Watch this webinar recording in case you missed the live presentation from December 17.

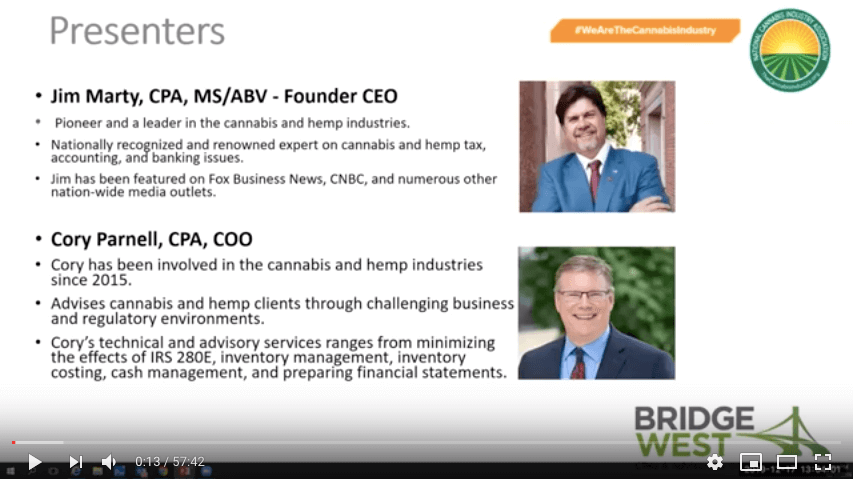

Legal cannabis has been spreading across the United States for over 10 years now. How has the industry been viewed in the eyes of the IRS? The cannabis industry has consistently lost in tax court against the IRS. Can these businesses be profitable on an after-tax basis? Do management companies help with profitability? Jim Marty and Cory Parnell of Bridge West LLC, CPAs and Consultants to the cannabis industry will explore these questions in light of recent tax cases.

Learning Objectives:

1. The session will help attendees understand the implications of recent Tax Court decisions that involve IRS Code Section 280E.

2. Learn how to avoid double taxation with related party management companies.

3. Explore the Eighth Amendment to the U.S. Constitution regarding excessive fines and penalties. Hear the arguments that conflict with 280E.

4. In light of the above, learn how C-Corporations can help protect again personal liability for dispensary income taxes.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–