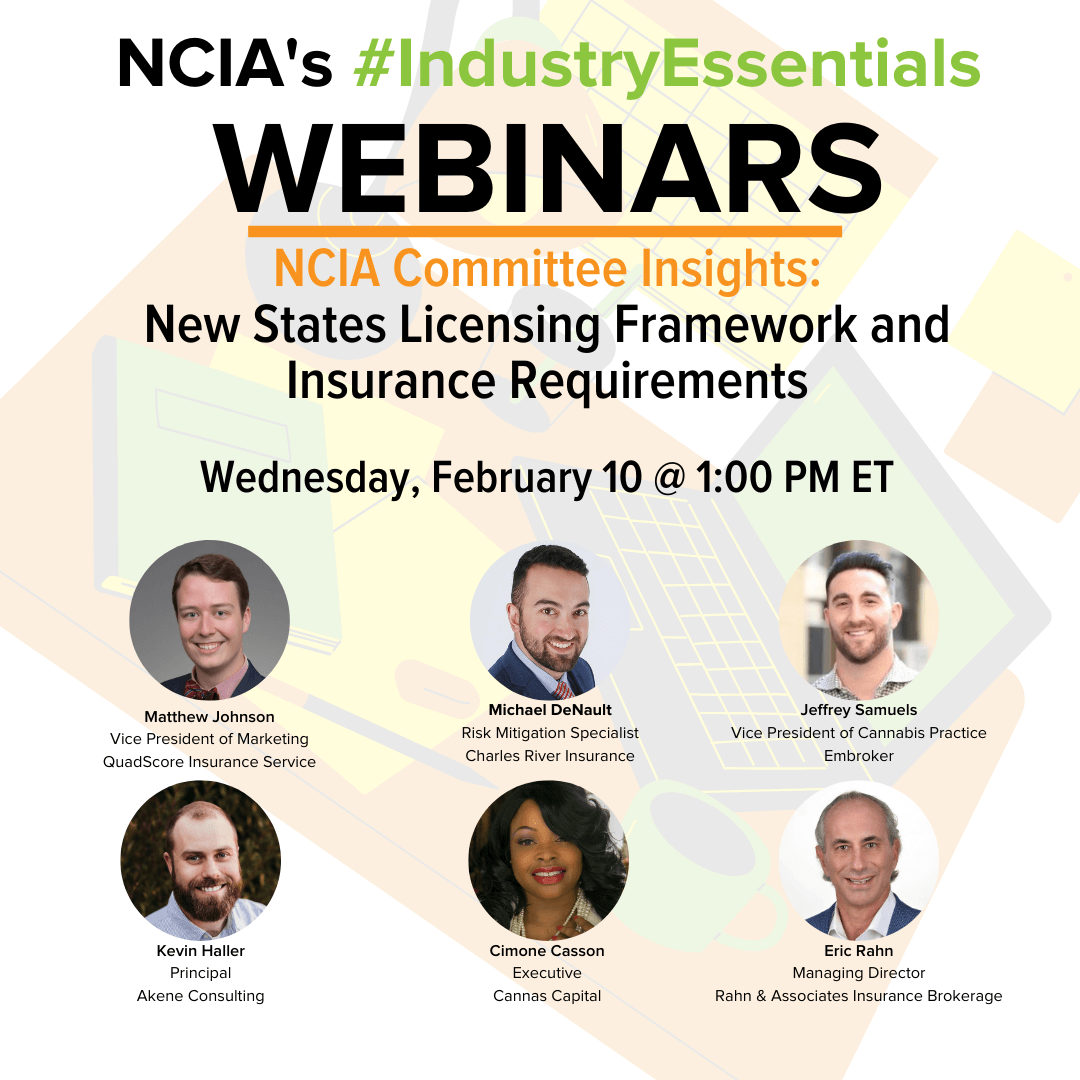

In this edition of our NCIA Committee Insights series originally aired on Wednesday, February 10, 2021 we were joined by members of our Risk Management and Insurance Committee for a discussion focused on new state cannabis medicinal programs as well as expanding adult-use programs and the insurance requirements that are part of the licensing process. Panelists reviewed the most common requirements for license hopefuls, took a deep dive into SOPs and best practices, and established key pillars for a sound, scalable risk management program.

Learning Objectives:

• Key licensing requirements pre and post application

• Imperative coverage to start your business

• Standard Operating Procedures that can be leveraged to ensure you have the right policies in place when you are opening your doors

• Key Risk Management Techniques

• What to do once you have a license & basic coverage

• Deep dive into key milestones and additional coverage that can be applicable as you scale your business

Panelists Include:

Jeffrey Samuels

Vice President Cannabis Practice

Embroker

Eric Rahn

Managing Director

Rahn & Associates Insurance Brokerage

Matthew Johnson

Vice President of Marketing

QuadScore Insurance Services

Michael DeNault

Risk Mitigation Specialist

Charles River Insurance

Kevin Haller, CPA

Principal of Akene Consulting

Cimone Casson

Executive of Cannas Capital

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–