Member Blog: Pre-Rolls are Poised to Become the #1 Category in Canada – Will the Same Trends Follow in the US?

Earlier this year, we predicted that pre-rolls were destined to be the top-selling cannabis product by the end of this decade, and a new deep dive into the Canadian market has only further convinced us that pre-rolls are not only a cornerstone of the current market, but a major driver for future growth not only North of the Border, but in a federally legalized U.S. cannabis market as well.

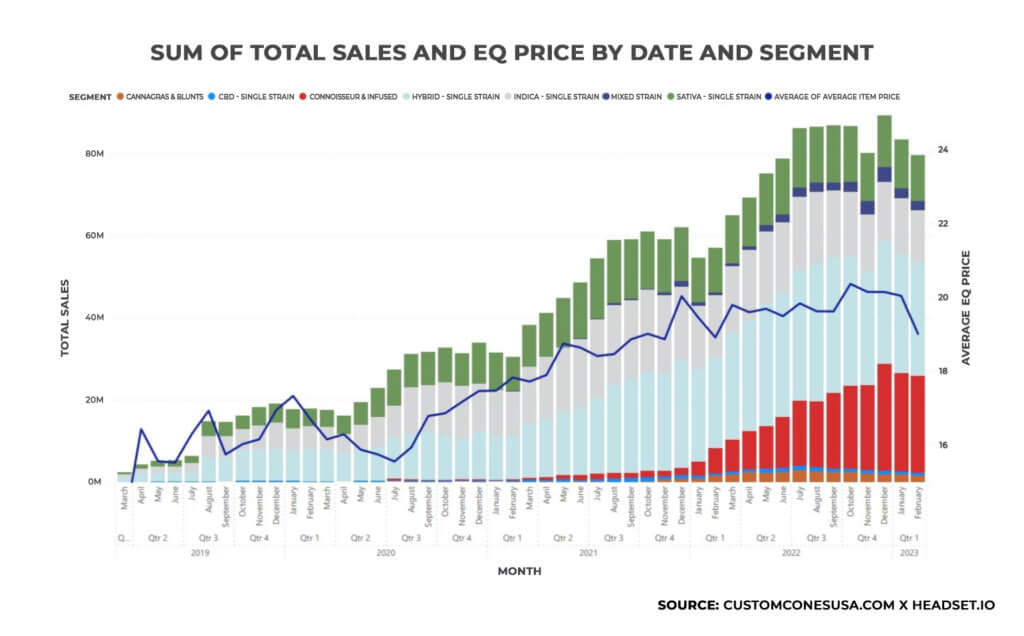

That’s because thanks in part to a staggering growth rate of 606% in infused pre-rolls from January 2022 to February 2023, pre-rolls are currently on the verge of overtaking flower as the top product category in Canada’s cannabis industry.

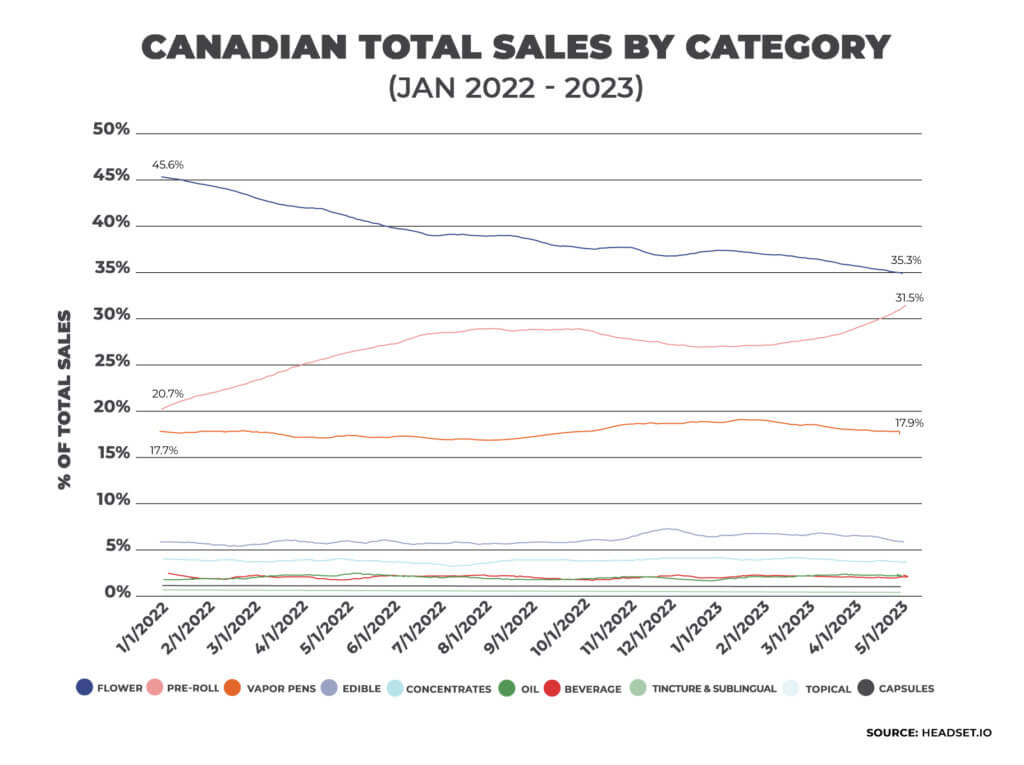

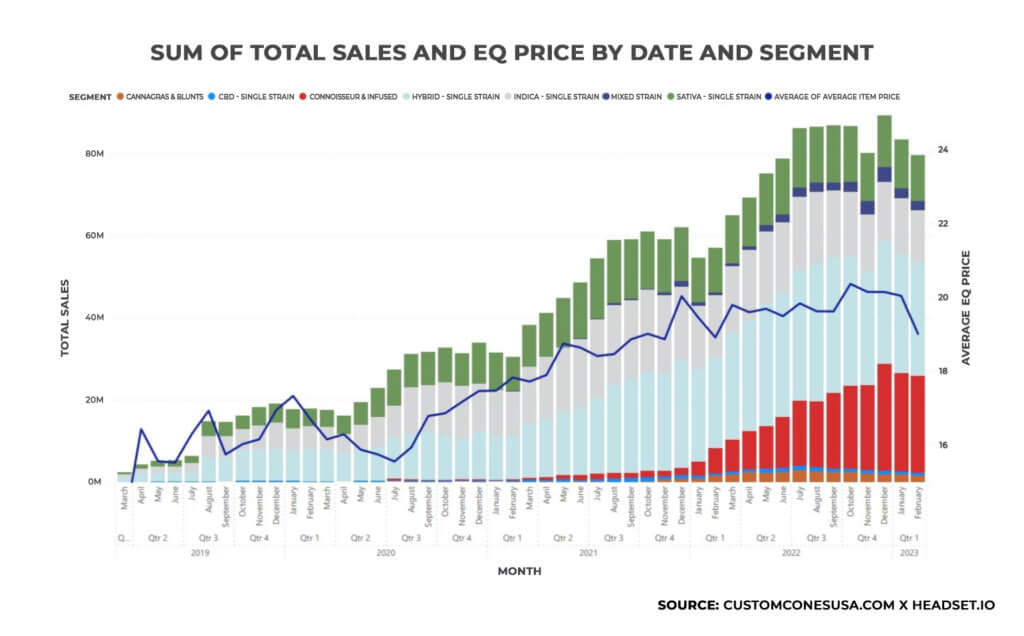

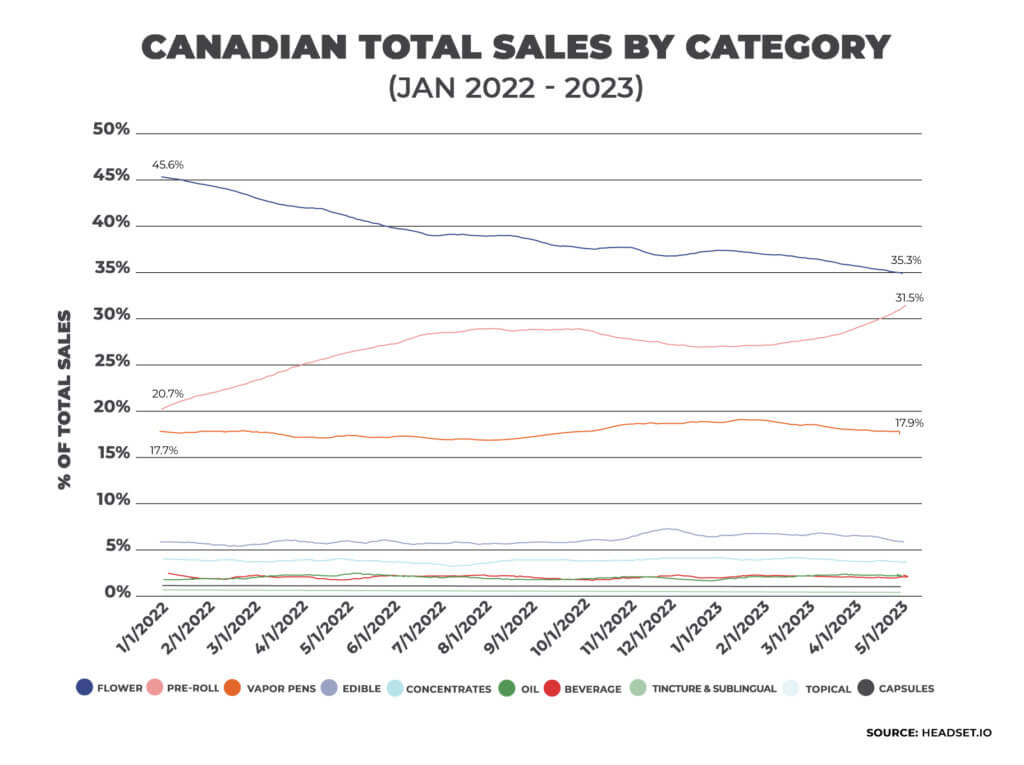

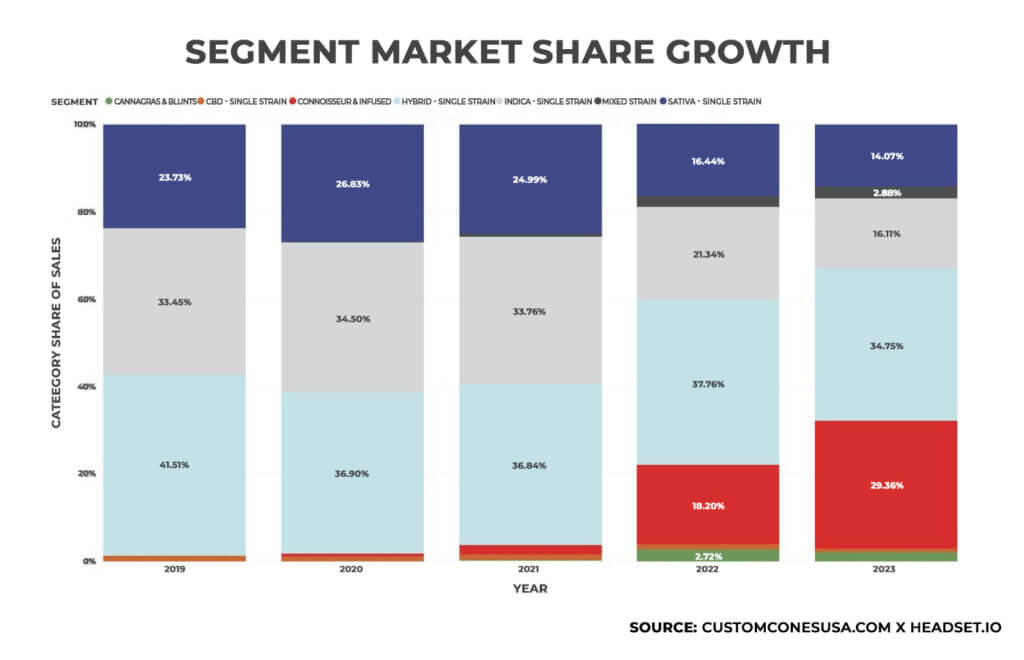

Using data from cannabis analytics firm Headset, our new White Paper, “Pre-Roll Growth in the Canadian Market,” details how pre-rolls in Canada have grown more than 50% over the past 18 months, from a 20.7% market share in early 2022 to a 31.5% total market share in May 2023, with total sales in the category topping CAD$1 billion in 2022. At the same time, flower sales in Canada continue to drop, falling to just 35% of sales in May 2023, compared to 31.5% for pre-rolls.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

Growth in Every Market

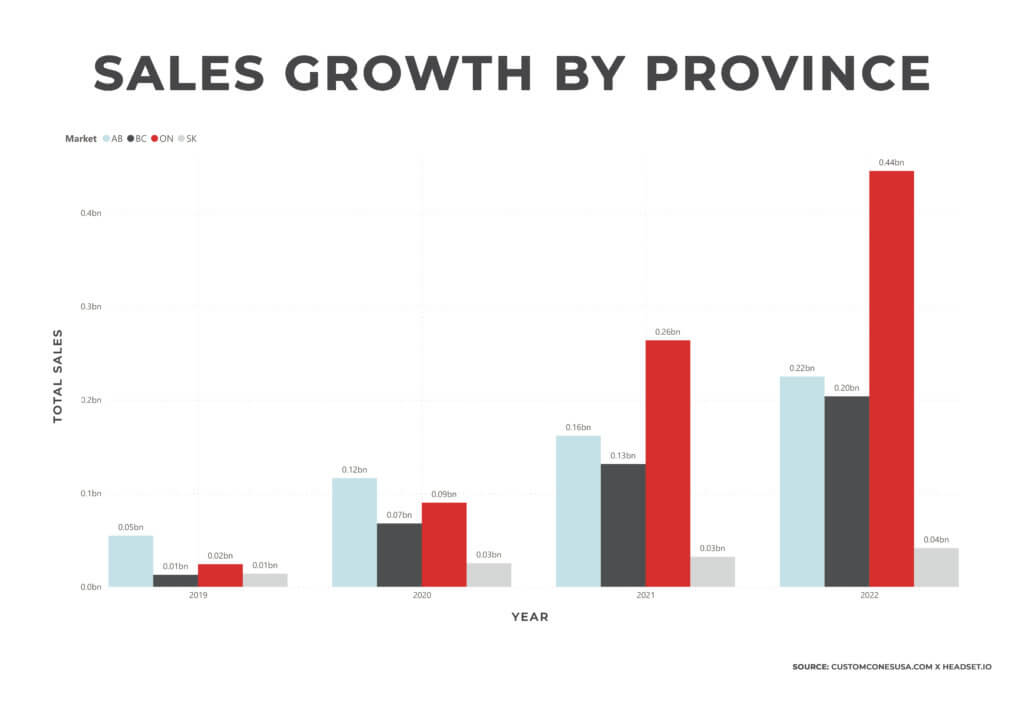

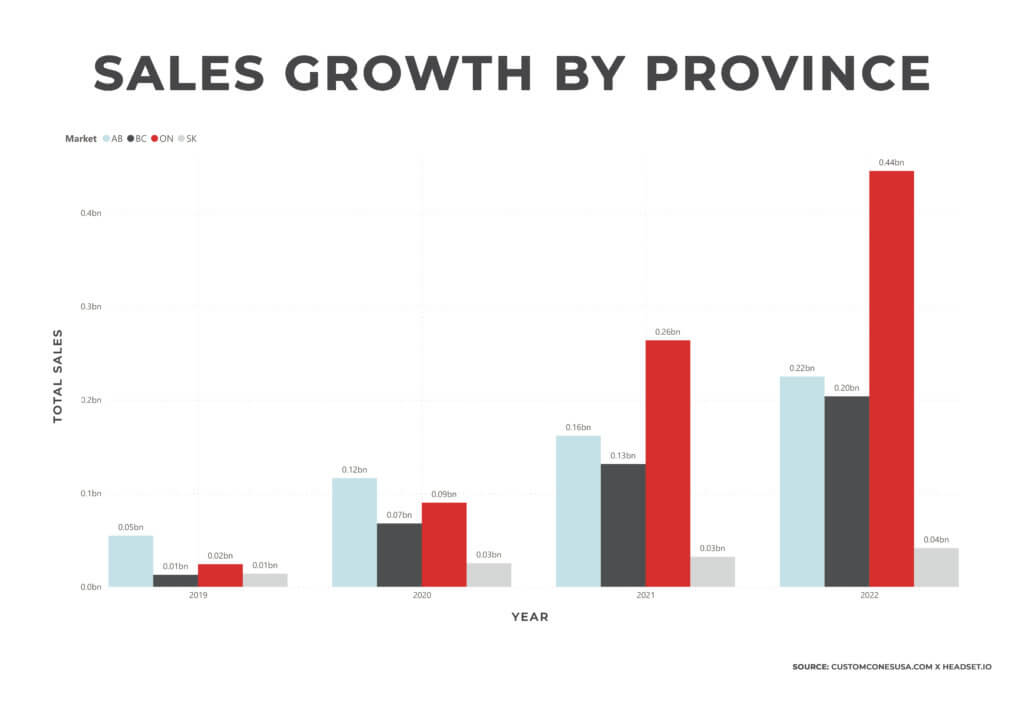

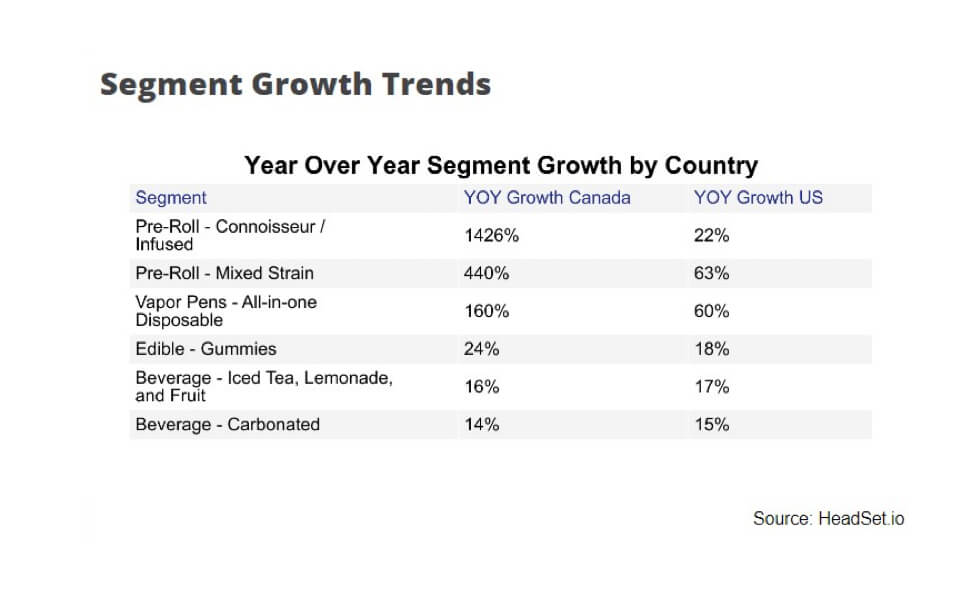

Sales of pre-rolls in all four of the provinces tracked by Headset saw large increases. Pre-roll sales saw 33% and 37% growth in Saskatchewan and Alberta, respectively, a nearly 54% growth in British Columbia and a whopping 69% increase in Ontario, the country’s most-populous province. In the U.S., pre-roll sales also continue to surge, growing to a 12.1% market share in the States.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

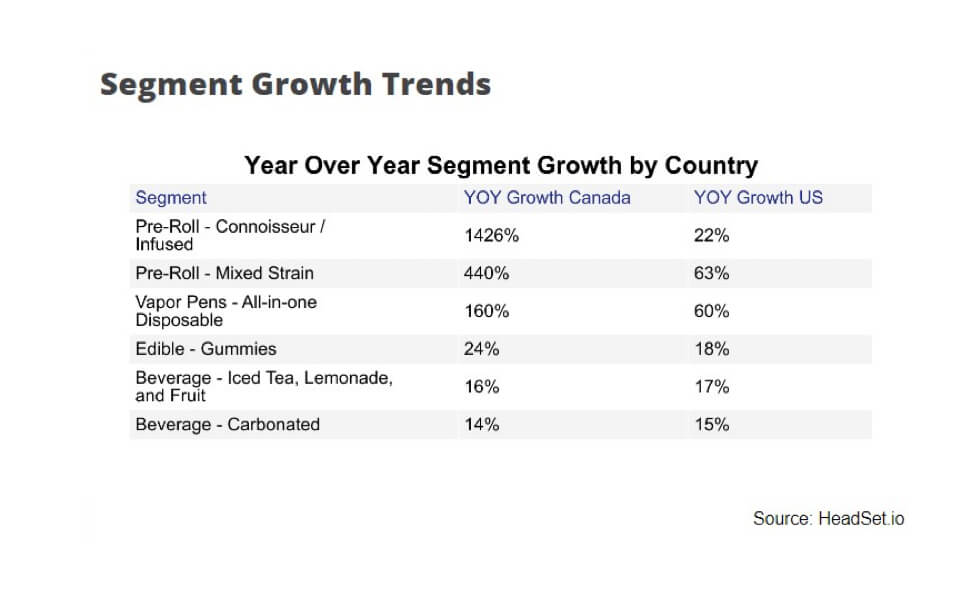

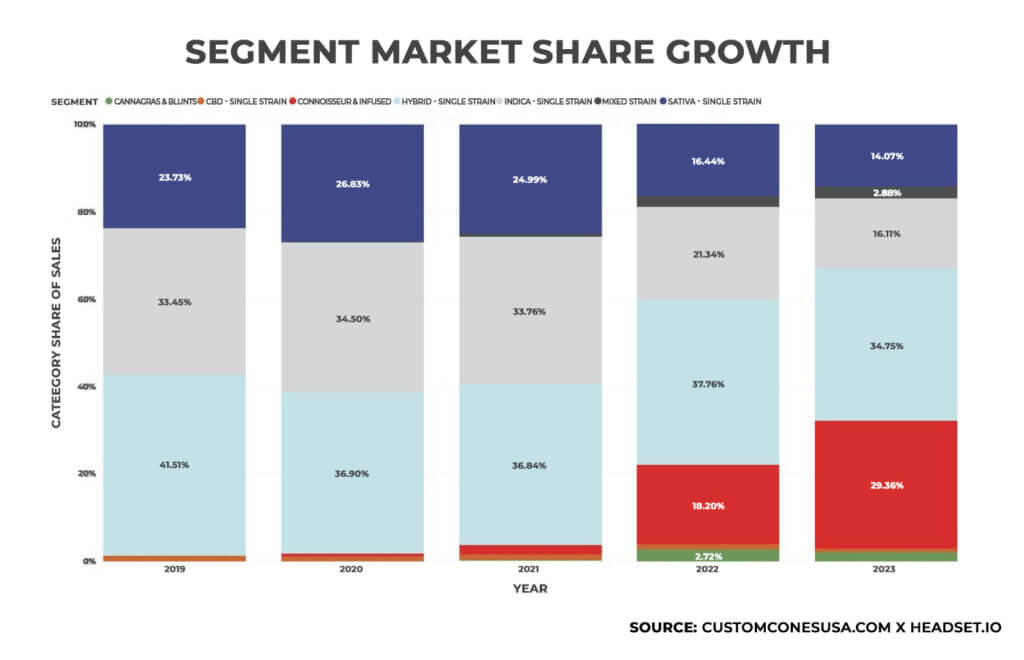

Consumers have responded, with infused pre-rolls seeing an eye-popping 1,426% growth rate from 2021 to 2022. The segment grew from just under 3% of the market at CAD$12.7 million in 2021 to nearly 30% and CAD$47.9 million by mid-2023. That’s more growth than any other pre-roll category except single-strain hybrids.

Keeping Price Points High

Keeping Price Points High

The rising popularity of infused pre-rolls, with their higher price point, has been a significant factor contributing to the increase in the average price of Canadian pre-rolls. Infused pre-roll sales jumped from 6.2% of total sales in January 2022 to 29.8% of sales by February 2023. This trend has been instrumental in maintaining the overall price of pre-rolls even as prices for flower and concentrates have decreased.

According to Headset data, in 2022, pre-roll products accounted for 27% of the new items introduced in the Canadian market, demonstrating a remarkable growth rate of 48.2% compared to 2021, second only to beverages. In response to the increasing demand in this category, a total of 1,870 new pre-roll products were launched in the Canadian market during that year.

The resilience of pre-roll prices can also partially be attributed to their manufactured nature and the unique attributes of infused pre-rolls. The demand for stronger pre-rolls, coupled with declining prices for flower and concentrates, has created a favorable environment for launching infused pre-roll products.

Additionally, automated pre-roll machinery continues to evolve, including new automated infused pre-roll machines, making it easier for manufacturers to produce large quantities of infused pre-rolls at a slight premium over regular pre-rolls, leading to the category’s rapid expansion.

Multi-Packs and Cross-Generational Appeal

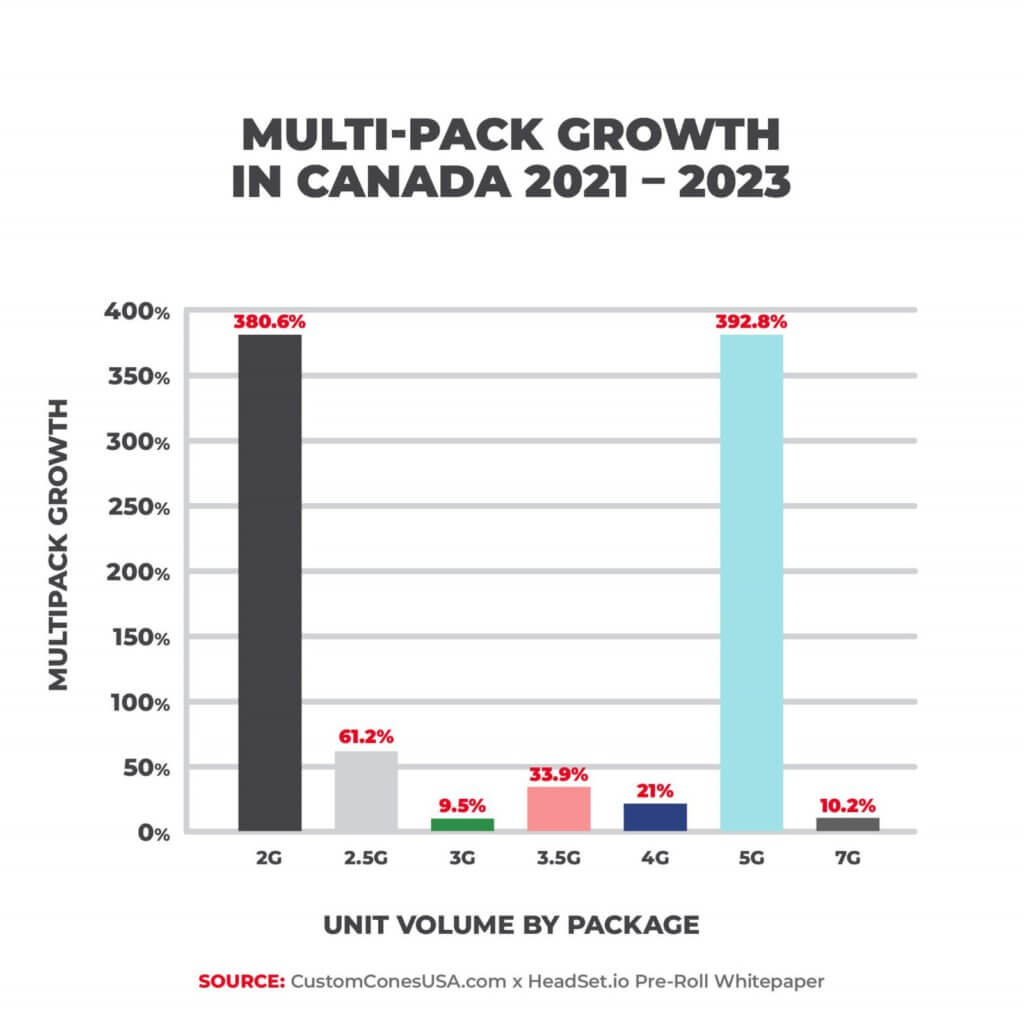

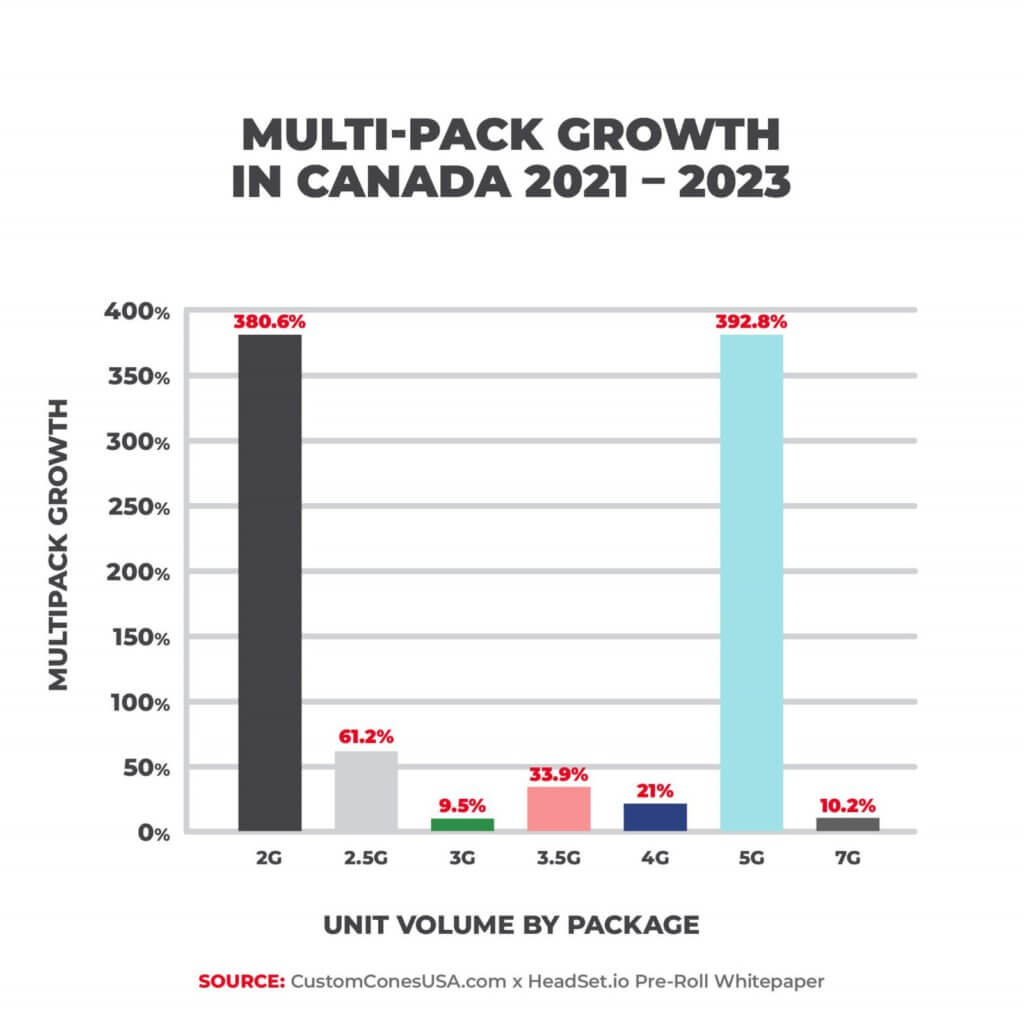

Other insights from our report include a surge in pre-roll multi-packs, with 2- and 5-gram packs seeing an almost 400% growth over the past two years, and that the pre-roll category shows less price compression than any other segment of the market, as it does in the U.S. as well.

Part of the strength of the pre-roll segment is its cross-generational appeal. For example, the Ontario market is the largest and fastest-growing of Canada’s provinces. With revenues reaching CAD$440 million in 2022, Ontario accounts for almost half of all sales in Canada. And within Ontario, the wallet share of pre-rolls grew within every generational group through 2021, with Gen X and Millennials seeing the largest growth, at around 45% each.

Within the fastest-growing group of consumers in the industry, Gen Z (which in Canada is a larger cohort than the U.S. due to a lower age restriction for cannabis purchases), pre-roll sales increased with both male and female consumers. The wallet share of pre-rolls among female buyers grew more than 4% to 20.4% in 2021. For males, the increase was even larger, growing from 14.6% of wallet share to 19.7%.

Final Thoughts on Pre-Roll Growth

The main factors driving the huge growth in pre-rolls are:

- Increased pre-roll quality, as flower and concentrate prices drop, so companies can create a higher quality pre-roll at cheaper and cheaper prices.

- Reduced labor costs, as advancements in pre-roll machinery help companies scale production and bring in automation.

- Consumer buying patterns showing that customers want convenience and are consuming for recreational use, not health and wellness.

The next big trend in pre-rolls, which will push pre-rolls to the No. 1 sales category in the industry, is freshness. Competing in the future will mean better packaging and a better supply chain, so pre-rolls are always fresh at retail.

But with sales surging across both Canada and the U.S., now is the right time for producer/processors to launch or expand pre-roll lines, particularly infused pre-rolls and pre-roll multi-packs.

For more information on how you can capitalize on the latest trends in the pre-roll segment, contact the Pre-Roll Experts at Custom Cones USA.

Member Blog: New Data Reveals Market Share Changes for Cannabis POS Software Providers

by Ed Keating, Co-founder and Chief Data Officer of Cannabiz Media

Point of sale software providers are a critical part of the cannabis economy, and as the industry grows, a shift is happening.

In the first half of 2019, the dominant POS providers of 2018 held onto their positions as market leaders. Others merged or were acquired, and new providers launched. Even big brands like NCR, NetSuite, and SalesForce entered the market joining Quicken and Square in an attempt to gain a piece of what they hope will be a lucrative market.

Cannabiz Media conducted a research study to identify POS software providers and market shares in mid-2019 and compared the data to findings compiled in a similar year-end 2018 report. The full report is available for free download here, and the results may surprise you.

Key Findings for Mid-Year 2019:

- There are 68 unique POS software providers in the U.S. cannabis industry (up 58% from 43 in December 2018).

- BioTrack is the market share leader overall.

- BioTrack is the market share leader in states with medical-only cannabis programs.

- Green Bits is the market share leader in states with adult-use cannabis programs.

- Green Bits is the market share leader in METRC states.

Cannabis POS Market Share Shifts in the First Half of 2019

In mid-2019, the top five POS providers account for 68% of the overall cannabis market, and the top 10 account for 84% of the market. Part of this change can be attributed to active California licenses expiring and revisions to the survey methodology.

In mid-2019, the top five POS providers account for 68% of the overall cannabis market, and the top 10 account for 84% of the market. Part of this change can be attributed to active California licenses expiring and revisions to the survey methodology.

Compare those numbers to how things looked at year-end 2018 when the top 5 POS providers made up 80% of market share, and the top 10 were responsible for 93% of the market.

In addition, the number of POS vendors servicing cannabis businesses increased by 58% from 43 in December 2018 to 68 by July 2019.

In other words, while the market is still highly concentrated, the market leaders have given up some market share, and new companies continue to enter the space.

The same shifts are happening in medical-only and adult-use states.

In mid-2019, 34 POS providers were active in medical-only states (up from 15 in December 2018), and 53 were active in adult-use states (up from 40 in December 2018).

At year-end 2018, the top five POS vendors accounted for 94% of the market in medical-only states, but in July 2019, they only account for 70.4% of the market.

In adult-use states, the top five vendors accounted for 78% of the market in December 2018 but only account for 71% of the market in mid-2019.

Top Cannabis POS Software Providers in Mid-2019

According to Cannabiz Media’s research, the top five cannabis POS software providers overall in mid-2019 are:

- BioTrack

- Green Bits

- Flowhub

- MJ Freeway

- Indica Online

In medical-only states, the top POS software providers in mid-2019 are:

- BioTrack

- MJ Freeway

- Indica Online

- Flowhub

- COVA

In adult-use states, the market share leaders in mid-2019 are:

- Green Bits

- BioTrack

- Flowhub

- Adilas

- MMJ Menu

In METRC states, the top five POS software providers in mid-2019 are:

- Green Bits

- BioTrack

- Flowhub

- Adilas

- MJ Freeway

Key Takeaways

While the POS market leaders have lost some market share in recent months, the biggest battle appears to be among the top two companies, which have approximately twice as much market share as the company ranked in third place in the overall market as well as in adult-use states and METRC states. In the meantime, the other 66 POS providers that service the cannabis industry are slowly chipping away at that share.

Get the Free Report with Detailed Data, Charts, and Commentary

Visit https://cannabiz.media/pos-report-2/ to download Cannabiz Media’s complete “Point of Sale Software in the Cannabis Industry: 2019 Mid-Year Report” for free to view all of the detailed market share data, the full list of POS vendors in the cannabis industry, 2018 vs. 2019 comparisons, and specific data about POS providers in the California and Oklahoma markets.

Ed Keating is a co-founder of Cannabiz Media and oversees our data research and government relations efforts. He has spent his whole career working with and advising information companies in the compliance space. Ed has overseen complex multijurisdictional product lines in the securities, corporate, UCC, safety, environmental and human resource markets and focuses on workflow products. Ed has spent the last twenty five years in the information industry. During that time he has worked for both startup and established information companies where he has led marketing, product management and sales organizations. These companies include Wolters Kluwer/Commerce Clearing House, CT Corporation, EDGAR Online and Business & Legal Reports. At Cannabiz Media, Ed enjoys the challenge of working with regulators across the country as he and his team gather corporate, financial, and license information to track the people, products and businesses in the cannabis economy. Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University. He has been active with the Software & Information Industry Association for his whole career and managed the Content Division for six years. He’s was recently a Trustee at the Country School in Madison CT and a Little League Coach for seven years.

Ed Keating is a co-founder of Cannabiz Media and oversees our data research and government relations efforts. He has spent his whole career working with and advising information companies in the compliance space. Ed has overseen complex multijurisdictional product lines in the securities, corporate, UCC, safety, environmental and human resource markets and focuses on workflow products. Ed has spent the last twenty five years in the information industry. During that time he has worked for both startup and established information companies where he has led marketing, product management and sales organizations. These companies include Wolters Kluwer/Commerce Clearing House, CT Corporation, EDGAR Online and Business & Legal Reports. At Cannabiz Media, Ed enjoys the challenge of working with regulators across the country as he and his team gather corporate, financial, and license information to track the people, products and businesses in the cannabis economy. Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University. He has been active with the Software & Information Industry Association for his whole career and managed the Content Division for six years. He’s was recently a Trustee at the Country School in Madison CT and a Little League Coach for seven years.

Guest Post: Tuning In on Cannabis Customers

By Mike Kennedy, Atomic20

Everybody must get stoned. Okay, so Bob Dylan was actually referring to the heartbreak of relationships in this song, not our fair state of Colorado since the legalization of marijuana in 2012. But after you take a look at the numbers you’ll likely agree that “never gonna be the same again” is a fitting Dylan lyric to describe Colorado’s current cannabis culture. That includes, perhaps most significantly, the legal bud marketplace.

A recent study prepared for the Colorado Department of Revenue painted a telling picture of marijuana usage in the state. One surprising figure is that only 9% of the population consumes cannabis in some shape or form. But it’s the flipside of that statistic that makes Colorado, and other states like it, such a tantalizing opportunity for budding marijuana businesses. While Colorado has less than 500,000 cannabis users, those users do so at extremely high rates, to the tune of more than 120 metric tons annually.

Assuming the cannabis industry is here to stay, that begs the question: who is positioning themselves to reap the benefits of this legion of dedicated cannabis users? The answer: those who understand that the legal marijuana business is just that, a business. A key to long-term, sustained success in any business is creating brand loyalty. And, as of now, we know that Colorado marijuana consumers who shop retail have yet to develop any.

This isn’t lost on us at Atomic20. We’re a creative agency that specializes in market strategy and design for marijuana companies. We recently commissioned an independent study of cannabis users with the help of consumer research expert Koert Bakker. The findings paint a clear picture of the current consumer landscape…

- Less than half, or 42%, of frequent marijuana shoppers have a regular store they visit.

- Only 18% of casual/occasional shoppers favor any given store.

- 67% of occasional buyers are still learning what they like and rely on a friend or budtender to influence what they buy.

Bottom line: There is a lot of market share to be had with nearly 80% of occasional buyers and 60% of frequent shoppers still up for grabs.

So how do you go about capturing the frequent and occasional buyer, and then convert them into lifelong brand loyalists? Obviously, there’s no simple answer to that question. But here are few things to keep in mind:

- Competitive pricing: Don’t kid yourself. Price supersedes just about any other factor in most buying decisions. Offering daily promotions and periodic sales is enticing to any marijuana user.

- High quality: For pot smokers, this is one factor that can take precedence over price. If they find a strain they like, they will search it out and buy it again and again. Developing proprietary strains is one way to give a retail shop its own unique identity.

- Market expertise: You have to have a clear understanding of what your customers want. Merchandise your shop in a logical way. Determine which edibles sell and only carry those.

- Strong social media presence: Having great product at excellent prices means nothing if consumers don’t know about you. In the medical marijuana industry, social media has become an effective way of reaching out to patients. For example, having a Facebook page gives you a way to stay in touch with customers on a daily basis.

- Knowledgeable and friendly customer service: This sounds easy enough, but you’d be surprised how many pot businesses fall short. Do the basics. Make sure the waiting area is clean and has comfortable seating. Offer pre-rolls that are rolled professionally. And, of course, know your product inside out.

This is a defining moment in the emerging Colorado marijuana industry. The consumer base is still anyone’s for the taking. So, even if everybody isn’t getting stoned, there’s no denying that the times they have a-changed, and the cannabis business is ripe for the picking.

Mike Kennedy is a staff writer for Atomic20 (A20) — Atomic20, a Sponsoring level member of NCIA since August 2014, is a full-service marketing agency and shared creative workspace in Boulder, Colorado. In mid-2014, A20 assembled a qualified team of MJ marketers and research experts to serve the rapidly growing needs of the cannabis industry. With a local network of 85 top designers, developers and researchers, A20 has the ability to curate the perfect team for its clients with a focus on dispensaries and MJ brands.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.

With federal legalization believed to be on the horizon for the United States, Canada’s data stands out as a national system and gives us some insight into how the American market could respond to a federal program, as opposed to one that is regulated state-by-state.  The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.

The sales growth has been fueled in part by the rise of infused, or “connoisseur” pre-rolls, which combine a cannabis concentrate and flower into a single pre-roll cone. The result is a more potent pre-roll, often at a higher price point, which has helped push revenue totals even higher since Health Canada clarified its rules in late 2021 to clear the way for the product.  Keeping Price Points High

Keeping Price Points High

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

News & Resource Topics

–

This Just In

Member Blog: Cannabis Banking – A Risk / Reward Analysis

Rooted in Community: Nice Guys Delivery