by Fred Whittlesey, Founder and President, Cannabis Compensation Consultants

by Fred Whittlesey, Founder and President, Cannabis Compensation Consultants

Member, NCIA Human Resources Committee

with assistance from

Kara Bradford, Co-Founder & CEO, Viridian Staffing

Chair Emeritus, NCIA Human Resources Committee

All high growth companies face the same challenge: Hiring high-quality people at a feverish pace, while dealing with all of the issues that come with that including recruiting, onboarding, training, and of course, compensation.

The cannabis sector (more than just an “industry”) has another layer of challenges rarely seen when finding and hiring the employees needed for the explosive growth underway:

- Diverse segments (to use a financial reporting term) often under a common entity, or

- Multiple entities housing those distinct businesses, and

- Diverse occupational categories either within a common entity or spread across multiple entities.

The cannabis product lifecycle, like any consumable product, spans agriculture, processing, packaging, branding, distribution, and direct sales. A fully vertically-integrated company might employ, within a single corporate entity, agricultural workers, lab workers and extraction specialists, manufacturing workers, distribution teams, and dispensary employees. That is a challenging environment for compensation plan design.

For example, agricultural workers, including agricultural managers, virtually never receive equity compensation as an element of their pay package. Biochemists, particularly when coming from a biopharma company, expect significant equity compensation. Retail dispensary managers, no equity. VP of sales, equity.

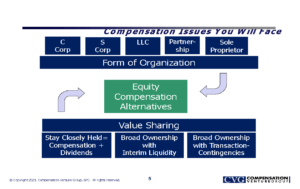

Now, imagine those jobs and people are spread across multiple entities. Maybe the overall corporate structure is a C Corp over some LLCs. Or, like in Arizona, a nonprofit corporation with a Management Services Agreement with a C Corp which directs money through an LLC.

Or in British Columbia which, like the U.S., prohibits alcohol and cannabis sales in the same stores or from the same company, but has owners that operate in both businesses. And the stores are next door to each other. Budtender vs. sommelier? Employees talk.

But perhaps the most compelling reason to consider a broad spectrum of compensation alternatives is unique to cannabis: The non-deductibility of compensation expenses that cannot be characterized as cost of goods sold — Tax Code Section 280E. More than in any other industry, using forms of compensation that avoid incurring a nondeductible compensation expense can have a direct and immediate impact on business financial performance.

Compensation Strategy

Complex cannabis companies have to mold their pay programs to fit this broad array of entities, lines of business, and types of jobs, under an unfavorable tax environment.

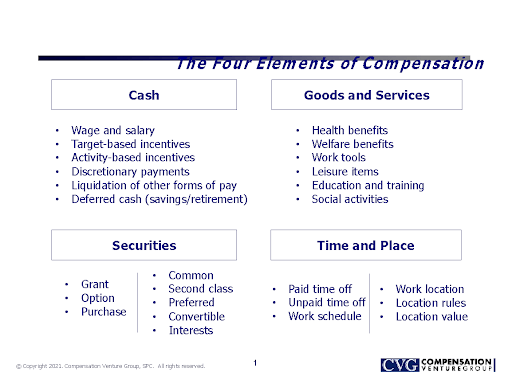

There are four, and really only four, types of compensation for employees (and independent contractors, and members of the Board of Directors, and consultants). Each of the four has many forms, but there are four types of things a company can do to pay — and hopefully continue to pay — an employee. This is a useful framework for thinking about compensation.

Cash

Wage, salary, performance incentives or bonuses, commission, 401(k) contribution (yes, a cannabis company can have a 401(k)), profit sharing, retention bonuses. Every employee will receive one or more of these forms cash payments. All require cash changing hands from the company to or on behalf of the employee.

The most common cash compensation arrangement is a base salary plus bonus as a percentage of salary that is typically dependent upon the performance of the individual, team, and/or company. Many companies have a 10% of base salary target. In the cases of budtenders and delivery drivers, tips (essentially a customer-paid commission) are common as compensation as well. Companies in some locations, such as California, continue to pay trimmers at piece rates (pay by unit production).

Goods and Services

I casually call this category “stuff” — a company gives people stuff as part of their compensation. Healthcare coverage, life insurance, job training, a laptop and a phone in the traditional model. But this category includes much more than traditional “employee benefits” — from free food to use of the company vacation home to sabbaticals, these meet employees’ needs while keeping them focused on, and sometimes physically at, work. Sometimes this free stuff is not taxable income to the employee (healthcare coverage, free food at work) and sometimes it is taxable (free gym membership). Be informed in your creativity here. Local regulations in many jurisdictions are dictating benefits coverage above the federally-mandated level.

Securities

This is by far the most complex form of compensation, and more so for cannabis companies. Whether it’s stock options, restricted stock, restricted stock units, or member interests (in an LLC) — the question is which entity is granting the compensation, and whether they are allowed to grant it to an employee in a different entity. We are beginning to see companies that compensate employees with cryptocurrency which is viewed as a “security” by both the IRS and SEC. Given the increasing social justice emphasis in the cannabis sector, equity compensation is the form of pay that truly levels the playing field across all income levels.

The choice of equity compensation will be driven by the form of organization and ownership philosophy.

Time and Place

Before COVID-19, companies in all industries were increasingly emphasizing this form of compensation. In the 1980’s, there was no “casual dress” and “working from home” was unheard of. An employee reported to the workplace at the assigned time, and there was no “flextime.” Over the past few years, companies were already experimenting with paid parental leave, unlimited vacation time, and employee-choice work location. Now, for many companies and many jobs, WFH is the model. Not for growers and not for budtenders (yet). But time and place can be highly valuable cash-free (sort of) equity-free forms of compensation.

And then…

Hiring is only half the battle. Retention of employees in the cannabis sector is as challenging as hiring. Companies need to be creative with the same four tools to retain employees. But you can’t wait until they give notice of resignation, because then it’s too late.

Your employee retention compensation program starts at the employee’s date of hire, because it is the same program.

_________

Cannabis Compensation Consultants (TM) , owned by Compensation Venture Group SPC (CVG) helps companies design and implement compensation programs that balance diverse stakeholder needs, under its Conscious Compensation© model. CVG specializes in working with startups and early stage companies in this complex regulatory environment.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–