Earlier this year, we predicted that pre-rolls were destined to be the top-selling cannabis product by the end of this decade, and a new deep dive into the Canadian market has only further convinced us that pre-rolls are not only a cornerstone of the current market, but a major driver for future growth not only North of the Border, but in a federally legalized U.S. cannabis market as well.

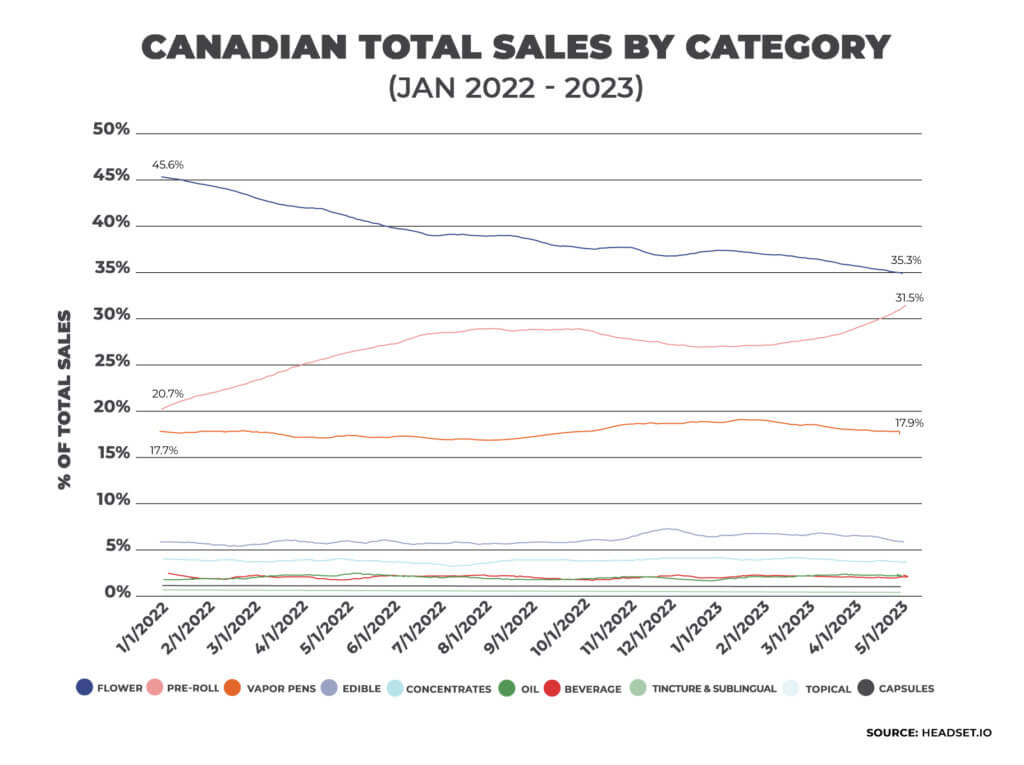

That’s because thanks in part to a staggering growth rate of 606% in infused pre-rolls from January 2022 to February 2023, pre-rolls are currently on the verge of overtaking flower as the top product category in Canada’s cannabis industry.

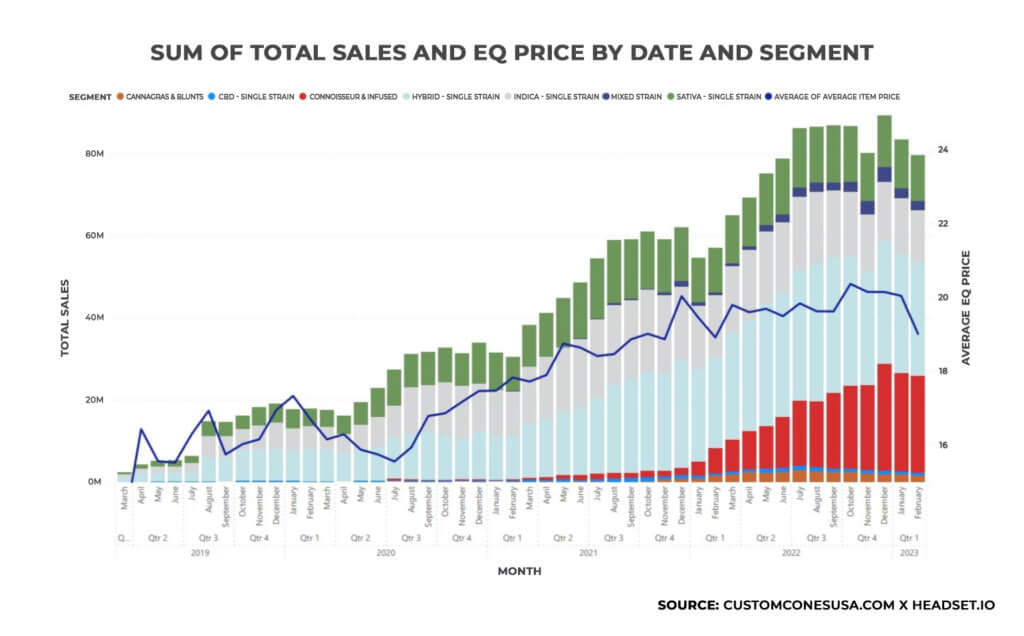

Using data from cannabis analytics firm Headset, our new White Paper, “Pre-Roll Growth in the Canadian Market,” details how pre-rolls in Canada have grown more than 50% over the past 18 months, from a 20.7% market share in early 2022 to a 31.5% total market share in May 2023, with total sales in the category topping CAD$1 billion in 2022. At the same time, flower sales in Canada continue to drop, falling to just 35% of sales in May 2023, compared to 31.5% for pre-rolls.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

Growth in Every Market

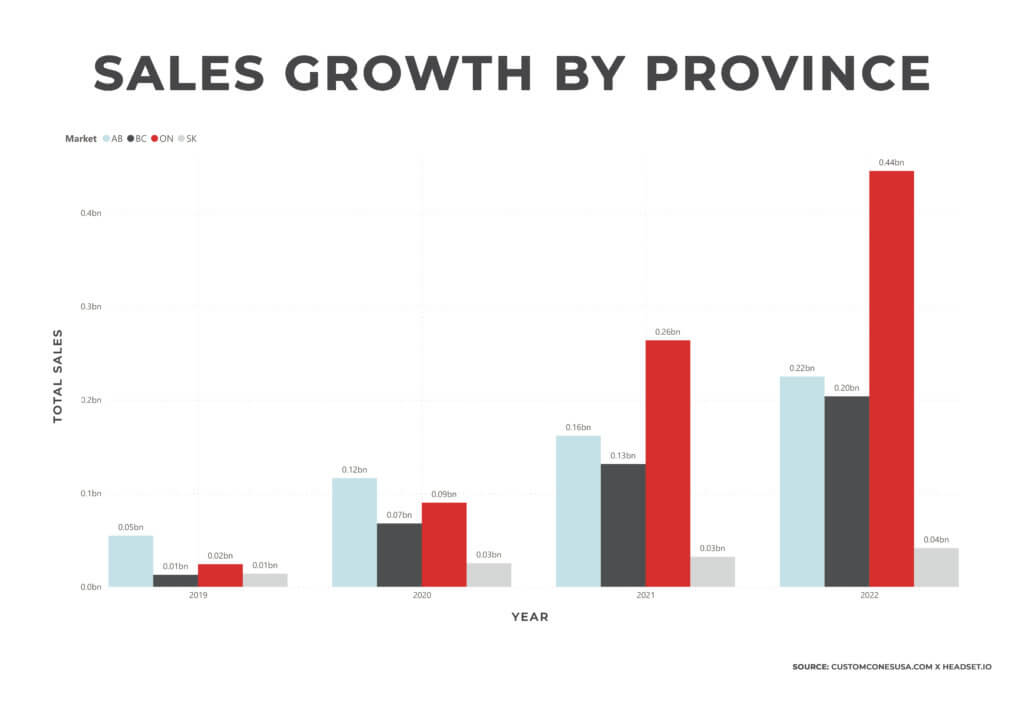

Sales of pre-rolls in all four of the provinces tracked by Headset saw large increases. Pre-roll sales saw 33% and 37% growth in Saskatchewan and Alberta, respectively, a nearly 54% growth in British Columbia and a whopping 69% increase in Ontario, the country’s most-populous province. In the U.S., pre-roll sales also continue to surge, growing to a 12.1% market share in the States.

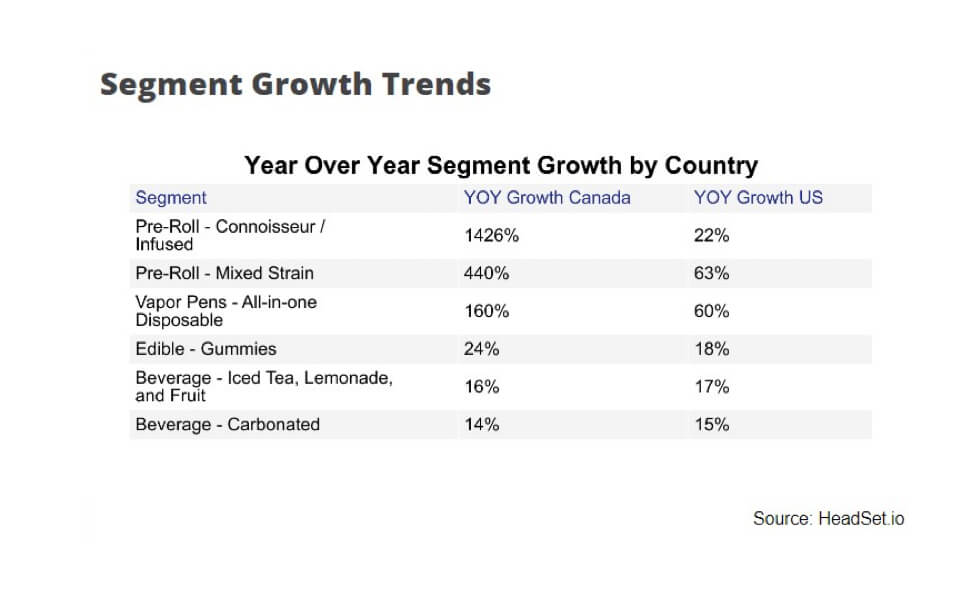

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

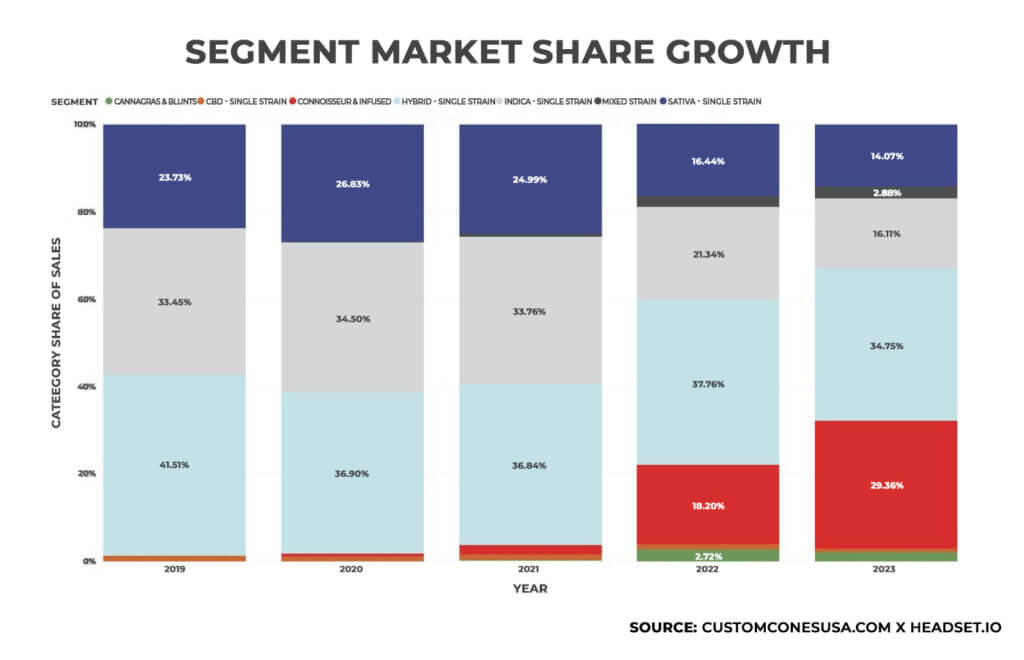

Consumers have responded, with infused pre-rolls seeing an eye-popping 1,426% growth rate from 2021 to 2022. The segment grew from just under 3% of the market at CAD$12.7 million in 2021 to nearly 30% and CAD$47.9 million by mid-2023. That’s more growth than any other pre-roll category except single-strain hybrids.

Keeping Price Points High

Keeping Price Points High

The rising popularity of infused pre-rolls, with their higher price point, has been a significant factor contributing to the increase in the average price of Canadian pre-rolls. Infused pre-roll sales jumped from 6.2% of total sales in January 2022 to 29.8% of sales by February 2023. This trend has been instrumental in maintaining the overall price of pre-rolls even as prices for flower and concentrates have decreased.

According to Headset data, in 2022, pre-roll products accounted for 27% of the new items introduced in the Canadian market, demonstrating a remarkable growth rate of 48.2% compared to 2021, second only to beverages. In response to the increasing demand in this category, a total of 1,870 new pre-roll products were launched in the Canadian market during that year.

The resilience of pre-roll prices can also partially be attributed to their manufactured nature and the unique attributes of infused pre-rolls. The demand for stronger pre-rolls, coupled with declining prices for flower and concentrates, has created a favorable environment for launching infused pre-roll products.

Additionally, automated pre-roll machinery continues to evolve, including new automated infused pre-roll machines, making it easier for manufacturers to produce large quantities of infused pre-rolls at a slight premium over regular pre-rolls, leading to the category’s rapid expansion.

Multi-Packs and Cross-Generational Appeal

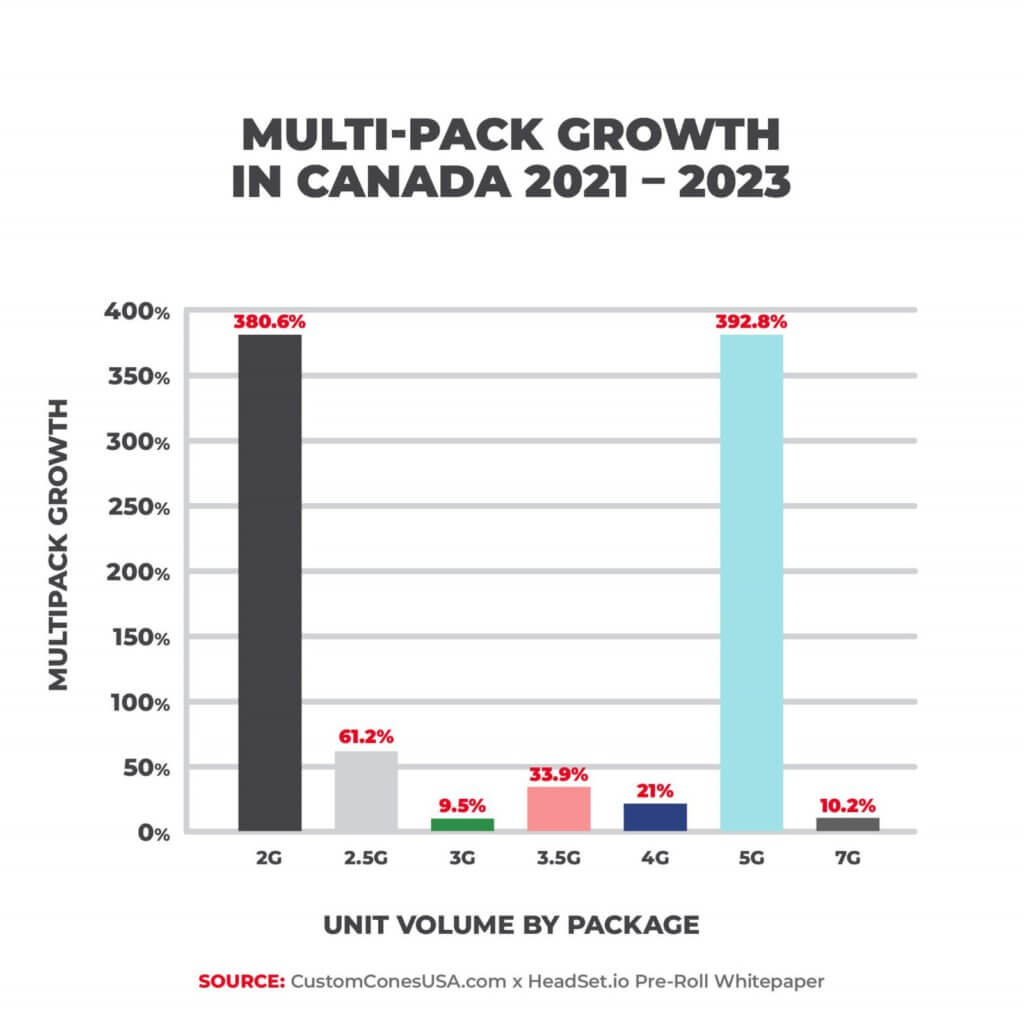

Other insights from our report include a surge in pre-roll multi-packs, with 2- and 5-gram packs seeing an almost 400% growth over the past two years, and that the pre-roll category shows less price compression than any other segment of the market, as it does in the U.S. as well.

Part of the strength of the pre-roll segment is its cross-generational appeal. For example, the Ontario market is the largest and fastest-growing of Canada’s provinces. With revenues reaching CAD$440 million in 2022, Ontario accounts for almost half of all sales in Canada. And within Ontario, the wallet share of pre-rolls grew within every generational group through 2021, with Gen X and Millennials seeing the largest growth, at around 45% each.

Within the fastest-growing group of consumers in the industry, Gen Z (which in Canada is a larger cohort than the U.S. due to a lower age restriction for cannabis purchases), pre-roll sales increased with both male and female consumers. The wallet share of pre-rolls among female buyers grew more than 4% to 20.4% in 2021. For males, the increase was even larger, growing from 14.6% of wallet share to 19.7%.

Final Thoughts on Pre-Roll Growth

The main factors driving the huge growth in pre-rolls are:

- Increased pre-roll quality, as flower and concentrate prices drop, so companies can create a higher quality pre-roll at cheaper and cheaper prices.

- Reduced labor costs, as advancements in pre-roll machinery help companies scale production and bring in automation.

- Consumer buying patterns showing that customers want convenience and are consuming for recreational use, not health and wellness.

The next big trend in pre-rolls, which will push pre-rolls to the No. 1 sales category in the industry, is freshness. Competing in the future will mean better packaging and a better supply chain, so pre-rolls are always fresh at retail.

But with sales surging across both Canada and the U.S., now is the right time for producer/processors to launch or expand pre-roll lines, particularly infused pre-rolls and pre-roll multi-packs.

For more information on how you can capitalize on the latest trends in the pre-roll segment, contact the Pre-Roll Experts at Custom Cones USA.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–