by Jimmy Makoso, Vice President of Lucid Oils

2015 was a very exciting time in the cannabis industry. According to public opinion polls conducted in the U.S., between 51% and 58% of respondents were in support of legalization. The highest level of support comes from the age range of 18-34, showing a staggering 71% supporting full legalization.

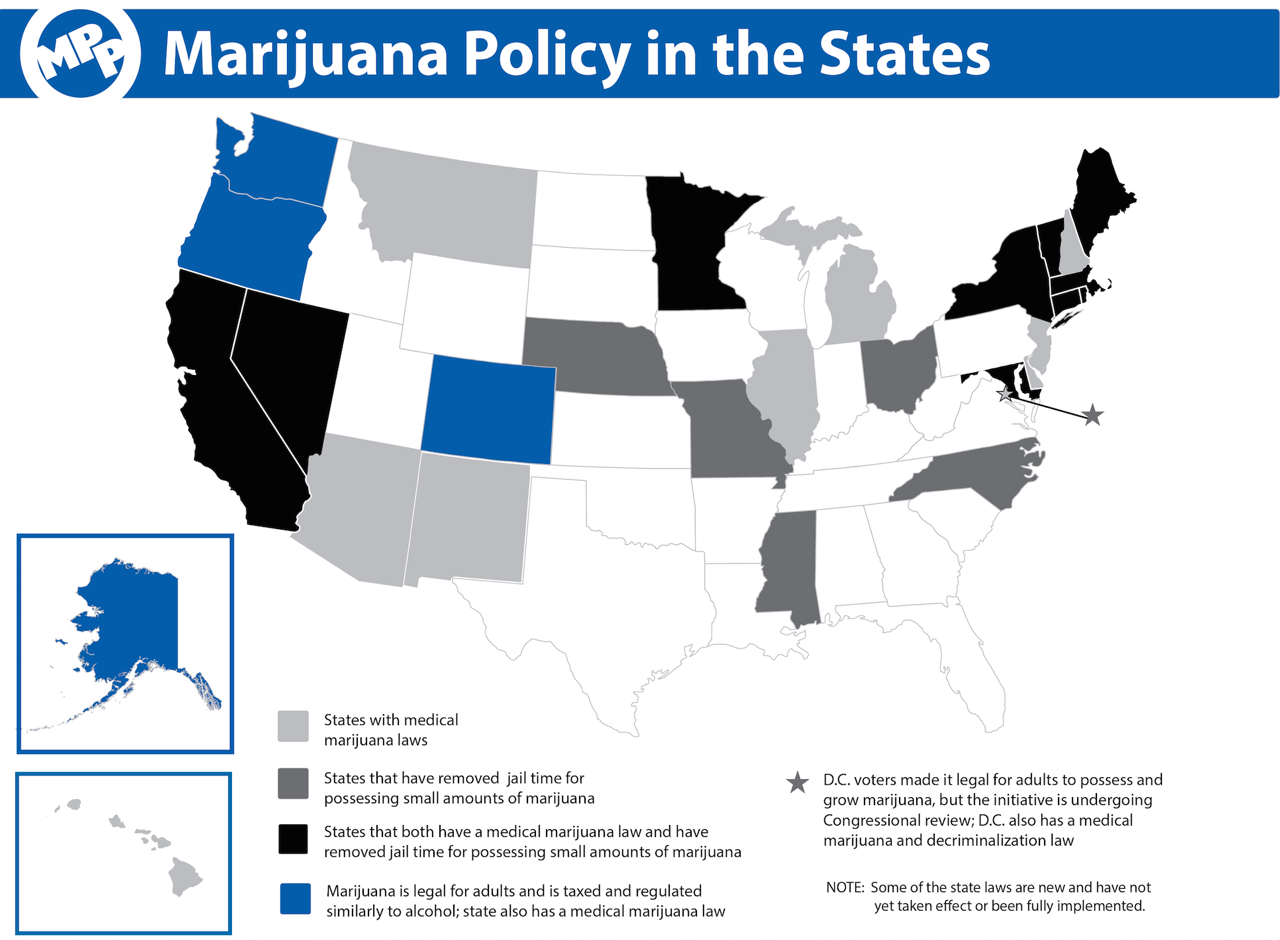

In 2015, several states voted for some form of cannabis proliferation, and many more have taken decriminalization measures. With a year of adult-use retail cannabis now completed in Colorado and Washington, and the start of full legalization in Oregon, the tide seems to be slowly but steadily shifting.

Reflecting back on 2015, here were a few of the notable developments that resonated throughout the cannabis industry.

Emerging Markets

Currently there are twenty-three states and the District of Columbia that have laws legalizing cannabis usage in some form. Four states have completely legalized cannabis use for adults 21 and older.

On the medical side, several states opened their first cannabis dispensaries to the public in 2015. Nevada, Massachusetts, Minnesota, Delaware, and Illinois were among these states. Though sales have been slow going for various reasons, 2016 should be a landmark year for legalization in many of these newly developing cannabis markets.

Adult-Use Cannabis Boom

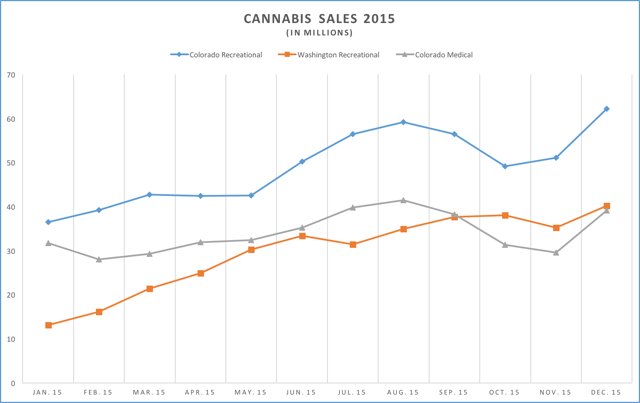

Colorado, Washington, Oregon, and Alaska have all completely legalized the possession of cannabis. On January 1, 2014, Colorado opened its first adult-use cannabis stores, which effectively combined their medical and retail markets. Their combined medical and adult-use system generated more than $699 million in gross revenue in 2014, with approximately $76 million in tax revenue collected. Washington, by comparison, opened its adult-use market in July of 2014 and finished the year with $64 million in total sales and $16 million in tax revenue collected.

The revenue figures for 2015 have eclipsed the previous year’s marks substantially. Colorado gross sales came in just over $996 million for 2015, with $135 million in tax revenue collected from close to 800 stores, servicing about 5.5 million residents.

Washington, by comparison, generated more than $357 million in retail sales, with more than $115 million going to the state as an excise tax. This revenue was generated at approximately 205 licensed stores, servicing 7 million residents.

Meanwhile, Oregon started a partial foray into adult-use cannabis sales by utilizing the existing network of medical dispensaries selectively approved for retail sales of cannabis flowers to anyone 21 and older. In July of 2016, Oregon will completely open its adult-use market. Alaska, with no medical dispensaries or infrastructure, will likely take much longer to develop as a viable market.

2016: Legalization Abounds

With the level of success, both fiscally and socially, that was achieved in relatively small states, it should be expected that 2016 will be a big year for ballot measures legalizing cannabis. There are several states that are gearing up for potential 2016 ballot initiatives. Massachusetts, Maine, Missouri, Ohio, Nevada, California, and Hawaii are the states that seem likely to make it to a vote.

Northeast

In the Northeast, there have been several developments causing optimism throughout the region. New England has taken a very progressive path to legalization. Every state has a medical cannabis market and has decriminalized possession of small amounts of cannabis with the exception of New Hampshire. New Hampshire has made at least six attempts to get decriminalization measures passed, but so far these initiatives have been unsuccessful getting past the State Senate. Ironically, four dispensaries are set to open in 2016 for medical patients that meet the qualifying conditions.

Midwest

Ohio had a ballot measure to legalize cannabis late in 2015. The legislation featured a basic monopoly on production being designated to 10 predetermined groups comprising wealthy residents. Unsurprisingly, there was overwhelming opposition, with the proposed legislation getting shot down by a margin of almost 2:1 against. We’ll likely see a second attempt to pass a legalization measure in 2016.

West Coast

With Washington and Oregon taking legalization measures, California is the next in line. At the end of the session in 2015, Californians passed the Medical Marijuana Regulation and Safety Act. This piece of legislation sets up the regulatory framework for a state-recognized medical marijuana industry. California, being one of the largest states, with a population of over 38 million residents, has had a vibrant quasi-grey market with an estimated 2,000 stores operating within the state. Despite the lack of reported sales figures, estimates of the California market are conservatively $3 billion to $5 billion annually. Should this market be legalized and regulated at some level, this could generate an estimated $450 million to $750 million in tax revenue, should the state impose a 15% tax rate.

2016 should be another historic year for the cannabis industry. With public opinion steadily growing in support of legalization, and the hysteria of an election year, it would not be surprising to see cannabis proliferation take the forefront in the national conversation.

Jim Makoso is an entrepreneur in the cannabis industry. He joined Vuber Technologies as one of the original investors in February 2014. He is currently an Advisory Board Member and shareholder responsible for guiding strategic development. January 2015, Mr. Makoso founded Lucid Labs and Lucid Oils. He currently holds the position of Vice President and is responsible for strategic partnerships and business development.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–