Member Blog: Ensuring Pre-Roll Compliance – Navigating New York’s Stringent Cannabis Testing Regulations

With several states going legal ahead of them, New York State regulators had the benefit of watching other states develop testing programs, which is why New York’s testing regiment goes beyond many of the early adopter states to be one of the most stringent in the nation.

And while the rollout of licenses has been slower than many expected, testing regulations are now in place to ensure the products that do make their way to the public are safe for consumption.

New York also requires products be tested in their final form, which means that pre-rolls, for example, will be tested with rolling papers included so it is vitally important that your rolling papers will also pass the following tests to ensure that all cannabis products are safe for human consumption.

New York requires testing for the following:

- Moisture Content and water activity;

- Residual solvents and processing chemicals;

- Eight different heavy metals;

Each of these tests are performed to protect consumers and are performed in some capacity by every state that has a legal cannabis program, though every state has its own regulation.

Some of the testing limits are fairly standard, like for example the limits on moisture content and water activity. Because any water activity above 0.70 Aw creates the conditions for mold to grow, which can be harmful if consumed, New York, like most states, caps water activity at 0.65 Aw in flower and pre-rolls. Additionally, dried flower batches must have a moisture content between 5.0-15.0%, with any sample exceeding 15.0% deemed unacceptable.

However there are some significant differences between the Empire State’s regulations and those in other markets.

Heavy Metals Testing

One of the major differences between New York and other programs is the number of heavy metals for which it tests. Plants absorb heavy metals from the soil, but they can damage all the body’s vital systems, including respiratory, central nervous and even the reproductive system.

While New York tests for the “Big Four” – mercury, cadmium, lead and arsenic (all of which are toxic even at small doses) – it is also one of a handful of states that also add chromium, which can damage the kidneys and liver.

But the Empire State goes even a step farther, requiring additional testing for copper, nickel and antimony.

Microbial and mycotoxin testing

Microbes and mycotoxins represent the greatest threat to human health among the tested items.

Most people are familiar with how microbes can make you sick, which is why New York tests for Salmonella, E. coli and several Aspergillus species of mold, including A. fumigatus, A. flabus, A. niger and A. terreus.

Mycotoxins are a toxic compound produced by molds like Aspergillus and can suppress the immune system and cause liver damage. New York requires testing for two classes of mycotoxins: Aflatoxins and Ochratoxin A. Both have properties that can alter DNA and potentially cause the formation of cancer cells. Testing for mycotoxins help ensure cannabis products are safe for human consumption.

The limit for all mycotoxins in New York is 0.02 micrograms per gram.

Pesticides

Like most states, New York limits the pesticides that cannabis growers may use to help boost production and prevent insects from destroying their crop and requires labs to test for residual pesticides on product.

All pesticide products sold in New York State must be registered with the state, unless classified as a “minimum risk pesticide” by the federal government. To help producers determine if a pesticide can be used on cannabis, the state’s Department of Environmental Conservation even added “cannabis” and “hemp” to the use/type drop down menu in its pesticide database.

All pesticide use “must be declared for targeted testing” and additionally, New York law also requires labs to specifically test for 70 different pesticides, providing actionable limits.

Ensuring New York Pre Roll Compliance

As we noted, New York law requires all products be tested in their final form, including pre-rolls. According to the law, “the entire pre-roll or a portion of it (depending on size (blunt, 0.5-g, 1-g)) must be prepped and tested for all contaminants of concern,” which means even if your cannabis is clean, your products can fail and be destroyed if your rolling papers or pre rolled cones are not.

Because of that, manufacturers need to protect themselves – and their customers – by carefully selecting suppliers. After all, a study from California’s SC labs found that 11% of rolling papers they tested would fail that state’s testing regiment – which doesn’t even include Chromium, copper, nickel or antimony – and that 90% of rolling papers contained heavy metals with more than 8% containing them at a rate above the allowable limits.

Also, this year in Michigan, researchers analyzed the elemental composition of 53 different rolling papers and discovered that about 25% of the samples contained copper at levels that exceed recommendations for inhalable pharmaceuticals. They also found elevated levels of copper, chromium and vanadium.

Pre-roll manufacturers in particular need to pay attention to their suppliers and make sure that the company from which they buy their paper takes testing as seriously as they do. This is especially true for blunt products, which contain more moisture and biomass in the hemp wraps, which makes these products more susceptible to fail these compliance tests.

Custom Cones USA’s Compliance Manager André Bayard always recommends making sure your pre-roll paper supplier is a partner.

“It’s important to find a supplier that does the due diligence and is willing to work with you so you know ahead of time if your papers will pass lab tests,” he says.

Bayard notes that when contacted by a manufacturer concerned about heavy metals content causing failures, Custom Cones USA sent samples ahead of time so the manufacturer could pack and test a handful of their completed pre-rolls to make sure the products were clean before committing to a full order.

If your pre-roll supplier is not willing to go through that step, it may be a sign that you should find another pre rolled cone supplier.

Testing failures can be expensive and damaging to a brand, so make sure you not only keep up on the latest changes to your state’s regulations, but also work with a reputable pre rolled cone company to get the cleanest, best tested pre rolled cones you can find. And always ask to see COAs. Even if you are just a dispensary selling rolling papers and empty cones for smoking, offering tested papers and pre rolled cones is crucial to protect your brand and offer quality products to your customers.

Join Us for More Exclusive Insights on the Michigan Marketplace

Striving to stay informed about New York’s dynamic cannabis industry? Mark your calendars for our upcoming New York Stakeholder Summit being held in New York, NY on Tuesday, September 24th.

At the New York Stakeholder Summit you’ll be able to dive deep into the latest trends, regulations, and opportunities shaping New York’s cannabis landscape, including hearing directly from John Kagia Hanna, Director of Policy for New York’s Office of Cannabis Management. All industry professionals are invited; NCIA members attend free. Register here to secure your spot.

Member Blog: Understanding Michigan’s Booming Pre-Roll Market and Cannabis Testing Requirements

There is no hotter pre roll market in the country than Michigan.

With an average unit price of $6.16 – one of the lowest in the country, according to cannabis analytics firm Headset – retailers have sold more than 56.7 million units for a total of more than $349.8 million through the first seven months of 2024. That puts the state of Michigan in the top spot for pre-roll units sold and second place – to much larger California – in pre-roll revenue.

And sales are actually accelerating, with Michigan posting record high pre-roll sales numbers of nearly $54.9 million in July 2024.

But if you want to compete in the Great Lakes State’s exciting and expanding marketplace, you are going to need to make sure you understand and follow Michigan’s cannabis testing program.

In Michigan, state law requires all “raw plant material” be tested for the following:

- Moisture content and water activity;

- Residual pesticides and chemicals;

These tests are primarily implemented to safeguard consumers from hidden risks in cannabis products.

“Laboratory testing minimizes the risk of exposure to pesticides, microbes, heavy metals, molds, and residual solvents by providing consumers with information about the products they are purchasing and helps to prevent consumption by sensitive populations,” reads the “Sampling and Testing Technical Guidance for Marijuana Products” document created by the state’s Cannabis Regulatory Agency.

For example, moisture content and water activity measurements are indicators of potential mold growth. When water activity exceeds 0.70 Aw, it creates an environment conducive to mold development, which can be detrimental if ingested. This is why Michigan, like many other states, has set a maximum water activity limit of 0.65 Aw for flower and pre-rolls.

Heavy Metals Testing in Michigan

Heavy metals are absorbed through a plant’s roots and can damage all of the body’s vital systems, including the respiratory system, the central nervous system and the reproductive system, even in small doses. That’s why Michigan, like all states, requires products to pass strict heavy metals testing.

But where most states limit testing to the “Big Four” heavy metals of mercury, cadmium, lead and arsenic, Michigan goes a step farther, joining a handful of states that require testing for chromium and even adding nickel to the list as well.

Microbials and Mycotoxins

Though certainly dangerous, heavy metals are less of a threat to human health than microbials and mycotoxins.

Michigan requires testing for standard microbials like yeast, mold, E. coli and salmonella, as well as Aspergillus flavus, fumigatus, niger and terreus.

As for mycotoxins, toxic compounds produced by molds, such as Aspergillus, can suppress the immune system and cause liver damage, so testing for them is certainly a health and safety issue. Michigan law requires testing for Aflatoxin B1, Aflatoxin B2, Aflatoxin G1, Aflatoxin G2 and Ochratoxin A, requiring all to be less than 20 parts per billion to receive a passing grade.

Pesticides and residual chemicals

Michigan allows the use of some pesticides and other chemicals on cannabis, but only those appearing on the Michigan Marijuana Pesticide List, which was updated in early 2024. Pesticides on that list have been reviewed for use by the Michigan Department of Agriculture and Rural Development (MDARD) and may be used in accordance with the label instructions.

For testing purposes, state law requires labs check cannabis for 58 different residual chemicals, each with their own action limits.

Keeping your pre-rolls in compliance

Michigan regulations require tests be conducted in the product’s “final form,” though that applies to the flower itself, according to an email from the Cannabis Regulatory Agency.

“If the pre-rolls were tested as flower, that would be considered final form testing unless something was added to materially change the product,” they wrote.

But with so much time and effort spent ensuring your cannabis stays in compliance with state regulations, why would you want to pack it into pre-rolled cones that haven’t also been tested?

To ensure your cannabis stays clean, only use pre rolled cones that that have also been tested for microbials, pesticides and heavy metals. Medical patients in particular need to be careful to ensure that the paper in their pre-rolls isn’tgoing to make them sick, whether they buy them at a dispensary or pack pre-rolls at home.

In fact, a study from California’s SC labs found that 11% of rolling papers they tested would fail that state’s testing regiment, which doesn’t even include Chromium, and that 90% of rolling papers contained heavy metals with more than 8% containing them at a rate above the allowable limits.

In fact, this year, a team of researchers from Michigan this year tested 53 commercially available pre rolled cones and rolling papers and found varying levels of heavy metals throughout the samples, many of which would have caused failures if included in testing.

“Even if testing is not required, any one issue can harm your brand,” says Custom Cones USA Compliance Manager André Bayard. “It’s important to make sure you work with a company that is as focused on keeping your products in compliance as you are.”

Bayard always recommends confirming your pre-roll supplier has COAs available to prove their products are clean and will pass tests, or will send you samples for you to test before committing to a full order.

“Make sure your supplier is focused on those requirements and is trying to set the industry standard with their products,” Bayard says.

Join Us for More Exclusive Insights on the Michigan Marketplace

Striving to stay informed about Michigan’s dynamic cannabis industry? Mark your calendars for our upcoming Michigan Stakeholder Summit being held in Detroit, MI on Thursday, September 12th.

At the Michigan Stakeholder Summit 2024 you’ll be able to dive deep into the latest trends, regulations, and opportunities shaping Michigan’s cannabis landscape, including hearing directly from Brian Hanna, Executive Director of Michigan’s Cannabis Regulatory Agency. All industry professionals are invited; NCIA members attend free. Register here to secure your spot.

Member Blog: Pre-Rolls are Poised to Become the #1 Category in Canada – Will the Same Trends Follow in the US?

Earlier this year, we predicted that pre-rolls were destined to be the top-selling cannabis product by the end of this decade, and a new deep dive into the Canadian market has only further convinced us that pre-rolls are not only a cornerstone of the current market, but a major driver for future growth not only North of the Border, but in a federally legalized U.S. cannabis market as well.

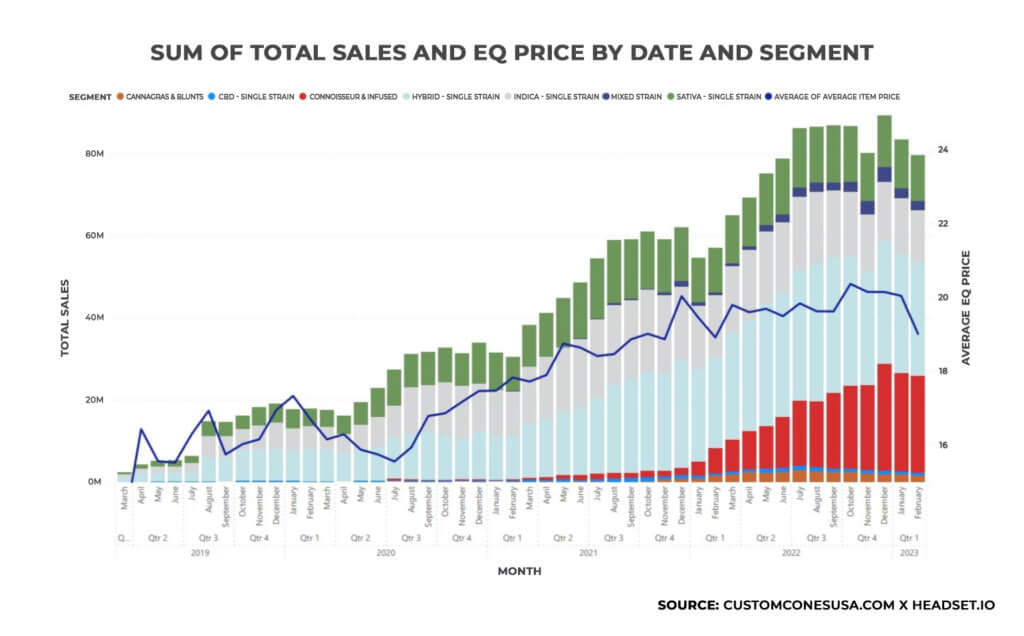

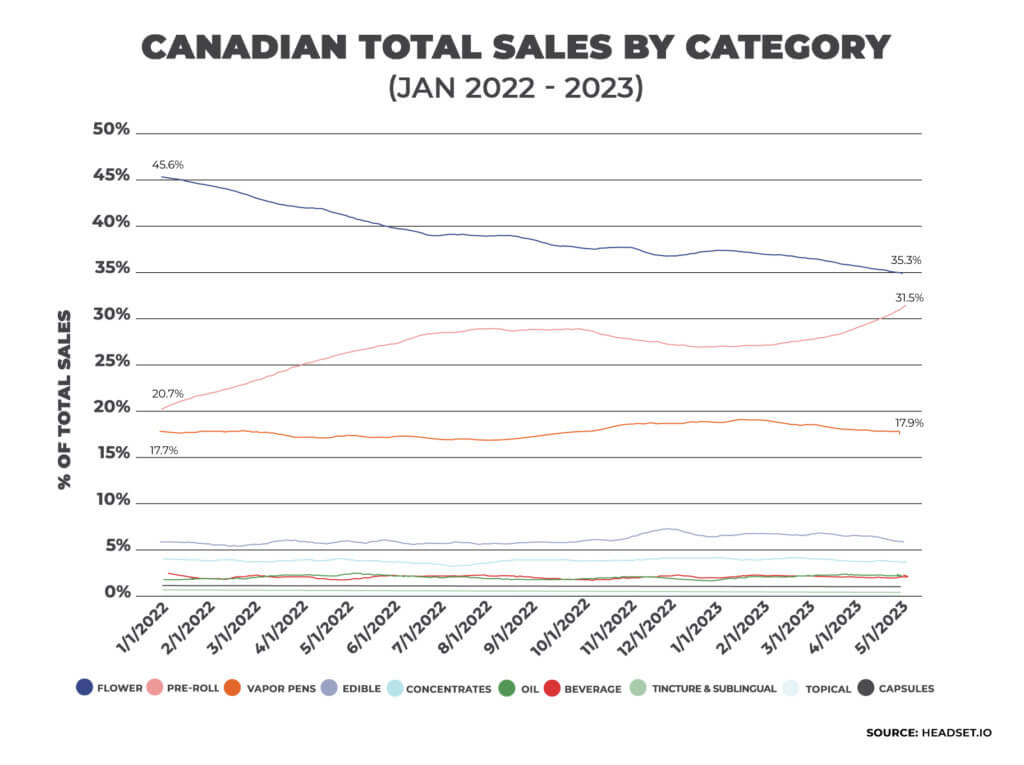

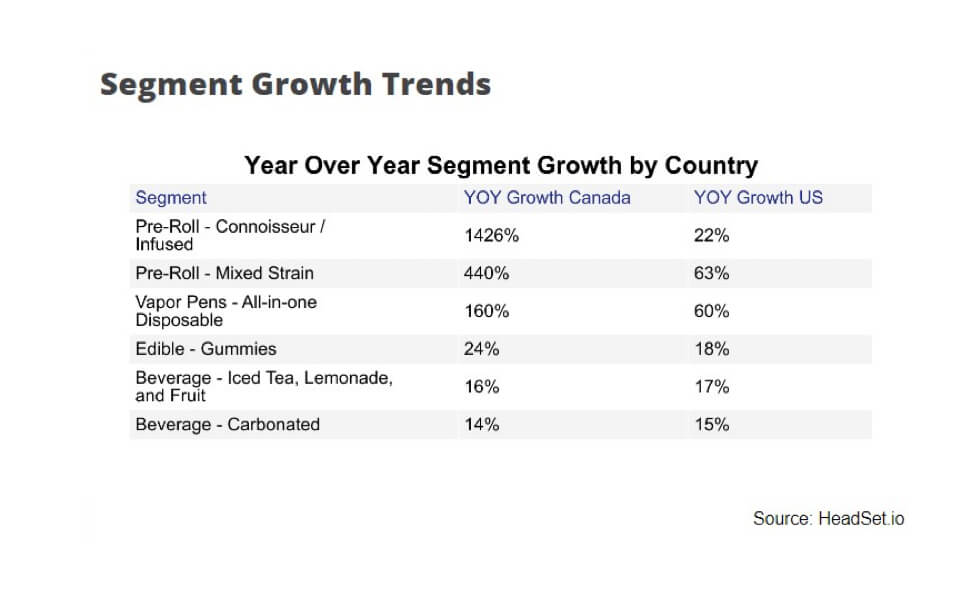

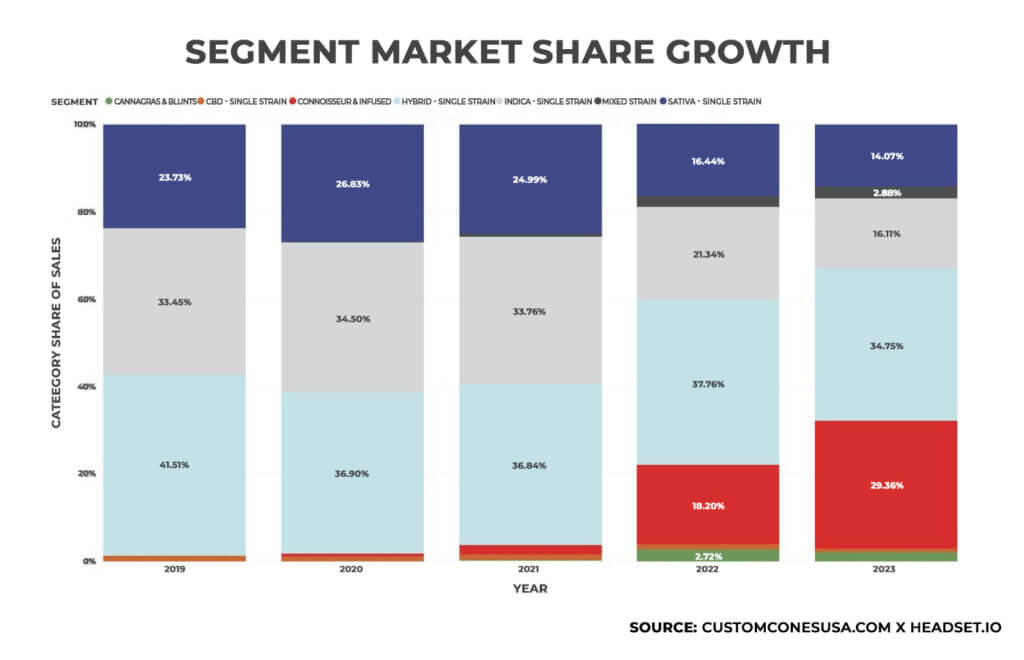

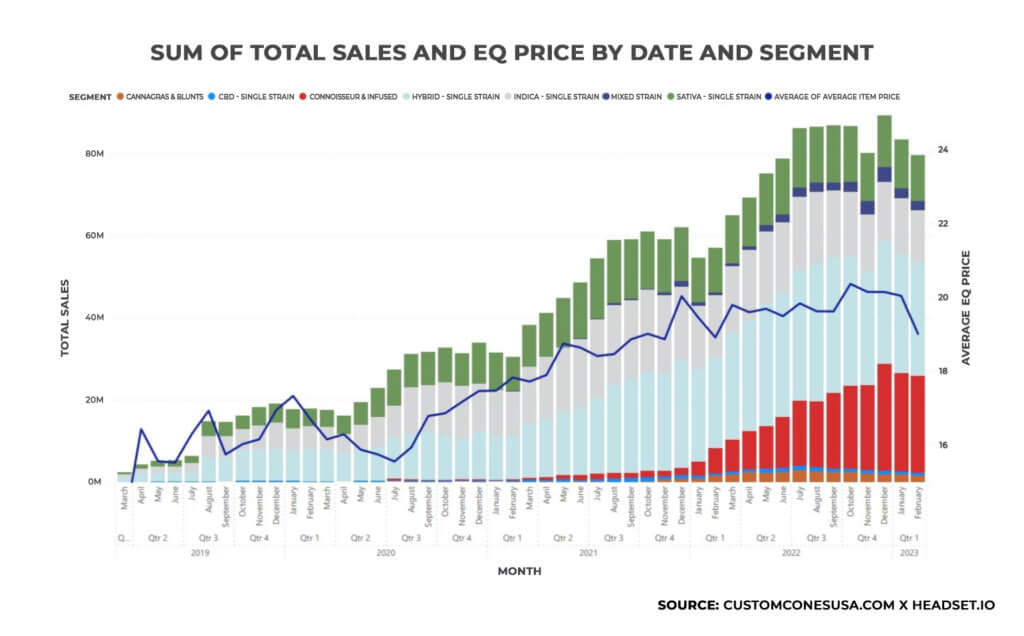

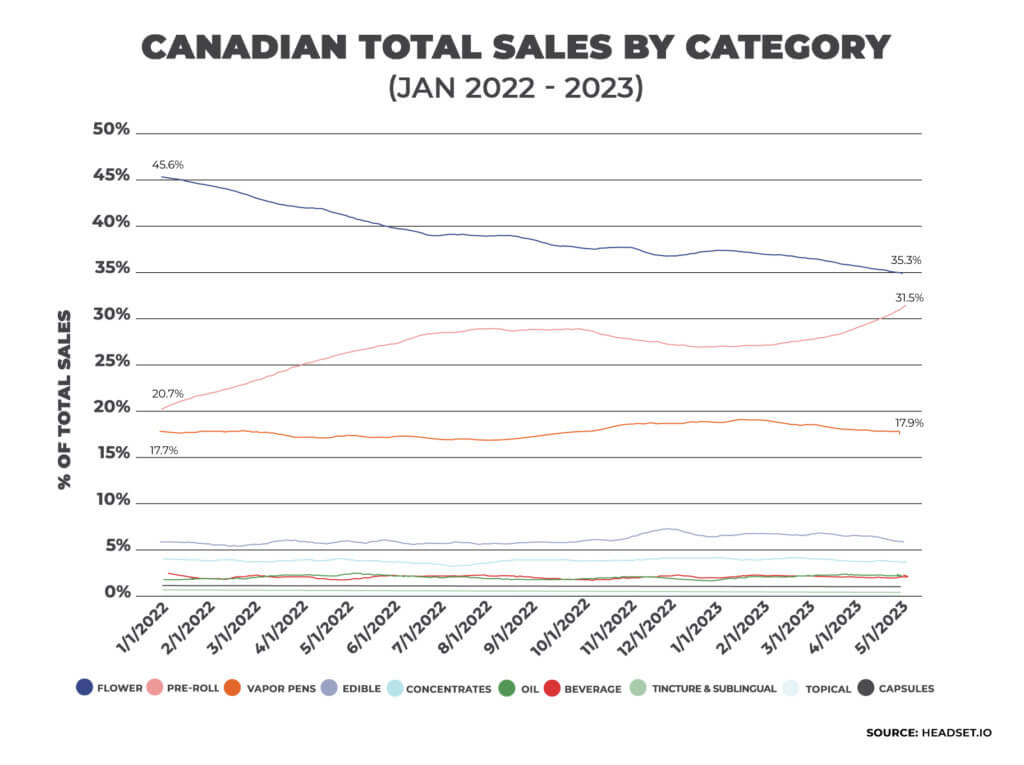

That’s because thanks in part to a staggering growth rate of 606% in infused pre-rolls from January 2022 to February 2023, pre-rolls are currently on the verge of overtaking flower as the top product category in Canada’s cannabis industry.

Using data from cannabis analytics firm Headset, our new White Paper, “Pre-Roll Growth in the Canadian Market,” details how pre-rolls in Canada have grown more than 50% over the past 18 months, from a 20.7% market share in early 2022 to a 31.5% total market share in May 2023, with total sales in the category topping CAD$1 billion in 2022. At the same time, flower sales in Canada continue to drop, falling to just 35% of sales in May 2023, compared to 31.5% for pre-rolls.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

Growth in Every Market

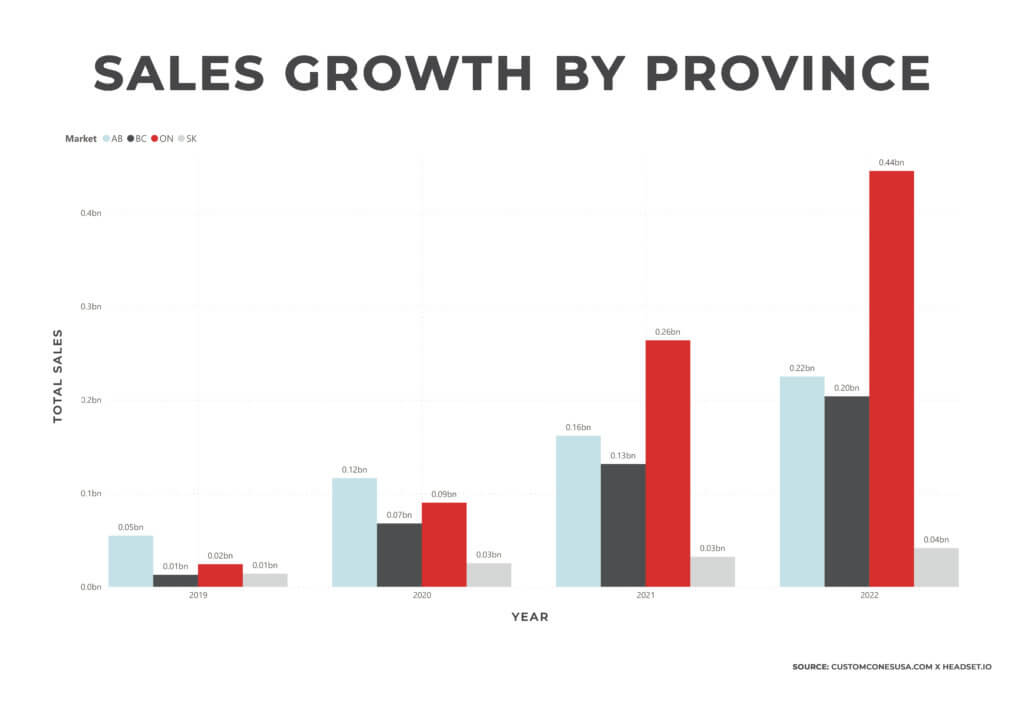

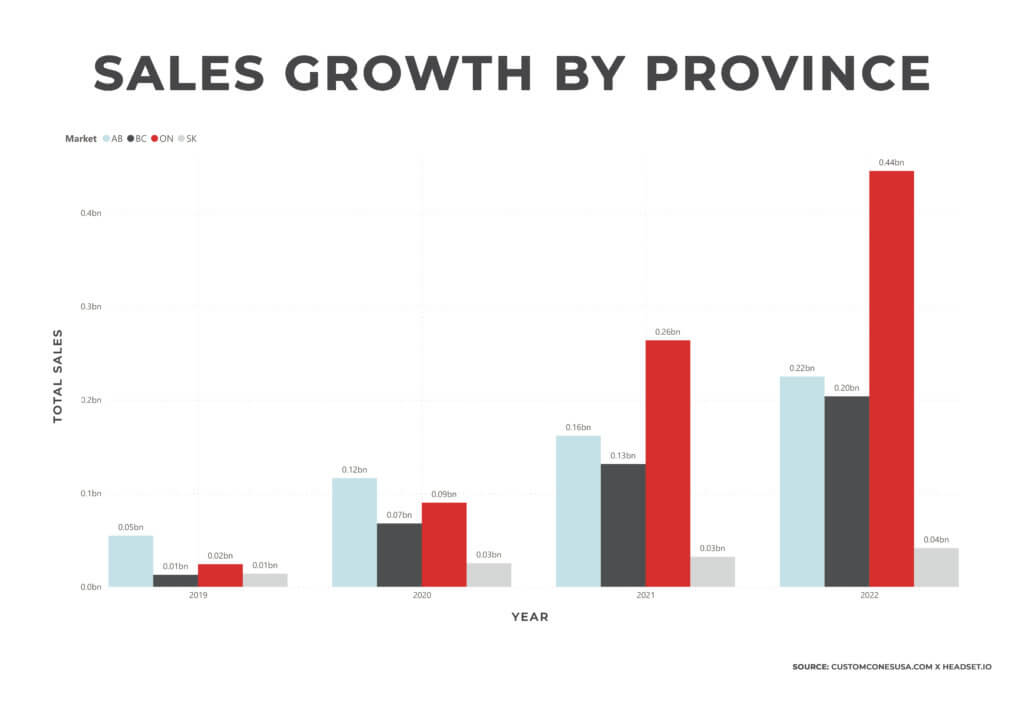

Sales of pre-rolls in all four of the provinces tracked by Headset saw large increases. Pre-roll sales saw 33% and 37% growth in Saskatchewan and Alberta, respectively, a nearly 54% growth in British Columbia and a whopping 69% increase in Ontario, the country’s most-populous province. In the U.S., pre-roll sales also continue to surge, growing to a 12.1% market share in the States.

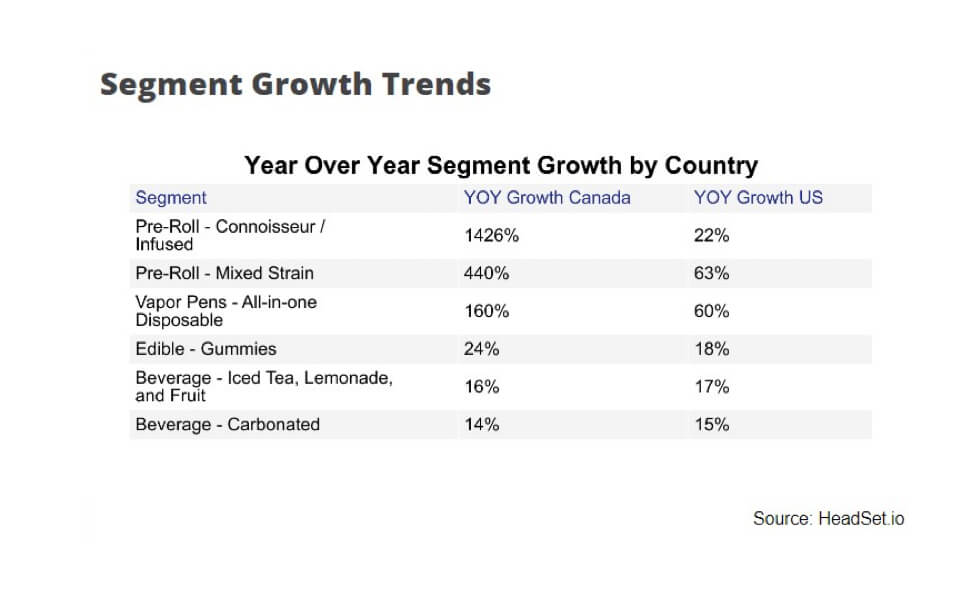

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

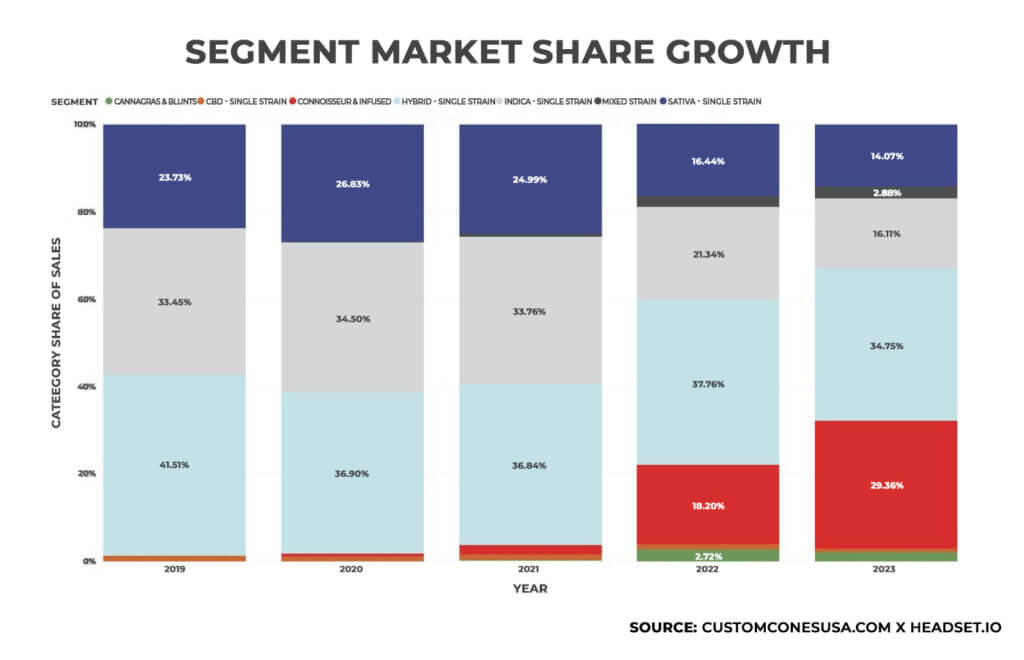

Consumers have responded, with infused pre-rolls seeing an eye-popping 1,426% growth rate from 2021 to 2022. The segment grew from just under 3% of the market at CAD$12.7 million in 2021 to nearly 30% and CAD$47.9 million by mid-2023. That’s more growth than any other pre-roll category except single-strain hybrids.

Keeping Price Points High

Keeping Price Points High

The rising popularity of infused pre-rolls, with their higher price point, has been a significant factor contributing to the increase in the average price of Canadian pre-rolls. Infused pre-roll sales jumped from 6.2% of total sales in January 2022 to 29.8% of sales by February 2023. This trend has been instrumental in maintaining the overall price of pre-rolls even as prices for flower and concentrates have decreased.

According to Headset data, in 2022, pre-roll products accounted for 27% of the new items introduced in the Canadian market, demonstrating a remarkable growth rate of 48.2% compared to 2021, second only to beverages. In response to the increasing demand in this category, a total of 1,870 new pre-roll products were launched in the Canadian market during that year.

The resilience of pre-roll prices can also partially be attributed to their manufactured nature and the unique attributes of infused pre-rolls. The demand for stronger pre-rolls, coupled with declining prices for flower and concentrates, has created a favorable environment for launching infused pre-roll products.

Additionally, automated pre-roll machinery continues to evolve, including new automated infused pre-roll machines, making it easier for manufacturers to produce large quantities of infused pre-rolls at a slight premium over regular pre-rolls, leading to the category’s rapid expansion.

Multi-Packs and Cross-Generational Appeal

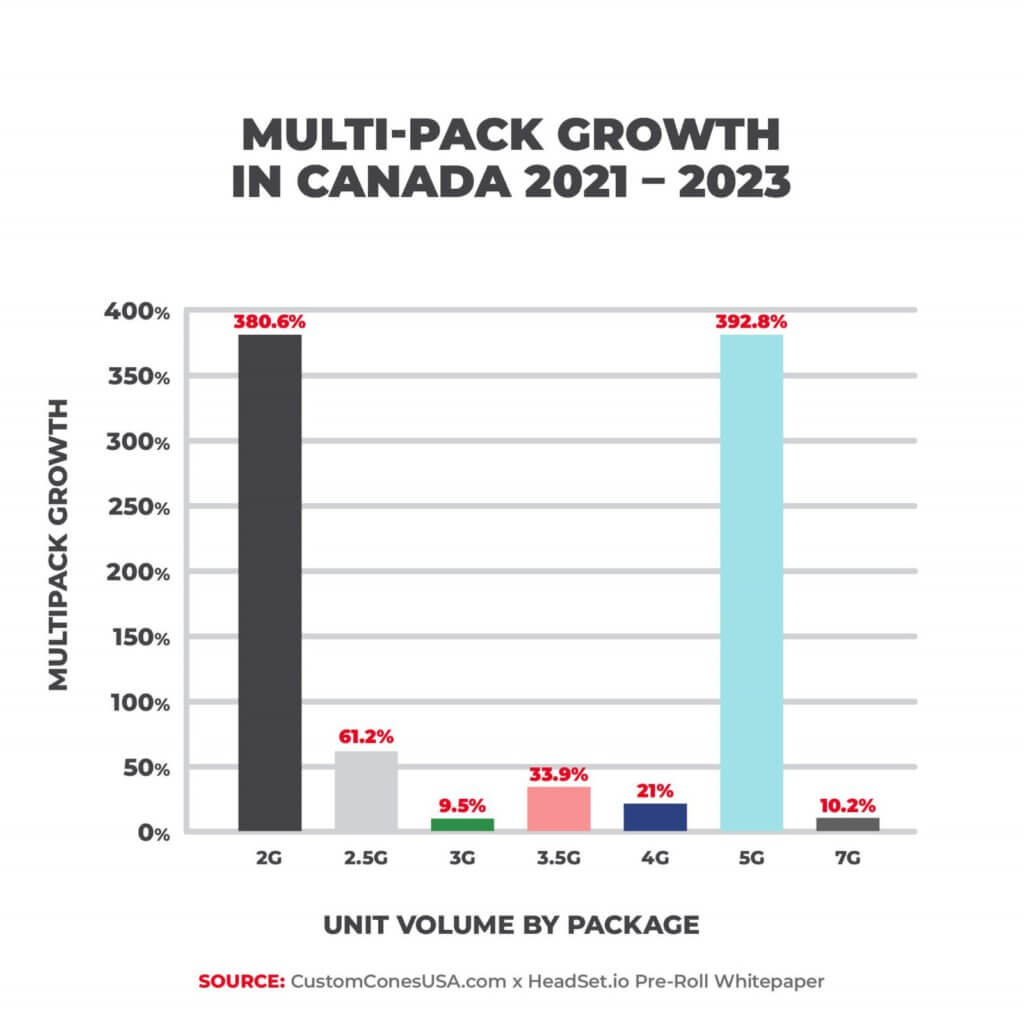

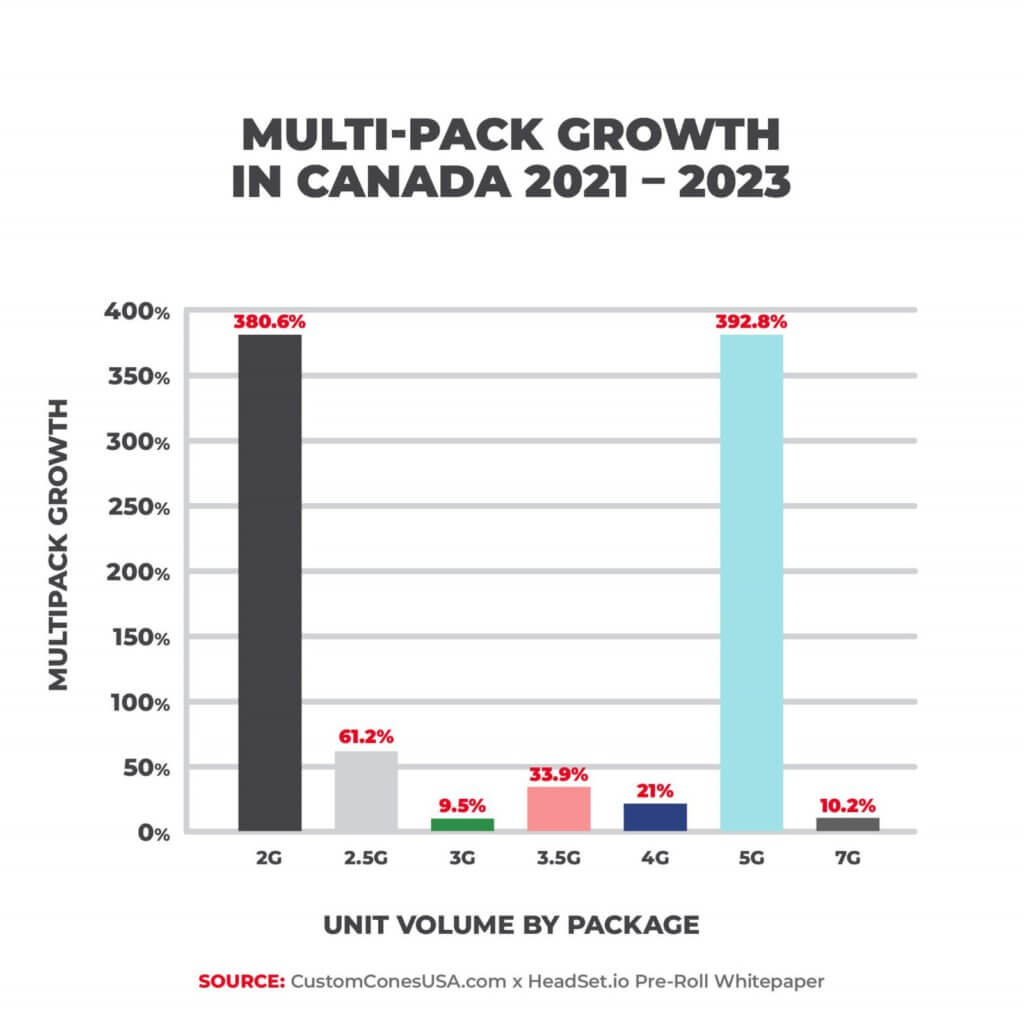

Other insights from our report include a surge in pre-roll multi-packs, with 2- and 5-gram packs seeing an almost 400% growth over the past two years, and that the pre-roll category shows less price compression than any other segment of the market, as it does in the U.S. as well.

Part of the strength of the pre-roll segment is its cross-generational appeal. For example, the Ontario market is the largest and fastest-growing of Canada’s provinces. With revenues reaching CAD$440 million in 2022, Ontario accounts for almost half of all sales in Canada. And within Ontario, the wallet share of pre-rolls grew within every generational group through 2021, with Gen X and Millennials seeing the largest growth, at around 45% each.

Within the fastest-growing group of consumers in the industry, Gen Z (which in Canada is a larger cohort than the U.S. due to a lower age restriction for cannabis purchases), pre-roll sales increased with both male and female consumers. The wallet share of pre-rolls among female buyers grew more than 4% to 20.4% in 2021. For males, the increase was even larger, growing from 14.6% of wallet share to 19.7%.

Final Thoughts on Pre-Roll Growth

The main factors driving the huge growth in pre-rolls are:

- Increased pre-roll quality, as flower and concentrate prices drop, so companies can create a higher quality pre-roll at cheaper and cheaper prices.

- Reduced labor costs, as advancements in pre-roll machinery help companies scale production and bring in automation.

- Consumer buying patterns showing that customers want convenience and are consuming for recreational use, not health and wellness.

The next big trend in pre-rolls, which will push pre-rolls to the No. 1 sales category in the industry, is freshness. Competing in the future will mean better packaging and a better supply chain, so pre-rolls are always fresh at retail.

But with sales surging across both Canada and the U.S., now is the right time for producer/processors to launch or expand pre-roll lines, particularly infused pre-rolls and pre-roll multi-packs.

For more information on how you can capitalize on the latest trends in the pre-roll segment, contact the Pre-Roll Experts at Custom Cones USA.

Keeping Price Points High

Keeping Price Points High