Video: NCIA Today – Thursday, April 20, 2023

It’s the 4/20 Cannabis Industry Update!

Join NCIA Director of Communication Bethany Moore for an update on what’s going on with NCIA and our members.

It’s the 4/20 Cannabis Industry Update!

Join NCIA Director of Communication Bethany Moore for an update on what’s going on with NCIA and our members.

Join NCIA Director of Communication Bethany Moore for an update on what’s going on with NCIA and our members. This week we discuss 13 women scientists you NEED to know, our recent podcast check-ins with members of the New York State Office of Cannabis Management, discuss a recent letter NCIA sent to the Congressional Banking and Finance Committees, and look forward to the remainder of our city events coast-to-coast leading up to Lobby Days in May.

NCIA Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every other Thursday on LinkedIN for NCIA Today Live.

NCIA Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. This week Bethany is joined by NCIA CEO Aaron Smith to talk about the importance of having your voice heard on Capitol Hill at our upcoming 10th Annual Cannabis Industry Lobby Days on September 13-14. Join us every other Thursday on Facebook for NCIA Today Live.

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every other Thursday on Facebook for NCIA Today Live.

The House of Representatives approved legislation again today that would provide safe harbor for financial service providers to work with cannabis businesses that are in compliance with state laws. The Secure and Fair Enforcement (SAFE) Banking Act, or H.R. 1996, was reintroduced in March by Reps. Ed Perlmutter (D-CO), Steve Stivers (R-OH), Nydia Velazquez (D-NY), and Warren Davidson (R-OH), and had 177 total cosponsors by the time of the vote. The legislation was approved by a vote of 321-101, including a majority of voting Republicans.

This is the fourth time that the House has approved the language of the SAFE Banking Act, initially as the first standalone cannabis policy reform bill ever passed by either chamber of Congress in 2019 and two more times last year as part of pandemic relief packages that were not approved in the Senate.

“We are incredibly grateful to the bill sponsors who have been working with us for the last eight years to make this sensible legislation become law and have shepherded it through the House time and again,” said Aaron Smith, co-founder and chief executive officer of the National Cannabis Industry Association. “The SAFE Banking Act is vital for improving public safety and transparency and will improve the lives of the more than 300,000 people who work in the state-legal cannabis industry. It will also help level the playing field for small businesses and communities with limited access to capital. It is time for the Senate to start considering the companion legislation without delay.”

Advocates are hopeful that Senate Banking Committee Chair Sherrod Brown (D-OH) will take up the bill in the near future so that it can begin to move through the upper chamber as soon as possible and become law before the end of the year.

The SAFE Banking Act would protect financial institutions from federal prosecution for providing banking and other services to cannabis businesses that are in compliance with state law, as well as help address serious public health and safety concerns caused by operating in predominantly cash-only environments. The legislation would improve the operational viability of small businesses by helping them reduce costs associated with lack of access to banking and increasing options for traditional lending that many small businesses in other fields rely upon. It would also mandate a study on diversity in the cannabis industry.

Laws making cannabis legal for adults have been passed in 18 states as well as the District of Columbia and the territories of CNMI and Guam, and 36 states as well as several territories have comprehensive medical cannabis laws. The substance is legal in some form in 47 states.

###

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every Friday here on Facebook for NCIA Today Live.

Join NCIA Deputy Director of Communications Bethany Moore and our Government Relations Director Mike Correia for a quick discussion about last week’s historic passage of the MORE Act.

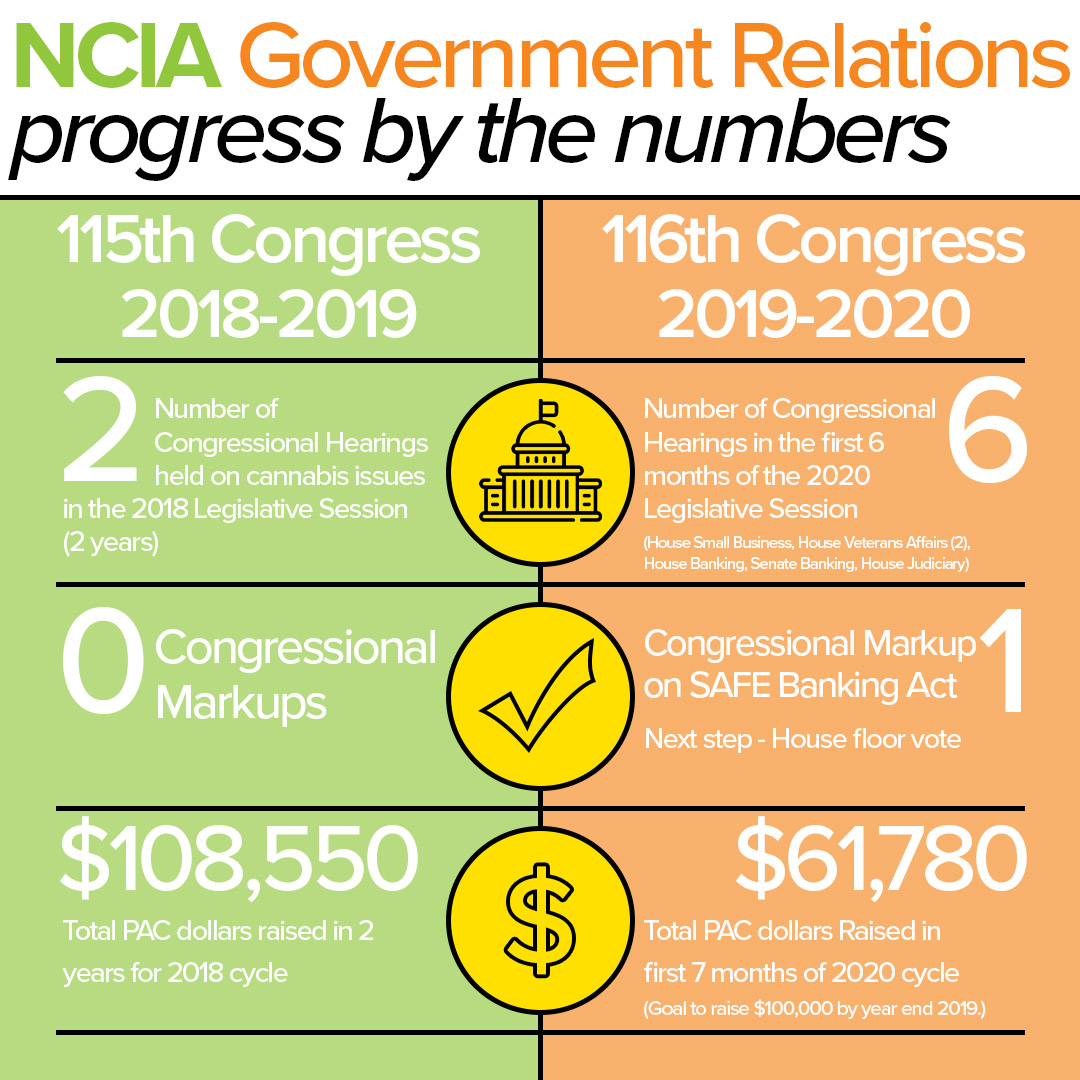

August recess is winding down, and soon, Members of Congress will return to D.C. for the remainder of the year. This year, however, was a benchmark year for cannabis policy, and we still have four months left to go! Let’s take a look back on how 2018 compared to 2019 (so far!).

Number of Congressional hearings held on cannabis issues in the 115th Congress (2017-2018)

The number of Congressional hearings as of August 2019 in the following committees:

House Small Business Committee

House Veterans Affairs Committee (2)

House Financial Services Committee

Senate Banking Committee

House Judiciary Committee

The number of cosponsors the House version of the SAFE Banking Act garnered during the entire 115th Congress.

The number of cosponsors on H.R. 1595, the SAFE Banking Act, just in the first seven months of 2019.

The number of Congressional markups held on a cannabis bill in the 115th Congress.

The number of Congressional markups held on a cannabis bill in the 116th Congress. In March 2018, the House Financial Services Committee marked up H.R. 1595: the SAFE Banking Act. It passed out of Committee by a vote of 45-15.

Total NCIA-PAC dollars raised for the 115th Congress (2017-2018)

Total NCIA-PAC dollars raised in the first 7 months of 2019. Our goal to raise $100,000 by the end of the year, so make sure you learn more about the NCIA-PAC here!

by Madeline Grant and Michelle Rutter, NCIA Government Relations Managers

The sun is hot, and the halls of Capitol Hill are empty… it must be August recess, but as your congressional representatives take a break from their busy schedule in D.C., we are still hard at work in the nation’s capital. We are continuing the momentum that the 116th Congress has had in changing cannabis policy. This summer there were many important hearings and events. Let’s take a look back at a few of them:

Since your representatives are not here in D.C., you don’t need to buy a plane ticket for them to hear your voice. Many representatives take this month to listen to their constituents, so there are many opportunities to speak to your members of Congress and make your voice heard. Go to https://townhallproject.com/ to find town halls in your area, invite your members of Congress to tour your business, or go visit their local office and schedule a meeting.

This is an important time in our country – history is changing right before our eyes. Cannabis policy has taken huge steps just these past months, and we cannot let that momentum stop. With your continued advocacy and support, we can continue to lead the change in our community.

Do you have questions or want to learn more about how you can help our efforts on Capitol Hill? We’d love to connect and tell you more via email or phone. Please send an email to Madeline@TheCannabisIndustry to set up an appointment to chat.

Every day, our Government Relations team is keeping our finger on the pulse of what’s happening on the Hill and how it affects our industry. In this case, we have important news from D.C. about movement to fix the banking crisis faced by cannabis industry operators.

Watch this video to learn more about the historic hearing that took place on February 13 in the Subcommittee on Consumer Protection and Financial Institutions. They held the first ever hearing on marijuana and financial services, entitled: Challenges and Solutions: Access to Banking Services for Cannabis-Related Businesses. Up for discussion was a new version of the Secure and Fair Enforcement (SAFE) Banking Act.

Be sure to register in advance for our popular Cannabis Caucus event series – tickets are complimentary for NCIA members, and a limited number of non-member tickets are available. Join us throughout the month of March in Los Angeles, San Francisco, Denver, Lansing, and Philadelphia. For more information, visit our website.

And now is the time to start planning your trip to Washington, D.C. to join us on Capitol Hill! For the 9th year in a row, we’re hosting our Annual Cannabis Industry Lobby Days on May 21-23. This is your chance to walk the halls of Congress and make your voice heard about the unfair tax and banking policies that cripple our industry. This event is exclusively for current NCIA members, so if you’d like to join us for what NCIA members say is “the most important and exciting NCIA event of the year,” then now is the time to join NCIA at one of our three levels of membership, and then join us in May in our nation’s capitol.

If you’re already planning to join us, now is a perfect time to read up on our latest Policy Council report to learn more about priorities for our industry in the 116th Congress.

by Michelle Rutter, NCIA Government Relations Manager

A week ago today, the House Financial Services Committee made history.

On Wednesday, the Subcommittee on Consumer Protection and Financial Institutions held its first ever hearing on marijuana and financial services, entitled: Challenges and Solutions: Access to Banking Services for Cannabis-Related Businesses. Up for discussion was a new draft of the Secure and Fair Enforcement (SAFE) Banking Act, which is expected to be introduced at the end of the month by Reps. Ed Perlmutter (D-CO) and Denny Heck (D-WA) and Sen. Jeff Merkley (D-OR) in the House and Senate, respectively. Compared to last session’s SAFE Banking Act (H.R. 2215), the discussion draft of this session’s bill has some differences: it adds protections for ancillary businesses providing products or services to a cannabis-related legitimate business; specifies how businesses on tribal land could qualify; and requires the Federal Financial Institution Examination Council to develop guidance to help financial institutions lawfully serve cannabis-related legitimate businesses.

NCIA was proud to work closely with the offices leading the effort, members of the subcommittee, and witnesses leading up to this historic hearing. NCIA submitted written testimony that was introduced for the record by Congressman Ed Perlmutter (D-CO) during the hearing. In addition to submitting our own testimony, NCIA called upon its members to submit their own stories and tell us why the cannabis banking crisis needs to be fixed. By doing so, we were able to submit nearly 100 personal stories that are now a part of the congressional record. Congressman Perlmutter even read three of those testimonies aloud at the hearing!

Witnesses for the majority (Democrats) included :

The minority (Republicans) invited Jonathan Talcott, partner at Nelson Mullins and board member of Smart Approaches to Marijuana (Project SAM) to speak at the hearing. Interestingly, in 2018, Nelson Mullins was paid $200,000 to lobby on behalf of cannabis company WeedMaps. The company has since found another firm to represent them.

This hearing was an historic and important first step in solving the cannabis banking crisis. In the coming months, we are hopeful that the House Financial Services Committee will hold an additional hearing and potentially even a mark-up on the SAFE Banking Act. You can also take a behind the scenes look at this video from the hearing day.

While NCIA is making change and advancing our issues every day, there’s still much work to do! Make sure to mark your calendars for our 9th Annual Cannabis Industry Lobby Days in Washington, D.C. on May 21-23 so that you can tell congressional offices your personal story. There’s strength in numbers, and we can’t do it without you!

Last week, as NCIA wrapped up another successful Seed to Sale Show, we were vigilantly preparing for a historic hearing about the issue of cannabis banking and the SAFE Banking Act. This is an incredible milestone for our industry. If this bill passes, it would allow marijuana-related businesses in states with existing regulatory structures to access the banking system.

The Consumer Protection and Financial Institutions Subcommittee of the U.S. House Committee on Financial Services held this historic hearing about a draft bill that provides safe banking services for legal cannabis businesses. This was the first Committee hearing on stand-alone legislation that is a priority for our industry. Learn more about the hearing from NCIA’s Aaron Smith.

Read NCIA’s Executive Director and Co-Founder, Aaron Smith’s official testimony here.

To find out more about what NCIA is doing to support this bill and other legislative priorities, join us at a Cannabis Caucus event near you!

Many financial institutions are still hesitant to bank the legal cannabis industry due to fear of running afoul of federal money laundering laws. For years, many legal, compliant cannabis businesses have been forced to operate on an all-cash basis, causing a headache for regulators and a public safety risk for cannabis industry workers across the country.

Today, the Consumer Protection and Financial Institutions Subcommittee of the U.S. House Committee on Financial Services will hold a hearing about a draft bill that provides safe banking services for legal cannabis businesses. This is the first Committee hearing on stand-alone legislation that is a priority for our industry. The hearing, “Challenges and Solutions: Access to Banking Services for Cannabis-Related Business,” is scheduled for Wednesday, February 13 at 2:00pm ET.

Read NCIA’s Executive Director and Co-Founder, Aaron Smith’s official testimony here.

Here’s how you can take action:

In a late-night vote on Thursday September 6th, the House Rules Committee blocked a full house vote on all cannabis-related appropriations amendments.

Fortunately, Congress passed a Continuing Budget Resolution which does keep the Rohrabacher medical marijuana protections in the budget until December 8th of this year, and more importantly for the long term, those protections currently included in the Senate’s Appropriations bill for the next fiscal year so Congress still has a chance to protect patients and state-legal cannabis businesses in conference committee.

What can you do? Watch the video to hear more from NCIA’s executive director Aaron Smith.

And log on to www.thecannabisindustry.org/SupportLeahy to contact your Senators!

Bethany Moore: You’ve been working as Deputy Director of National Cannabis Industry Association since last winter. What are your responsibilities and how do you like working in the cannabis industry?

Taylor West: Working in the cannabis industry has been one of the most exciting, interesting, and educational jobs I’ve ever had. As one of our members told me, cannabis industry years are kind of like dog years – one is equivalent to seven in any other business. That certainly feels like it’s been true for my first year!

My job at NCIA covers a lot of different areas, but one of the most important is strategic communications and media relations. Our industry is in a very bright spotlight these days, with an intense amount of media interest. I try to make sure we’re telling the real story of our members, highlighting the businesses that make up our responsible, legitimate, and community-engaged industry. It’s really important that policymakers understand that we are an industry of hard-working, innovative small-business people, and that we deserve to be treated fairly.

Read more: Lady Business: Taylor West, Deputy Director at National Cannabis Industry Association | Ladybud

LADYBUD: You work at the National Cannabis Industry Association NCIA — what is it that you do there?

BETHANY: My primary role at NCIA is focused on membership development. I foster deeper relationships with our existing members, as well as seek out relationships with cannabis companies that are not yet a part of NCIA. I travel quite a bit for the events we do all around the country, and I enjoy that opportunity to feel the connection of this growing community from one end of the country to the other. I obviously recruit new members, but also do fun stuff like work with members to write blog posts, match members with event sponsorship opportunities, and otherwise assist in development for the organization. The future is bright and I’m honored to be in this role at this time, after years of being a volunteer activist for drug policy reform issues, when honestly, I didn’t see this whole legalization thing coming as soon as it did. I’m pleasantly surprised about the forward progress of the movement recently and look forward to helping the industry and movement progress forward responsibly and ethically.

Read more: Lady Business: Bethany Moore from National Cannabis Business Association | Ladybud Magazine

The Obama administration on Friday gave the banking industry the green light to finance and do business with legal marijuana sellers, a move that could further legitimize the burgeoning industry.

For the first time, legal distributors will be able to secure loans and set up checking and savings accounts with major banks that have largely steered clear of those businesses. The decision eliminates a key hurdle facing marijuana sellers, who can now legally conduct business in 20 states and the District.

Read more: Obama administration clears banks to accept funds from legal marijuana dealers | Washington Post

The conflict between federal and state marijuana laws has become a bigger issue as more states legalize the drug for medical and, more recently, recreational, uses. Dispensaries in the other 19 states that have legalized medicinal cannabis have run into similar banking problems, requiring entrepreneurs to hide the nature of their business, establish separate holding companies, or just haul around bags of cash.

Last week, Attorney General Eric H. Holder Jr. said that legal marijuana businesses should have access to the banking system and that the Obama administration would provide rules aimed at easing banks’ concerns, mainly by making these activities low priorities for federal prosecutors.

Bank officials in Massachusetts, however, are far from assured, worried what might happen under different administrations. Their preferred solution: changing federal law.

Read more: Medical marijuana firms face cash economy as banks steer clear | Boston Globe.

DENVER – A new NBC News-Wall Street Journal poll finds a majority of Americans support legislative efforts to legalize marijuana.

Fifty-five percent say they would support laws in which adults 21 and older are allowed to buy limited amounts of marijuana for personal use.

About a quarter would not approve of legalizing marijuana, but they wouldn’t actively oppose it either. Nineteen percent would actively work to oppose and overturn any legalization efforts.

There is no question that marijuana has changed Colorado’s image. Whether that’s for the better or worse is still up for debate.

“To the extent that the cannabis industry has changed Colorado. I think Colorado has even more changed the image of cannabis industry. We are showing the world that there is a sensible alternative to the underground black market for marijuana by taking it off the streets, out of the underground and putting it behind a highly regulated counter,” Taylor West of the National Cannabis Industry Association said.

Read more: How has marijuana changed Colorado’s image? | 9NEWS Denver

ASHLAND — If the packed meeting room Thursday at the refined Ashland Springs Hotel is any gauge, interest in Oregon’s medical marijuana industry is, pardon the pun, high.

The Oregon Medical Marijuana Business Conference, the brainchild of Ashland businessman Alex Rogers, opened Thursday morning with a keynote address by Troy Dayton, the man behind The ArcView Group, a San Francisco-based business that, for a fee, pairs marijuana entrepreneurs with deep-pocketed investors.

The sold-out two-day event in Ashland is one of two conferences this week that focus on the business of marijuana – the latest sign that the state’s once-underground industry has moved into the mainstream. Beginning in March, the Oregon Health Authority will register medical marijuana retail outlets, the first effort to regulate an already thriving trade.

Read more: Medical marijuana in Oregon: Ashland conference draws packed house | The Oregonian

ASHLAND — Medical marijuana retailers in Oregon need to shift their focus from staying out of jail to being stand-up business owners who sweep their sidewalks each morning and donate to local charities, a California marijuana advocate told prospective dispensary owners on Friday.

Don Duncan, the California director of Americans for Safe Access, a medical marijuana patient advocacy group, spoke to about 150 people gathered here for the Oregon Medical Marijuana Business Conference.

The sold-out event is one of two major marijuana conferences being held this week in Oregon. The National Cannabis Industry Association, based in Washington, D.C., will hold a daylong symposium in Portland on Saturday.

WORCESTER — Medical marijuana is coming to Worcester’s canal district at 9 Harrison St, care of the Colorado medical marijuana dispensary Good Chemistry.

The company was one of two that received medical marijuana licenses in Worcester County Friday. It will be setting up shop at 9 Harrison St. between Water and Green Streets in Worcester’s canal district.

The Colorado company has two medical marijuana dispensaries located in Denver where they cultivate and dispenses marijuana, according to an informational folder that was given to MassLive. The company has 26 employees and grows over 60 strains of marijuana.

The storefronts in Denver have the atmosphere of a 1940’s apothecary, according to the company. The store is designated by a single lowercase “g” above the doorway. In addition to the storefront on Harrison Street, the company will also have a growth facility at another location in Worcester.

Read more: Good Chemistry bring Colorado experience to Worcester medical marijuana dispensary | MassLive

DENVER — Brandon Coats was working as a customer service representative for Dish Network when he was given a random drug test in spring 2010. Although he had worked there for three years, the company fired him when the 30-year-old quadriplegic tested positive for marijuana.

Coats — who has used a wheelchair since age 16 after a car he was riding in crashed into a tree — says he uses marijuana to control his muscle spasms, which weren’t alleviated by other pharmaceuticals.

“It’s a matter of need, and not a matter of want,” Coats’ attorney Michael Evans told BuzzFeed of his client’s marijuana use.

Coats sued Dish Network, arguing that his medicinal marijuana use was legal and that he was never impaired while working, but the trial judge quickly dismissed the case.

Last April, the Colorado Court of Appeals upheld Coats’ firing in a divided opinion.

The court decided Colorado’s Lawful Off-Duty Activities Statute, which prohibits employers from firing employees for participating in legal activities during their free time, like gambling or drinking alcohol, doesn’t apply to marijuana. For the judges, the fact that marijuana is still a federal crime means it is unlawful across the board and the protections of the law don’t apply.

Read more: Colorado Pot Smokers Can Still Be Fired For Failing Drug Tests | BuzzFeed

SPRINGFIELD – Even after the state implements rules for the sale of medical marijuana, federal banking regulations could make Illinois’ budding cannabis industry a cash-only operation.

While Illinois already has moved to legalize the use of marijuana for certain medical conditions, federal regulations prevent marijuana dispensaries and related businesses from using federally insured banks.

“What it means for a lot of businesses is that they’re forced to operate entirely in cash,” said Taylor West, deputy director of the National Cannabis Industry Association in Washington, D.C. “That’s not just the sales side. It also affects the business side.”

Read more: Illinois pot stores may just accept cash | Herald & Review (IL)

At 7:30 a.m. on New Years Day, dozens of members of the media, marijuana policy reform advocates, elected officials, and business leaders crammed in the cavernous lobby at 3D Cannabis Center while hundreds of eager shoppers waited outside in the snow for their chance to participate in the historic day when cannabis was first sold legally, regardless of medical status, in the post-prohibition era.

At 7:30 a.m. on New Years Day, dozens of members of the media, marijuana policy reform advocates, elected officials, and business leaders crammed in the cavernous lobby at 3D Cannabis Center while hundreds of eager shoppers waited outside in the snow for their chance to participate in the historic day when cannabis was first sold legally, regardless of medical status, in the post-prohibition era.

The press conference, orchestrated by the National Cannabis Industry Association, the Marijuana Policy Project, and Sensible Colorado, highlighted the social, economic, and health benefits of selling marijuana through a regulated market. Speakers Betty Aldworth, Mason Tvert, and Brian Vicente — the leaders of Colorado’s Amendment 64 campaign — highlighted some of the actual and protected benefits of Colorado’s tax-and-regulate system for adult use marijuana, including plummeting arrest case filings, significant sales contributing to a vibrant market, and the resulting tax revenue.

The press conference was immediately followed by the world’s first legal sale at 3D Cannabis Center, an NCIA Founding Member. Toni Fox, 3D’s owner, conducted the sale to Sean Azzariti, a combat veteran suffering from PTSD who knew cannabis could help him but was previously unable to access it legally.

Following the sale, NCIA members and staffers spent the remainder of the day visiting other adult-use marijuana establishments around the city where long lines full of happy customers snaked around buildings. In the first day of legal sales, it is conservatively estimated Colorado’s 37 open stores conducted well over $1 million in sales. Most observers intend to revise adult use and medical marijuana sales projections for 2014 upward from original estimates of between $400 and $600 million.

This site uses cookies. By using this site or closing this notice, you agree to the use of cookies and our privacy policy.