Editor’s Note: From time to time, NCIA hears from researchers looking into an issue related to the cannabis industry. Recently, two Northwestern University economics Ph.D. candidates contacted us because they are studying the economic impact of the cannabis industry’s lack of banking access. In order to complete their research, they need real-world data from cannabis businesses like yours.

This blog post explains their research. We encourage our members to take part in their research, as the results can help support our case for an immediate banking solution. To get involved, contact them at bornstein@u.northwestern.edu or gaby@u.northwestern.edu.

By Gideon Bornstein and Gabriela Cugat

A large number of banks in this country are not willing to work with businesses in the cannabis industry, even when those sales are legal under state law. This is causing major difficulties for thousands of business owners that are forced to operate on a cash-basis. But are they the only ones to suffer? Using straightforward economic analysis we ask who is losing due to these restrictions. The short answer is – almost everyone. Not only businesses are being hurt, but also consumers. In addition, such restrictions also decrease the revenues of the government.

While it is not difficult to argue, as we do below, why restricted access to banking services is bad for the economy, quantifying the different costs is a complicated task. It requires rich data on the costs incurred by businesses together with modern econometric techniques. In the next few months, we plan on collecting the required data to tackle such task. We believe that quantifying these costs is both of scientific interest and of that of the legal cannabis industry. If you are in the legal cannabis industry and would like to get more information about our study, we encourage you to contact us! Our contact information is listed at the top of the page.

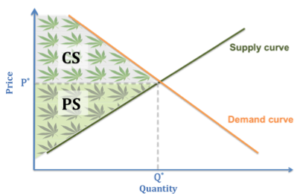

In economics, when we want to analyze the effects of a government policy on market participants (consumers and producers) a first and simple approach is to look at the changes in consumer surplus (CS) and producer surplus (PS). These two measures represent what consumers and producers win by participating in the market.

As reference, Figure 1 shows what market equilibrium, CS and PS would be in the market for marijuana products if everyone had access to banking. If we think of the market demand function as representing how much consumers benefit from each transacted quantity, CS can be computed as the shadowed area in Figure 1 below the demand curve. Similarly, if we think of the market supply function as representing how much it costs to sellers to produce each transacted quantity, PS is the shadowed area in Figure 1 above the supply function.

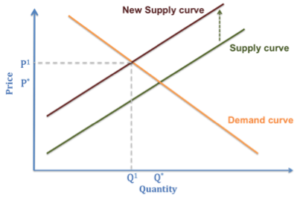

What is the effect of banking restrictions on market equilibrium, CS and PS? Not having access to banking implies that producers have to take additional measures in order to be able to sell: install ATMs, hire security companies, allocate extra time to counting and moving cash, etc. This means that for each quantity transacted, the cost of doing so is higher than before. For the sake of simplicity, let’s think that these extra costs can be measured in dollars and correspond to a linear cost of $T per unit. In this case, such increase would shift the market supply curve as shown in Figure 2. Market equilibrium would feature a higher price and lower quantity.

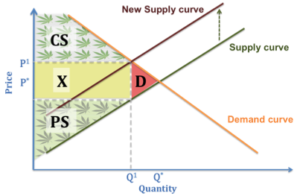

We can decompose the effect on CS and PS as shown in Figure 3. There are two factors that reduce both CS and PS. First, consumers and producers share the burden of the extra cost generated by the lack of access to banking, this is represented by area X in Figure 3 that reduces both surpluses. Second, since the quantity transacted is now lower than before, there is an irrecoverable loss for both consumers and producers represented by area D in figure 3.

What is the difference between areas X and D? Well, area X is not entirely a loss to society as a whole: it includes payments to security companies, so it is a transfer from one sector to another, but it also includes the cost of the extra time needed to process cash payments, which could be better allocated to leisure or working in something else. Area D, on the other hand, is entirely a loss to society: if the market had access to banking, costs would be lower and quantity transacted would be greater and at a lower equilibrium price. New consumers would be incorporated into the market, and existing consumers would pay less.

Gideon Bornstein and Gabriela Cugat are two economics PhD candidates from Northwestern University in Evanston, Illinois, who are studying the costs incurred by businesses transacting only with cash.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–