’s office and legislative leaders couldn’t decide how to address underage possession and use of cannabis. Now, lawmakers agree that minors should be subject to a three-tiered warning system in lieu of hefty fines.

But for adults, the Governor’s signature does not allow for immediate access to or use of recreational cannabis. Even with the passage of the recreational use law, residents cannot grow their own cannabis at home or legally purchase it without a medical marijuana card. Presently, there are no dispensaries authorized to sell adult-use cannabis.

Medical dispensaries, however, are expected to be the first access point for the adult-use cannabis market. There are 13 medical dispensaries serving the 100,000+ medical patients in the Garden State, and 24 new medical marijuana licenses are expected to be announced soon, many of which will be designated as dispensaries. Once the existing medical dispensaries demonstrate to the CRC that they have satisfied the medical needs of their patients, and that they have municipal approval for adult-use sales, they should be the first to sell to adults 21 and over.

In order for the Garden State to grow a recreational market, the CRC requires the appointment of two more members. Once all five members of the CRC are appointed, it has a specific timeframe to promulgate the rules that will regulate New Jersey’s recreational use industry. The CRC must, for example, fully develop the criteria and application process for the following six classes of recreational licenses that applicants can apply for:

Class 1 Cannabis Cultivator license — permits growing, cultivation or production of cannabis in New Jersey. Cultivators are also permitted to sell and transport cannabis to other cultivators, manufacturers, wholesalers or retailers, but not to consumers.

Class 2 Cannabis Manufacturer license — permits the manufacturing, preparing and packaging of cannabis and selling it to other cannabis manufacturers, wholesalers, retailers, but not to consumers.

Class 3 Cannabis Wholesaler license — permits the storage and sale of cannabis strictly for resale to another wholesaler or retailer, but not to consumers.

Class 4 Cannabis Distributor license — permits the intrastate transportation of cannabis in bulk from one licensed cannabis establishment to another licensed cannabis establishment. Distributors may also engage in the temporary storage of cannabis as necessary to carry out transportation activities.

Class 5 Cannabis Retailer license — permits the sale of cannabis directly to members of the public from a retail store. Cannabis retailers may also operate cannabis consumption areas for consumers.

Class 6 Cannabis Delivery license — permits courier services for consumer purchases of cannabis by a cannabis retailer directly to consumers.

Once established, we anticipate applications for licensing to be announced. This will certainly happen after the epic snowfall melts, but many New Jerseyans and others are already starting to get their fertilizer ready…

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Daniel Pierre is an Associate in Genova Burns’ Newark, NJ office and a member of the Cannabis and Labor Law Practice Groups. In addition to labor work, he likewise assists clients in the cannabis industry, from analyzing federal and state laws to ensure regulatory compliance for existing businesses to counseling entrepreneurs on licensing issues.

Daniel Pierre is an Associate in Genova Burns’ Newark, NJ office and a member of the Cannabis and Labor Law Practice Groups. In addition to labor work, he likewise assists clients in the cannabis industry, from analyzing federal and state laws to ensure regulatory compliance for existing businesses to counseling entrepreneurs on licensing issues.

For over 30 years, Genova Burns has partnered with companies, businesses, trade associations, and government entities, from around the globe, on matters in New Jersey and the greater northeast corridor between New York City and Washington, D.C. We distinguish ourselves with unparalleled responsiveness and provide an array of exceptional legal services across multiple practice areas with the quality expected of big law, but absent the big law economics by embracing technology and offering out of the box problem-solving advice and pragmatic solutions.

Given Genova Burns’ significant experience representing clients in the cannabis, hemp and CBD industries from the earliest stages of development in the region, the firm is uniquely qualified to advise investors, cultivators, processors, distributors, retailers and ancillary businesses.

Member Blog: The Explosive Growth of California Cannabis Licenses and What Comes Next

by Ed Keating, Co-founder of Cannabiz Media

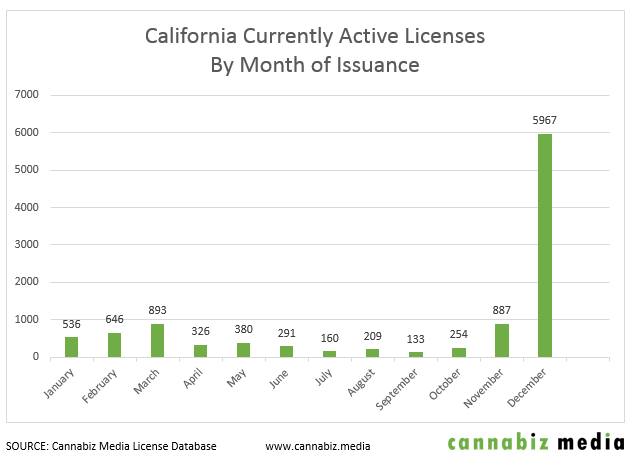

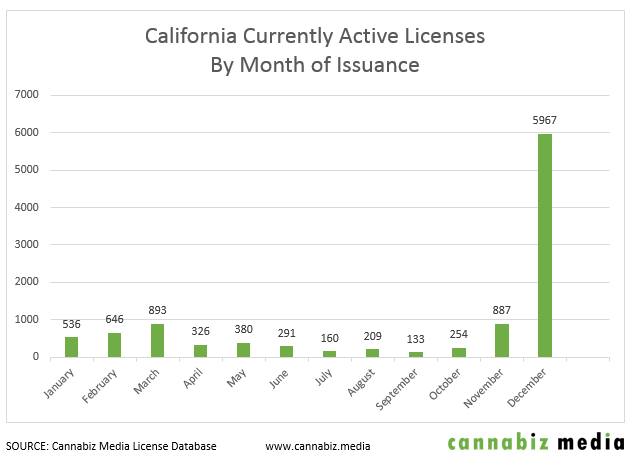

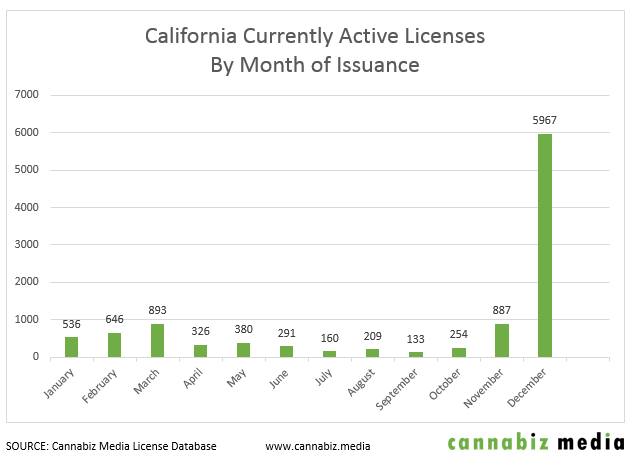

We’re more than one year into California’s legal cannabis industry and license growth continued on a fast-rising upward trajectory through the end of 2018. In fact, between November 1, 2018 and December 31, 2018, California issued a total of 6,855 new cannabis licenses according to the Cannabiz Media License Database as people worked extended hours to process the remaining temporary license applications.

To put that number into perspective, California had 4,085 active licenses as of October 31, 2018. During the next 61 days, the state more than doubled that number to 10,940 active licenses on December 31st. You can see the data visually in the chart below.

Majority of Licenses Granted Went to Cultivators

Of the 6,855 licenses granted in California during November and December 2018, 65% were issued to cultivators by the California Department of Agriculture.

Distributor licenses accounted for 14% of the licenses granted during that two month period, followed by manufacturer licenses at 12%, retailers/dispensaries at 3%, microbusinesses at 3%, delivery businesses at 3%, and testing labs at less than 1%.

Cultivators Continue Stacking Licenses

During the final two months of 2018, 45 license holders gained double digit licenses, which accounted for 24% (1,665) of the 6,855 new licenses issued. One reason for this is because cultivator licenses are skyrocketing as more growers secure multiple small licenses to create large cultivation facilities.

Between November and December 2018, five companies received 729 cultivator licenses, which equates to more than 16% of cultivator licenses granted during that time and nearly 11% of all licenses awarded during that time.

Those five companies are Coyote Hills Agricultural Enterprises (210 new licenses), White Light Farms (173 new licenses), BDZ, Inc. (134 new licenses), Iron Angel II, LLC (133 new licenses), and Busy Bee’s Organics (79 new licenses).

Distributor Licenses Saw the Most Growth in Late 2018

While new cultivator licenses grew by the largest quantity during November and December 2018, new distributor licenses saw the largest growth jump over the previous 10 months of the year.

The number of new distributor licenses issued in December and November 2018 was nearly double the amount granted in the previous 10 months. Manufacturer licenses issued increased by 188%, cultivator licenses by 178%, testing licenses by 68%, and retailer/dispensary licenses by 58%.

What’s Next for California’s Cannabis License Holders?

California has stopped issuing temporary cannabis licenses, and throughout 2019, many of the temporary licenses awarded during 2018 will expire. Each of these temporary licenses will need to become provisional and/or annual licenses in order for the license holders to stay active in California’s cannabis industry.

A few months in 2019 stand out as ones to watch because a large number of temporary licenses will expire. In March, 1,559 licenses will expire. In April, the number of expiring licenses jumps to 4,731, and in July, another 2,453 temporary licenses will expire. During other nine months of 2019, the number of licenses that will expire ranges from three licenses in October to 682 licenses in May.

Clearly, the story of cannabis licensing in California is far from over, and the Cannabiz Media team will be watching closely and tracking all of it in the Cannabiz Media License Database. Follow the link to see more data and insights related to license growth in California during the last two months of 2018.

Ed Keating is a co-founder of Cannabiz Media and oversees our data research and government relations efforts. He has spent his whole career working with and advising information companies in the compliance space. Ed has overseen complex multijurisdictional product lines in the securities, corporate, UCC, safety, environmental and human resource markets and focuses on workflow products. Ed has spent the last twenty five years in the information industry. During that time he has worked for both startup and established information companies where he has led marketing, product management and sales organizations. These companies include Wolters Kluwer/Commerce Clearing House, CT Corporation, EDGAR Online and Business & Legal Reports. At Cannabiz Media Ed enjoys the challenge of working with regulators across the country as he and his team gather corporate, financial, and license information to track the people, products and businesses in the cannabis economy. Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University. He has been active with the Software & Information Industry Association for his whole career and managed the Content Division for six years. He’s was recently a Trustee at the Country School in Madison CT and a Little League Coach for seven years.

Ed Keating is a co-founder of Cannabiz Media and oversees our data research and government relations efforts. He has spent his whole career working with and advising information companies in the compliance space. Ed has overseen complex multijurisdictional product lines in the securities, corporate, UCC, safety, environmental and human resource markets and focuses on workflow products. Ed has spent the last twenty five years in the information industry. During that time he has worked for both startup and established information companies where he has led marketing, product management and sales organizations. These companies include Wolters Kluwer/Commerce Clearing House, CT Corporation, EDGAR Online and Business & Legal Reports. At Cannabiz Media Ed enjoys the challenge of working with regulators across the country as he and his team gather corporate, financial, and license information to track the people, products and businesses in the cannabis economy. Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University. He has been active with the Software & Information Industry Association for his whole career and managed the Content Division for six years. He’s was recently a Trustee at the Country School in Madison CT and a Little League Coach for seven years.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions. Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling. Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

Jennifer Roselle

Jennifer Roselle Daniel Pierre

Daniel Pierre

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

News & Resource Topics

–

This Just In

How THCa Vapes Are Changing Consumer

Announcing NCIA’s 2026-2028 Board of Directors