Video: NCIA Today – May 14, 2021

by NCIA’s State Regulations Committee

by NCIA’s State Regulations Committee

Contributing authors Jennifer Gallerani, Tim Gunther, Elise Serbaroli, and Erin Fay

The COVID-19 pandemic and subsequent recession powerfully demonstrated that the cannabis industry is providing essential medicine and products to countless Americans, as well as creating jobs and tax revenue. Retail sales of medical and adult-use cannabis in the United States were on pace to eclipse $15 billion by the end of 2020, and if you include ancillary products and services, the industry is estimated to reach $68.4 billion in 2021. The U.S. cannabis industry is experiencing rapid job growth, boasting an estimated 300,000 full-time jobs in 2020. Those numbers are expected to almost double by 2024. Over the next four years, the industry is expected to add nearly 250,000 full-time equivalent positions. By comparison, roughly 271,000 people currently hold beverage manufacturing jobs. These numbers demonstrate with sureness that the U.S. cannabis industry is on a high-growth trajectory, which makes it imperative that the market operate under a practical regulatory framework that benefits both regulators and operators.

Most states that have approved some form of legal cannabis sales (medical and/or adult-use) have also selected a single, mandated technology platform that all operators must use to track and trace their cannabis seeds, plants, and end products. Some iterations of the current track and trace model — which is primarily centralized approach — sets businesses, employees, and regulators up to fail. Of course, it also further limits the competitiveness of the regulated market with the unregulated market, and the ability for policymakers to be confident that cannabis consumers in their states are obtaining taxed, tested, and regulated products.

Local governments are missing out on tax revenue, and businesses (both large and small) are forced to spend unnecessary resources on a system that is fundamentally flawed. The centralized model, contracting with one specific software provider, and mandating operators to use that software provider in order to stay compliant, is wreaking havoc on the entire U.S. cannabis industry and is not sustainable for a federally-legal and global supply chain.

As a team, the National Cannabis Industry Association’s State Regulations Committee’s Technology and Compliance Subcommittee has spoken to regulators, operators, and international technology providers in the interest of presenting a practical track and trace solution to benefit the industry as a whole. This is the first blog in a series that will highlight the issues that cannabis operators and regulators are facing because of the current centralized state-mandated track and trace model. We propose that the U.S. cannabis industry operate under a more practical framework that has a higher probability of success for regulators and cannabis businesses through slight changes and improvements based on proven best practices.

Track and trace systems serialize assets to identify where assets are (track) and to identify where assets have been (trace). Track and trace is not something new. It is the globally acknowledged standard for product movement and reconciliation in both the Pharmaceuticals and Consumer Packaged Goods (CPG) industries. A secure track and trace system combines material security and information security elements to confirm assets are legitimately produced and sourced, following a pre-defined and auditable path.

As the regulated cannabis markets started to take shape and mature in 2012, one of the driving factors that shaped the need for a track and trace system was the 2013 U.S. Department of Justice Cole Memorandum (Cole Memo). The Cole Memo indicated for the first time that the federal government would only intervene in states that failed to prevent criminal involvement in the market, sales to youths, and illegal diversion to other states.

The first four states to legalize adult-use cannabis were Colorado, Oregon, Washington, and Alaska. All four of these states instituted a market-based licensing system to regulate the commercial activity of cannabis sales. The intentions of the newly instituted policies were two-fold: protect consumer health and minimize diversion, both of which align with the core principles of the Cole Memo. To meet these intentions, the states instituted procedures for inventory control and tracking documentation using a state-mandated centralized model, in an effort to create a transparent and controlled system of oversight within the cannabis industry.

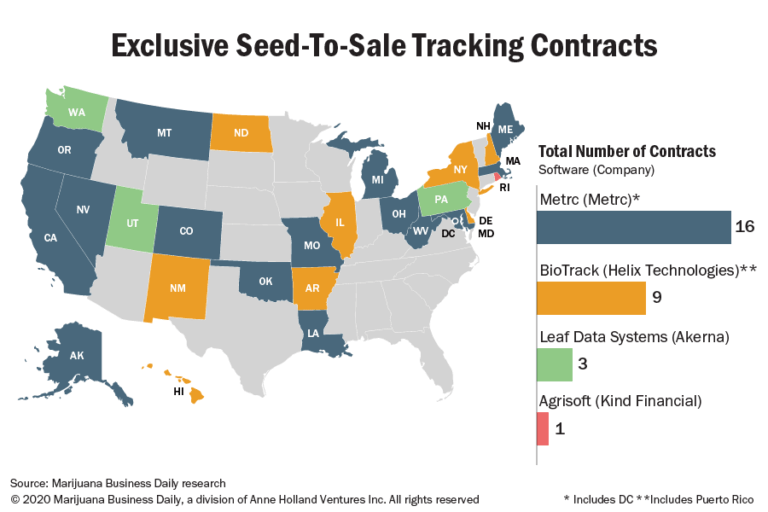

As the industry has developed over the years, most states that have approved some form of legal cannabis sales have selected a single mandated technology platform that all operators must use to track and trace their cannabis seeds, plants, and cannabis products. As shown in Figure 1, the majority of legalized states have chosen METRC as their exclusive contractor of track and trace services.

Figure 1: https://mjbizdaily.com/metrc-sees-sale-tracking-opportunities-in-new-cannabis-markets/

The legal cannabis market has changed significantly since 1996 and it is important for the industry to re-evaluate the intention and implementation of track and trace. Regulatory bodies contracting with one track and trace technology provider and mandating operators to use that specific provider in order to stay compliant is problematic for many reasons. Time has shown that the current centralized model is fiscally irresponsible and ultimately counterproductive, with significant negative externalities, including ethical concerns such as anti-trust issues. Most recently, an Oklahoma cannabis operator (seeking class-action status) initiated litigation against the state’s Medical Marijuana Authority (OMMA), alleging that the state exceeded its authority by requiring licensees to pay for a state-mandated track and trace program, and that the state’s contract with METRC creates an unlawful monopoly, among other claims.

To provide an analogy, let’s think about how businesses are required to report taxes. The IRS sets out certain rules and every business must report their income and assets according to that framework. Technology providers (such as TurboTax, Tax Slayer, H&R Block, etc.) have built scalable products to support businesses in reporting their taxes. The IRS does not mandate that businesses use one single specified software in order to report their taxes. Doing so would kill competition, introduce a monopoly, and eliminate any incentive for the technology providers to improve their product. By the IRS allowing free competition over the realm of tax preparation and processing software, the public benefits from the technology companies being incentivized to update and improve their software features and benefits.

The centralized model is crippling the entire industry as system failures are occurring on a more frequent basis, and its after-effects are causing a more detrimental and wide-ranging impact as the industry grows at an exponential rate. Most recently, METRC’s integration functionality (how third-party business operations software communicates to the state’s system) was down for more than fourteen days in California, causing significant problems in the nation’s largest cannabis market. One software provider and its tag-producing partners are benefitting, while setting industry regulators and operators up to fail. One software provider cannot meet the current or future needs of regulators and operators, especially not on a national level. Meanwhile, there are many excellent software providers that specialize in track and trace. The free market should determine the most efficient and user-friendly approach to allow businesses to stay compliant and accurately report to the appropriate regulatory authorities.

By leveraging the knowledge and experience the industry has gained over the last 20 years, we can incorporate best practices from other industries’ and other markets’ track and trace systems, and set regulators and operators up for success.

Join us as we dive deeper into the issues surrounding compliance and track and trace in the cannabis industry. Our multi-part blog series provides an in-depth look into the technical shortcomings of the current centralized approach and provides a roadmap for implementing a distributed model approach. Some of the disadvantages we will cover in the subsequent posts include:

Impact of System Failure: The current centralized model provides a single point of failure: if the system goes down, all licensee operations must stop operating entirely. In some cases, operators may manually record activity during a system failure, and then manually enter the activity when the system resumes. This introduces a high risk of human error. No backup system or alternative means of recording through the use of technology exists since the state relies on only one system.

Challenges with Scalability: The history of performance with centralized track and trace systems demonstrates that there are significant challenges in scalability because of multiple system failures and shutdowns. The system would benefit from a more advanced track and trace capability, specifically with its API (Application Programming Interface). Many times it is not the technology of the licensee system, but the technology design of the state-mandated systems.

Fiscal and Environmental Impacts: Licensees are required to purchase plant and product tags from the single state-mandated vendor, which creates a fixed price system that is typically not in favor of a licensee. It is also creating a sustainability issue in the industry, as the plant and product tags are single-use. More operators are speaking up about the waste it is generating in our cannabis industry.

Interested in joining us in establishing an effective and scalable track and trace framework for regulators and operators in the legal cannabis space? Click here to stay updated on the State Regulations Committee, and the efforts that it’s Technology and Compliance Subcommittee are taking to improve and advance track and trace nationally. Let’s close the informational gap between operators and regulators, and help the entire industry move forward together.

Stay tuned for the next two blog posts in our multi-part series!

#cannabisindustry #legalcannabis #trackandtrace #wearethecannabisindustry #cannabiscompliance

by NCIA’s Cannabis Manufacturing Committee

by NCIA’s Cannabis Manufacturing CommitteeDespite prohibition, the cannabis industry is not behind the curve of sustainability progress. While other industries were inventing modern Cloud-based quality control/distribution systems and making stuff out of plastic, cannabis producers were maximizing yields per watt and creating stronger concentrates in attempts to get the most out of their value streams while staying under the radar. Now all industries are racing towards a more sustainable future and the cannabis industry has the opportunity to show that it can be a good example, even a leader in sustainability. Regardless if it is in preparation for competition or regulation, now is the time to start building more sustainable, energy-efficient, and overall lower footprint businesses.

As the manufacturing branch of the cannabis industry paves its way into the future, the processes involved need to be made environmentally sustainable and best practices need to be shared and standardized to ensure product safety and industry longevity. Collecting and sharing data from manufacturing facilities is the ideal way to achieve these sector goals.

Environmental sustainability is a multi-discipline effort. Experts in engineering, emissions, air quality, worker health and legal matters should be relied on for educating and guiding businesses into a more sustainable future.

While cultivation is one of the main focuses of the cannabis sustainability effort, manufacturing procedures are also prime targets for sustainable advancements. Due to the nature of the organic chemical processes used to produce consumables, some of the materials and practices could have a negative impact on both worker and environmental health if not addressed and handled properly. As a best management practice, regulated cannabis manufacturers typically operate closed-loop systems, which greatly reduce certain dangers, but this can require other more energy-intensive systems. As these relatively new processing techniques are being pioneered, we need more data to understand how they can be made more efficient and sustainable. For various reasons — such as intellectual property concerns — advancements in sustainable practices are often not shared and therefore not visible to potentially become a standard process that ensures product and consumer safety.

The scientific improvements for manufacturing cannabis into consumer products in high demand have outpaced regulations. From process design and equipment to processing material sourcing, the manufacturing branch of the cannabis industry has much to offer the future of sustainable cannabis products. In many jurisdictions today, regulators have hastily opted for vertical, prescriptive regulations which have left many manufacturing operations without the leeway required to innovate more sustainable process strategies. Even more businesses with the legal leeway simply do not want to push the envelope in today’s regulatory climate. More forward-thinking, regulation-savvy equipment manufacturers have begun focusing on lower energy-use in their newer products as a selling point. The industry as a whole could be making progress much faster if regulators focused on performance standards for manufacturing facilities.

Strategies inspired by building and process heat recovery offer dozens of basic possibilities when it comes to implementation in a cannabis manufacturing facility. Using the energy released during solvent condensation for solvent evaporation is a prime example. Connecting liquid-cooled equipment with the building’s central plant system is another. These are big ideas that could be implemented in different ways with different efficiencies. Intelligent use of insulation, exhaust recirculation, odor mitigation, ventilation minimization, demand-control ventilation for providing makeup air, etc. could also make significant differences. Data collected from actual operating facilities experimenting with different strategies will be the best guide going forward in determining what the best energy saving strategies are.

In an effort to prevent unnecessary Volatile Organic Compounds (VOC) emissions it is important to maintain proper solvent transfer and storage, perform extraction equipment inspections, and ensure a maintained inventory and handling of solvents on site are a part of a facility’s standard operating procedures. Best practice for extraction and post-processing dictates the use of butane, propane, CO2, ethanol, isopropanol, acetone, heptane, and pentane as solvents to encourage safe consumer products.

Carbon filtration is also the best management practice for controlling cannabis terpenes (VOCs) and odor emissions. It is important to install properly engineered molecular filtration systems (aka carbon scrubbers) that are sized appropriately for a facility’s ‘emission load’ and don’t exceed the maximum cfm rating for air circulation through the filter. To prevent VOC and odor breakthrough, it is imperative to inspect and conduct regular maintenance of HVAC systems and carbon filters. A standardized method for measuring the lifespan of carbon is by using a Butane Life Test, which equips manufacturers with the data to know how to manage their carbon replacement schedule effectively, minimizing unnecessary carbon waste. Additionally, processors can conduct air sampling to detect and measure VOC and odor levels in their facilities and the data can be used to validate the impact of control technologies further protecting worker and environmental health.

Proper VOC and cannabis odor control from manufacturing processes helps reduce community odor complaints and improve neighborhood relations. It also improves public and environmental health by reducing local ozone concentrations. Proper emissions control when running cannabis manufacturing processes and handling chemicals helps to shift the industry at large toward sustainable and environmentally conscious business practices.

Cannabis manufacturers are seeing big changes on the horizon. Increased legalization brings increased competition and inevitable M&A activity. Whether a business aspires to compete on the world stage or to be acquired in one of the coming green waves, there are actions that can be taken today to help cannabis manufacturers maximize their value to both customers and potential acquirers.

One of the most important assets a company can have — both to compete effectively and to attract purchasers — is intellectual property. Intellectual property, or IP for short, is the term for an intangible asset that has been afforded certain legal protections to solidify the asset into a commodity that can be bought, sold, and licensed. IP can have a negative connotation in some circles, mostly resulting from misconceptions in the law but also rooted in IP abuses by unscrupulous “trolls.” In reality, IP is an important tool to help companies protect their hard work and, when properly deployed, intellectual property can increase transparency into cannabis manufacturing processes and open new avenues of scientific advancement.

Intellectual property broadly covers a number of different types of rights. Patents protect new inventions like processes, machines, compositions of matter, ornamental designs, and plant genetics. Patents can grant relatively broad rights to these ideas, but with substantial additional costs and scrutiny.

Similarly, copyright can protect creative works, like writings, drawings, and sculptures. But many do not recognize that copyright can also protect compilations of data that have been creatively selected or arranged. Data and algorithm copyrights are relatively nascent, but they promise to play a large role in the intellectual property landscape of the future cannabis industry.

Another sect of intellectual property, trademarks, is all about protecting a brand: the names, logos, slogans, and overall look that tells customers that a good or service is from a particular company. Federal trademark registration is unavailable for federally illegal goods and services, but that does not mean that federal trademark protection is unavailable to cannabis brands. Many companies are using the zone-of-expansion doctrine baked into federal trademark law to set up registrations on related legal products (smoking/vaping devices, clothing, and even CBD edibles) that can be expanded to cover THC products when federally legal.

The nuances and requirements of these property rights — along with other IP rights like trade secrets and trade dress — are highly fact-specific, so involve a good IP attorney to guide your strategy from the start.

Now is the time to start building more sustainable, energy-efficient, and overall lower carbon footprint businesses and the emerging legal cannabis industry is well-positioned to be the leader. If manufacturers are incentivized to safely share processing data directly or through emerging data collection and tracking platforms, the industry will make major advancements towards more environmentally sustainable practices. Environmental impact areas, such as air quality, energy, water, soil waste, and community all need to be considered by the manufacturing arm of the cannabis industry. Regulators can help push the industry forward by reducing negative impacts in these areas though focusing on performance standards for manufacturing facilities and their processes. Lastly, understanding that IP, including trademarks, can in fact increase transparency into cannabis manufacturing processes and open new avenues of scientific advancement will help position operators for M&A activity coupled with proper legal representation. These factors work together to protect the environment and communities, as well as future-proof manufacturing operations setting up the rest of the cannabis industry for longevity and federal legalization.

By Mell Green, CBD Oracle

Medical cannabis hasn’t always had a smooth go in the United States. Thankfully, as time has slowly started to change and viewpoints have shifted, cannabis legalization is finally gaining traction state-wide. While this is an incredible feat for so many different reasons, many states see long-term benefits of cannabis legalization much further reaching than anyone could have imagined.

Today, we’re talking about how cannabis legalization in Minnesota may actually help further equality and break down barriers that have long been deeply rooted. Let’s get started.

Quickly, it’s essential to understand the tumultuous history behind marijuana and just how far we’ve come as a society. However, seeing this rocky past also helps illuminate how much further we still have to go.

The cannabis plant has existed for millennia on planet Earth. Its therapeutic benefits have supported civilizations in spiritual, religious, and medicinal ceremonies across the globe. As this idea spread to Western societies, the plant was, at first, welcomed with open arms. At the start of the 20th century, all of this changed entirely in the United States.

During the Mexican Revolution from 1910-1920, many Mexican citizens fled their war-torn home country in search of a safer, more promising future. With this, the U.S. saw an influx of Mexican immigrants.

Throughout Mexico, enjoying cannabis for its recreational effects wasn’t a new idea. So, when citizens began migrating North, they also brought more normalized recreational cannabis use. At first, for those in the U.S. who already adored cannabis, this was incredibly exciting. But, for many in positions of power, class, and wealth, this type of cannabis use wasn’t going to fly. Thus came the Reefer Madness film and decades-long racially charged cannabis persecutions.

It took way too long, but the United States finally started getting on board with cannabis decriminalization and legalization back in the 80s and 90s. With this, the exposure to cannabis science became more extensive, and it was easier to see that the plant did (and still does) have some serious medicinal benefit. Seeing these facts caused a lot of opinions to change, resulting in an almost domino-like effect of cannabis legalization across the country.

Now, 36 states have legalized medical cannabis, allowing more people than ever access to the precious plant they love. But has this legalization impacted the people most disproportionately punished? Not really.

Still today, we see Black men arrested for cannabis crimes at disproportionately high rates, even though cannabis is legal in most states across the U.S. If anything, these legal changes have made the divide all the more evident, allowing the country to see just how horrific the cannabis industry can be for people of color. At the same time, it simultaneously celebrates white American consumers. This may help boost PR for big business, but it doesn’t help local (black-owned or otherwise) businesses on the ground. Legally or economically.

So, what can we do to change this? How can cannabis legalization help to further the progress we’ve made?

I know, it sounds like we’re a bit cynical, but it’s crucial to bring up these divides before discussing how we can move further. The country often loves to praise all the beauty that the cannabis industry brings, forgetting the intense harm it has caused so many communities.

Let’s talk about Minnesota, for example. In May, it looks as though the state is going to vote to pass adult-use cannabis use. If this happens, here’s what could potentially occur in terms of furthering equality — but, at the end of the day, this change is up to you.

Realistically, the legalization of cannabis should help reduce the number of victimless crimes in the area, helping the community feel more at ease. With this, you would also expect a lowered number of consistent police presence in areas where cannabis use was a previous “problem.” Often, when communities of color experience increased and frequent police presence, this does not provide a sense of safety. Typically, it provides the opposite. Thus, legalizing cannabis in places like Minnesota may be able to create an environment that not only feels safer but feels more accepting of all residents. Feeling safe is great for business, big and small – but especially small. Reduction of victimless crimes and less police presence could really boost the state economy, and additionally enhance everyone’s sense of community and unity.

Furthering equality through the legalization of cannabis can be done, but the work goes much deeper than just on a legal level. As we’ve seen, just because the law says one thing, that doesn’t mean it applies to all groups of people. So, once legalization happens in Minnesota — or your state — the next steps are in your hands.

With this, you’ll also understand how legalization is not an end-all-be-all solution. If we want to erase cannabis’s racially charged stigma, the answer is holistic: it starts with a community.

Mell Green is a content creator who believes that cannabis can help anyone achieve a life-enhancing experience. Her participation in the advocacy of the plant for the last several years has not only allowed her to create solid relationships with the world’s leading cannabis companies, but it has also helped her to educate and spread awareness on the power of alternative medicine.

Mell Green is a content creator who believes that cannabis can help anyone achieve a life-enhancing experience. Her participation in the advocacy of the plant for the last several years has not only allowed her to create solid relationships with the world’s leading cannabis companies, but it has also helped her to educate and spread awareness on the power of alternative medicine.

CBD Oracle is a California-based online magazine dedicated to cannabis and CBD education. The company has made it its mission to provide specialized, expert advice to those who need it, publishing detailed, informative, and entertaining articles, guides, and reviews, all backed by the latest scientific studies and research.

by Anne Davis, Bennabis Health

The use of medical cannabis in chronic conditions is well-known, and some estimates are that medical cannabis can be an adjunct to more than 100 medical conditions. Frequently mentioned conditions include neuropathic disorders such as multiple sclerosis, neuropathy, PTSD, anxiety and depression and certain epilepsies among young children.

Although cannabis is still federally illegal, multiple studies of patients with multiple sclerosis and their providers have acknowledged that cannabis may have a role in improving symptom control, particularly pain, muscle spasticity, and more.

Anne Davis is a successful attorney, mother and community leader in New Jersey. In 2007, she focused her practice on the legal, regulatory, and advocacy issues surrounding use of medical cannabis. In this role, she became a national figure, presenting at conferences, and a sought-after contributor to health care law and advocacy initiatives.

Fast forward to 2013: Anne was thriving in her career and caring for her 2 daughters, ages 8 and 19-a critical time for her young family, whose needs were typical of busy and actively involved children and parents. In 2013, Anne was diagnosed with relapsing-remitting MS.

Devastated by the diagnosis, Anne began to research the impact of the medical regimen, prescribed medications and ongoing testing and lab work that would be required. Anne would need frequent lab tests to ensure treatment was not harming her vital organs, a potential side effect of many medications used in treating MS.

After careful consideration, Anne decided to use her professional knowledge about medical cannabis for herself, a decision not supported by her neurologist and care team.

Much like Anne, studies indicate that most patients conduct their own research when considering medical cannabis. The advice from friends and family are the most frequently cited resources when considering cannabis. A 2014 study indicated that only 18% of patients discussed use of cannabis with their healthcare provider, and less than 1% received assistance from their healthcare team on the kinds of formulations available. This leaves patients in a precarious and potentially harmful situation. Patients rely on and trust their healthcare team.

Surprisingly, despite lack of support and collaboration with their healthcare team, a survey of MS patients conducted in 2019 showed that more than 40% of patients said they used medical cannabis in the past 3 months. This is a striking number, indicating that patients are seeking non-traditional resources in managing their care. These data beg the question: Why are MS patients trying medical cannabis? Are their current prescriptive medicines not working? Do they have ongoing and unresolved symptoms that interfere with their quality of life? What is motivating patients to pay out of pocket costs for medical cannabis on top of their co-pays and health insurance premiums?

For Anne, the answer was “to avoid potential side effects” of her prescription medicines.

“I knew from my years in the industry cannabis was effective and had zero side effects. I was well aware of the research that indicates that cannabis has neuroprotective qualities, in addition to symptom relief. For that reason, I decided to use it every day as part of my treatment plan.

As an MS patient, cannabis is an integral part of my daily life. I use it every night before bed to help with fatigue, muscle cramping and spasticity. It also significantly helps elevate my mood, especially on days when I feel a sense of overwhelm. For me, I struggle with cognitive issues the most from MS. It depends on where the lesions occur in your body, or specific regions of the brain that determines what is impacted the most. It is important to live a healthy lifestyle. For me, that consists of exercise, nutrition, avoiding saturated fats, sugars, beef and dairy. I have reduced stress in my life, get enough sleep, meditate and stay positive. Add cannabis, and I feel like I am doing everything in my power to live my best life.”

Anne is often asked what strains work best? The fact is, there is not one in particular. “I prefer to change strains often. It seems that you build up a tolerance when you use the same strain every day. The therapeutic benefits are best from a blend of strains. I prefer high THC as my use is primarily in the evenings. The level of relaxation that I can experience helps me to fall asleep, stay asleep and get a good night’s rest. I have heard of pharmaceutical companies getting in the cannabis industry and making the argument that cannabis should be mass-produced and you should have the same consistent THC and CBD levels with every plant. Nothing can be further from accurate. Patients need and want variations.”

“First, celebrate and recognize your work, no matter if it is behind the counter, in the boardroom, growing, cultivating, and supporting advocacy that directly benefits patients like me. No matter your role in this industry, behind at the end of the supply chain is a patient seeking resolve from one or more symptoms. It could be the nausea associated with cancer, the pain from glaucoma, the night terrors from PTSD.”

“Continue to grow and produce quality products. What is a quality product in the opinion of a patient? In my experience, it consists of large green or purple buds with aromatic terpenes. I strongly believe in the “entourage effect “so I like both high THC and CBD combined, another reason that I prefer to mix cultivars and create blends.”

The industry can also advance healthcare and consumer knowledge about cannabis in all its forms. Although peer reviewed articles and scientific evidence are less available than we would like, helping patients and their providers understand what and how to use medical cannabis is essential to its acceptance as an alternative treatment option.

Anne continues to successfully use medical cannabis today. Anne’s neurologist, who was originally against her decision, has since advised her that she made the right choice.

Anne M. Davis, Esq. has been practicing law for 20 years. For the past 12 years, she has been recognized as one of the state’s leading experts in marijuana law and policy. In that role, Davis has presented workshops and seminars nationally about marijuana law reform. Since her diagnosis with MS, she has dedicated her skills and experience to create programs and expand access for medical marijuana patients. As part of that mission, she is a Patient Advocate for Bennabis Health, the first health care plan in the nation covering medical marijuana.

Anne M. Davis, Esq. has been practicing law for 20 years. For the past 12 years, she has been recognized as one of the state’s leading experts in marijuana law and policy. In that role, Davis has presented workshops and seminars nationally about marijuana law reform. Since her diagnosis with MS, she has dedicated her skills and experience to create programs and expand access for medical marijuana patients. As part of that mission, she is a Patient Advocate for Bennabis Health, the first health care plan in the nation covering medical marijuana.

As a community leader, Anne serves as a CASA (Court Appointed Special Advocate) working with foster children; she teaches CCD at her local Church, and has served as a Girl Scout leader for 11 years. Anne was recognized as a “Woman of Distinction” by the Girl Scouts at their annual Gala in 2020. Working with children, keeping them safe and giving them the best opportunities possible are some of her top priorities.

by Madeline Grant, NCIA’s Government Relations Manager

by Madeline Grant, NCIA’s Government Relations Manager

The Secure and Fair Enforcement (SAFE) Act, or H.R. 1996, passed the U.S House of Representatives with a final recorded vote of 321-101. This is the first floor action on a cannabis reform bill this Congress. This is not the first time we’ve seen movement on this bipartisan piece of legislation that would protect banks that service state-legal marijuana businesses from being penalized by federal regulators. The bill was reintroduced in March by Reps. Ed Perlmutter (D-CO), Steve Stivers (R-OH), Nydia Velazquez (D-NY), and Warren Davidson (R-OH), and had 177 total cosponsors by the time of the vote. The bill was taken up under a process known as suspension of the rules, which requires a 2/3rd supermajority to pass and does not allow for amendments. This is the fourth time that the House has approved the language of the SAFE Banking Act, initially as the first standalone cannabis policy reform bill ever passed by either chamber of Congress in 2019 and two more times last year as part of pandemic relief packages that were not approved in the Senate.

The SAFE Banking Act would protect financial institutions from federal prosecution for providing banking and other services to cannabis businesses that are in compliance with state law, as well as help address serious public health and safety concerns caused by operating in predominantly cash-only environments. The legislation would improve the operational viability of small businesses by helping them reduce costs associated with lack of access to banking and increasing options for traditional lending that many small businesses in other fields rely upon. It would also mandate a study on diversity in the cannabis industry.The SAFE Banking Act seeks to harmonize federal and state law by prohibiting federal banking regulators from: threatening or limited a depository institutions access to the Deposit Insurance Fund, discouraging, prohibiting, or penalizing depository institutions from dealing with the cannabis industry, taking any action against a loan made to a covered business and forcing a depository institution to halt providing any kind of banking services.

Legislation to provide safe harbor for financial institutions that choose to service the cannabis industry was first introduced in 2013 and was called the “Marijuana Businesses Access to Banking Act.” When the bill died in Congress, it had 32 cosponsors and no Senate companion legislation. The bill was reintroduced in 2015 with the same name and 39 cosponsors and a Senate companion with 11 cosponsors.

In 2017, the bill was reintroduced and renamed the Secure and Fair Enforcement (SAFE) Banking Act. By the end of that session, the bill had 95 cosponsors and the Senate companion bill had 20 cosponsors.

On March 7, SAFE Banking was introduced in the House by Rep. Ed Perlmutter (D-CO) and was referred to the Judiciary and Financial Services Committees. On March 28, 2019, the Financial Services Committee voted 45 to 15 to advance the bill to the full House. The bill had broad bipartisan support with 153 cosponsors, over a third of the entire House, at the time of the committee vote (a major jump from 2017). On April 1, Senator Jeff Merkley (D-OR) introduced a companion bill to the Senate and the bill was referred to the Senate Banking, Housing, and Urban Affairs Committee. On June 6, the House bill moved out of committee and was placed on the Union calendar for a vote. The bill then passed the House by 321-103.

Congress spent 2020 legislating relief legislation for Americans as the coronavirus took a toll across our nation. SAFE Banking language was also included in two coronavirus relief packages that the House approved, but unfortunately, did not make it through the Senate.

One thing is abundantly clear, states are continuing to legalize cannabis and the federal government must mitigate the state and federal conflict that legal cannabis businesses are facing. Access to banking is not only essential for any business to function, but a necessary measure for public safety. Laws making cannabis legal for adults have been passed in 18 states as well as the District of Columbia and the territories of CNMI and Guam, and 36 states, as well as several territories, have comprehensive medical cannabis laws. As the House of Representatives, again, has passed SAFE Banking, we will turn our focus to the Senate and keep up the momentum. Make sure when you have a few minutes call your senators and urge them to support the SAFE Banking Act, S. 910. You can look up your senators’ information HERE.

by Deborah Johnson, MCA Accounting Solutions & James Whatmore, MAB Investments

by Deborah Johnson, MCA Accounting Solutions & James Whatmore, MAB Investments

NCIA’s Banking & Financial Services Committee

Part 2 of a 3-part series

In our first part of this blog, we discussed the very beginnings of a company; an idea, gathering a team around you, self-funding, opening a bank account and forming an LLC or incorporating. Now you are ready to take a big step, bring on some more people, purchase more equipment and explore partnerships. You have a path with real milestones. This is the time to plan a funding strategy.

If you are not plant-touching, or you are directly ancillary, you might be able to secure a bank loan or an SBA loan. As the SAFE Banking Act is being considered in Congress (at time of writing) the reality of greater access to cannabis banking services may be getting brighter. However, traditional banking sources may still be an issue. These challenges have blended into some ancillary activities. There are a few other debt instruments including venture debt, an accounts receivable (AR) line, or an asset loan. Some of these instruments can be originated with specialty firms or other investment sources.

“While debt has traditionally been scarce in our industry, the relatively recent arrival of lenders has fortunately changed the construct of cannabis company balance sheets. Industry normalization, low rates, relatively high equity capital costs and supply-demand imbalances have attracted capital pools into credit and provided companies with the ability to further normalize their blended cost of capital,” said Sumit Mehta, founder and CEO of Mazakali and chairperson of NCIA’s Banking & Financial Services Committee.

Recently Harborside Inc. (CSE:HBOR) (OTCQX:HBORF) in California landed a historic $12 million revolving line of credit with a bank, marking the first time a cannabis touching company has secured this kind of access. Granted it is secured, but it is a commercial loan from a traditional lender. If you have real estate involved many investors will do a sale leaseback on the property to provide some liquidity. Equipment may also secure a loan; this is often a choice to outfit a capital-intensive production. When evaluating your debt options consider what is happening at this point in your life cycle. For an early-stage company, a revolver may not be the right fit; however, having the right equipment getting you to revenues might be worth investigating.

There are also grants available. Especially with COVID-19, many local jurisdictions are providing small business grants, or you might find one aligned with your demographic or target market niche. Many startups find an accelerator or incubator to help both fund and scale the company. In cannabis, the accelerators have historically been targeted to the ancillary market. Several exist, including Canopy Boulder, Momentum, Gateway, Hood Incubator, The Initiative, Cannabiziac, and even traditional market accelerators such as Y Combinator are addressing the needs of the cannabis market. Accelerators will invest in the companies they are providing guidance to and are generally hosted over a short period of time like 3-4 months, whereas an incubator provides resources, networks, and services over an 18+ month time and might charge a fee to participate. This early mentoring is a great resource for social and personal capital as well. If you have participated in an accelerator or incubator environment you should be exposed to early-stage investors; if you haven’t been exposed to them, this is the time for a solid PowerPoint deck and to polish your presentation.

Next on the list are angel investors. Angels are those individual investors that provide early-stage funding for a startup usually in exchange for convertible debt or ownership equity but are not locked into a funding structure. Banks make loans, angels can do as they please. They can be sophisticated or unsophisticated as they technically just need to qualify as an accredited investor. Most are drawn to investing in something familiar, so either they have a direct professional background in your industry or have felt the pain point you are addressing personally. Some want to roll up their sleeves and be engaged in helping your company grow, others just want to diversify their investment portfolio and take a more passive role. They can invest in the idea and direction of the company and a good angel will understand the timing of the investment. This means that early-stage investors like angels and funds should understand that this is a long-term investment that might take 5-8 years to see liquidity.

The greatest challenge to an entrepreneur is where to find them. Sometimes it’s as easy as looking around your network. With some work you can attract attention to your business idea by either presenting/speaking or pitching at a conference. Over the years, many opportunities to do so have developed. NCIA hosts CannaVest and Cannabis Business Summit, one of the longest running is The Arcview Group, Benzinga, IC3 by IMN, CWCBExpo and many cut their teeth at MJ Biz. Angels are individuals, but often belong to a group of angels to assist with deal sourcing and due diligence. With the normalization of cannabis, you can find many groups via the Angel Capital Association. We’d suggest reviewing market transactions and see who is announcing that they secured funds and with whom. You can find this information through keywords and press releases, consolidating sites such as New Cannabis Ventures or Viridian Capital Advisors, or even Pitchbook. This is the hard part of fundraising: connecting with the right investors.

You can also gain exposure to investors by sharing your expertise. Whether it’s articles on LinkedIn or podcasts and panels, exposing your knowledge of your niche is critical to gaining their confidence in your ability to execute. The conferences above may host your presentation as well furthering your investor engagement. One word of caution, there is a new platform being used by millions – even though it’s still in beta – called Clubhouse. There have been many people that are running pitch rooms on that platform and they are running up against the SEC and rules for fundraising. We encourage an extra dose of caution when pitching where you don’t understand who your audience is and if they adhere to qualifying factors. Many times, the later investors (Series B or C rounds) have to do a lot of work to clean up the cap table from earlier investment rounds. That can be a hurdle that an investor might walk away from. So, the more you can do to assure you are running a clean and efficient fundraising round, the better.

Given that we are in the cannabis industry, it is of particular importance to be an advocate. Access to this plant is still restricted for many, people are still going to jail or are still in jail, and businesses have a disadvantage to all other industries given the repercussions of federal illegality. So being an advocate, aligning and engaging with advocates like the National Cannabis Industry Association (NCIA), Marijuana Policy Project (MPP), Students for Sensible Drug Policy (SSDP) and others, can also expose you to investors who recognize your understanding that there is much work to be done to assure fair access. Expertise, Advocacy, and Engagement will build your social capital. The early rounds can hinge on these factors. While you will need a proforma, other financials and a solid plan, an angel is investing in you as much as in your current project. With enough social capital, your relationship with the early angel investor will survive major setbacks.

Once past these early rounds, your focus will turn to more formal investment groups and businesses in private equity, venture capital and then the public market. Currently those companies touching the plant are able to be hosted on the OTC (over-the-counter) market or the CSE (Canadian Stock Exchange) with a growing number of ancillary companies listing on the traditional exchanges. Here there will be a deep dive into the numbers and execution, pre/post revenues with a clear runway to real revenue. This requires an adaptive corporate culture with some loss of control expected.

In our final piece of the series, we will review crowdfunding, tips on angel and fund investors, and types of funding.

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every Friday on Facebook for NCIA Today Live.

by Aaron Smith, NCIA’s CEO and Co-founder

Today, 70% of Americans support the end of cannabis prohibition and almost four in every ten adults have access to regulated, legal cannabis for their own use — no questions asked.

We are on the precipice of the end of federal prohibition, with even the Senate Majority Leader calling regularly for his chamber to advance legislation that would legalize cannabis. In 2012, when Colorado voted overwhelmingly to amend their constitution to create the adult-use cannabis industry, it seemed incredibly unlikely – even in that moment of success – that we’d see the explosion in progressive policy and normalization coast-to-coast in marijuana that we have.

For those that were fortunate to know Steve Fox, though, our present felt more like an inevitability than anything else. Remembered as an energetically empathic and enthusiastic advocate, anyone who has enjoyed any part of the legal cannabis boom owes a moment of peace to Steve’s memory.

Steve was one of the first political power players to turn their attention to cannabis, long before it was polling at a place where prominent politicians were tripping over themselves to attach themselves to 420-friendly policy. Building on momentum from the medical cannabis movement and championing the personal liberties being accosted by the overcriminalization of cannabis, he had an immediate and lasting impact when he arrived on Capitol Hill.

In 2002, only five years after the first state decriminalized cannabis for medical use, Steve was the lone full-time cannabis lobbyist in Washington, D.C., pushing for federal reform in our nation’s capital on behalf of Marijuana Policy Project. He answered the call for justice long before most others heard it, championing cannabis as a proxy for his own views on societal justice and individual freedom.

Dedicated to a clear set of righteous ethics, armed with his passionate voice for sensible reform, Steve worked incredibly hard and with every tool at his disposal to do the right thing, in the correct way. While drafting and campaigning for Colorado’s Amendment 64, which would be the nation’s first to legalize cannabis for adult use, Steve never took his eyes off the need for succinct and coordinated efforts for the community that would grow in a patchwork across a country opening their markets state by state.

It was in 2010 that he and I, fellow Marijuana Policy Project alums, set out to answer that call for a single voice to speak on behalf of the emerging industry and founded the National Cannabis Industry Association. Recognizing that his incredible energy, rarely slowed, would serve best in his lobbying efforts, Steve opted to become the first Secretary of the NCIA Board of Directors and worked with and around — though never in — his own organization for the next decade.

At the time, after the release of the Ogden Memo by the U.S. Justice Department directing prosecutors not to prioritize the use of federal resources to prosecute patients with serious illnesses or their caregivers who are complying with state laws on medical marijuana, cannabis policy was wide open.

An industry association, uniting all voices and allowing for progressive policy to be pushed in a single stroke, remains only one of Steve’s legacies. Though his work is unfinished, we are all fortunate that he inspired dozens of passionate activists, lobbyists, and policy writers who are dedicated to seeing it done in his memory and with his spirit.

If you’ve enjoyed any of the benefits of legal, regulated, adult-use cannabis — whether it is your own personal consumption, better schools from taxes, a safer neighborhood — please consider contributing to the GoFundMe set up by VS Strategies to support his wife and daughters in this difficult time.

by Rachel Kurtz-McAlaine, NCIA’s Deputy Director of Public Policy

by Rachel Kurtz-McAlaine, NCIA’s Deputy Director of Public Policy

Like many of you, NCIA needed to pare down during the pandemic. This has been hard on everyone and we understand first hand the sacrifices. Thankfully cannabis was deemed essential throughout much of the country, which isn’t a surprise to any of us in the industry. But we know that our members still needed to adjust their operations and spend a lot of money trying to stay safe and in operation. Like you, we also needed to adjust.

During this time we weren’t able to oversee our Allied Associations Program, although we maintained our relationships and were able to include many of our Allied Associations and their valuable insight in our webinars. As the number of vaccinations continues to rise and things start opening up, we can’t help but feel hopeful in the future — not to mention a Senate Majority Leader committed to legalization. We want to thank everyone for their patience and announce that we are picking up where we left off on the Allied Associations Program.

What is the Allied Associations Program?

The Allied Associations Program is a network of cannabis trade associations from the local, state, national, and international level designed to harness our collective knowledge and work together to advance the cannabis industry. As the leading national cannabis industry trade association, we felt an obligation to the community to make sure cannabis businesses have strong trade associations to educate and represent them in every way, so we started this complimentary program for other cannabis trade associations.

While the focus of our lobbying efforts is at the federal level, we know what a huge impact state and local policies have on the day-to-day operations of our members. The Allied Associations Program allows us to keep updated about these important issues so we remain a valued resource. It also allows us to keep other associations informed on federal issues and utilize this extensive national network for important federal policy action items.

We encourage our members to learn more about the Allied Associations Program and check out the directory of participating associations. Being part of the Allied Associations Program means the association is providing educational opportunities for their staff and leadership, and networking with other cannabis trade associations from around the country, ensuring they are adding value for their members.

What does this mean for cannabis trade associations?

Current Allied Associations need to check their email for information on the next Allied Associations Program monthly call, and updating any information that has changed via the NCIA member portal. In addition to the return of monthly calls, Allied Associations should be aware of NCIA’s upcoming conferences: our Midwest Cannabis Business Conference in Detroit in September, and the Cannabis Business Summit in San Francisco in December. Allied Associations are visible at our events and important to the planning process.

Cannabis trade associations who would like to learn more about joining should check out our Allied Associations Program page and click on “learn more about the AAP” to get in touch with Rachel Kurtz-McAlaine, our Deputy Director of Public Policy who also manages the program.

by Carol Welch & Jim Gerencser

by Carol Welch & Jim Gerencser

NCIA’s Risk Management & Insurance Committee

Cannabis was legalized for medical use in California in 1996. Since then, 47 states, the District of Columbia, and three territories (Puerto Rico, Guam, and CNMI) have legalized some form of cannabis, leaving only three states with no legal use. Thirty-six states have an effective medical use law in place. The main reason insurance companies haven’t had to consider providing coverage for patients is because federally cannabis is still listed as a Schedule 1 drug. Even though the likelihood of cannabis being legalized nationally seems bound to happen within the next few years, insurance companies should start planning to incorporate new cannabis policies into their plans now.

Here are five great reasons to cover medical cannabis:

SAVES MONEY

Science has proven that cannabis helps over 60% of epilepsy patients decrease the frequency and severity of seizures. Cannabis products should cost less than traditional epilepsy medications, especially when taking into account the added prescriptions often needed to combat the side effects of currently available prescription drugs.

Compared to the traditional cost of cancer treatment, patients opting to skip conventional treatments for cannabis could save their insurance companies thousands in initial cancer treatment, and potentially will have less recurrence and costly maintenance prescriptions.

Insurance companies are paying billions in healthcare costs to include doctor visits, lab tests, hospital admissions and prescriptions for conditions that cannabis has shown to improve dramatically. Chronic pain, depression and PTSD are all treatable with cannabis, and cannabis is much less dangerous than the opioids that are commonly prescribed in chronic pain cases.

SAVES LIVES

There are no known deaths reported from cannabis consumption alone. According to the CDC, there were 70,630 deaths due to drug overdose in 2019. In addition, there are estimates of over 1.5 million hospitalizations per year from adverse drug reactions that don’t cause death but are still costly to many people. Insurance companies can avoid some of the negative PR, potential litigation and upset related to deaths caused by pharmaceuticals, while providing patients with a solution that works for many conditions.

Research is increasingly showing that certain strains and compounds within the cannabis plant can have a significant positive effect on several conditions. For instance, breast cancer responds very well to FECO (full extract cannabis oil), with lab tests showing how cannabis causes cancer cell death. More study is still needed, and that is currently being conducted in Israel where there are fewer legal barriers to research.

REDUCES MEDICARE SPENDING

Data from all prescriptions filled by Medicare Part D enrollees from 2010-2013 showed a significant decrease in prescriptions being filled for symptoms for which cannabis could serve as an alternative treatment. Overall reduction in Medicare spending in states that implemented medical marijuana laws were estimated to be $165.2 million per year (2013). This one difference alone could mean billions in savings for insurance companies in the coming years.

IMPROVES SATISFACTION RATINGS

Let’s face it, insurance is a competitive business. Several large health insurers cover most of the country and will likely be the last to jump on board to cover medical cannabis. But for the smaller, regional or state-specific insurers out there, adding cannabis to the coverage lineup in legal states can provide a competitive advantage with employers and group plans.

Medical cannabis is listed as an eligible expense in many Canadian companies’ HSAs and is listed as an eligible medical expense by the Canada Revenue Agency. Since our northern neighbors are starting to cover it, hopefully that will encourage U.S. insurers to do the same.

IT’S THE RIGHT THING TO DO

Cancer is the #2 leading cause of death in the United States and can cost several thousand dollars for treatment. Using cannabis as a complementary treatment to traditional cancer therapies could decrease the cost of treating cancer to the patient, to the insurance companies and in the end to all of the people across the United States that contribute to Medicare and Medicaid.

If you would like to take action, contact your legislators to push for the federal legalization of cannabis or sign this petition calling on all U.S. insurers to step up and cover medical marijuana for their patients. Here’s a link to the Care2 petition: Health Insurance Companies Should Cover Medical Marijuana Now.

by Scott Thomas, National Director of Signature Brands, Genetec

In the last few years, the cannabis industry has exploded. Recent changes in the U.S. administration could speed up the approval for medical and adult-use cannabis usage, leaving policymakers rushing to keep up with this fast-changing industry.

As more states legalize both medicinal and recreational usage, demand will increase and lead to new cultivation and retail operations. Some of these new businesses will expand and grow, while others will get acquired by larger organizations.

Whether you’re new to the market or already established, you know that security is important. Keep reading to learn how to go beyond securing your people and assets, while also maximizing your operational efficiency, protecting your data, managing compliance including audits, and more.

The cannabis industry is expanding fast. Growers, distributors, and retailers are all looking to build and extend their businesses into new markets and territories, which means physical security needs are constantly changing. Can your security system evolve with you?

A physical security platform that combines your IP security systems into one platform can give you true seed-to-sale visibility for all your products. It can combine required components like video monitoring, access control, and intrusion detection into a single, unified view of all on-site activity.

Cannabis laws and regulations are complicated and can put stress on cultivators and retailers.

Although governments are becoming more accepting of cannabis, complicated regulations will continue to dictate how your product is produced, distributed, and sold. It’s important to be proactive and not wait until laws are finalized before taking the necessary steps to avoid fines, product recalls, or the loss of your license.

A physical security solution should do more than protect your people and assets. It can also help you maintain compliance by integrating policy and regulations within its platform. Then you can easily create security and operational reports and manage evidence for internal and external audits.

When referring to technology, the simplest way to explain the difference between open architecture and proprietary systems is that some manufacturers design products that only work with their hardware or software. This locks the customer into their product, whether that product meets their future needs or not.

With an open architecture platform, your physical security solution can support hundreds of different camera models, access control systems, license plate readers, visual and audible devices, input and output devices (IO devices), Programmable Logic Controllers (PLC’s), and more. When you combine all of these devices into a single unified platform, you can gain access to a constantly growing ecosystem of hundreds of systems, sensors, and applications like:

Securely storing your data can be challenging. Retail and online dispensaries need to keep sensitive patient and customer information safe to maintain trust. And cultivators need to keep research, intellectual property, and financial information secure. While many states have basic protocols around data and video storage, new federal and state regulations are quickly evolving as concerns over data privacy increase.

That’s why it’s important to have a provider that’ll continue to work with you as laws change and the threat landscape evolves. Your physical security system can help keep your data safe from people within your organization that shouldn’t have access, as well as mitigate your exposure to outside threats such as cyber attacks.

Trying to cut corners while securing your business can result in unexpected complications and higher costs in the long run. Think long term and prioritize a unified physical security solution that provides more than basic security and is a core component of your business operations:

Scott Thomas has worked in the retail industry for over 27 years. Prior to joining Genetec Scott was a National Account Manager at Checkpoint Systems where he worked with numerous loss prevention and physical security technologies. Scott is a member of multiple Retail organizations and an active participant in the retail community.

Scott Thomas has worked in the retail industry for over 27 years. Prior to joining Genetec Scott was a National Account Manager at Checkpoint Systems where he worked with numerous loss prevention and physical security technologies. Scott is a member of multiple Retail organizations and an active participant in the retail community.

Genetec Inc. is an innovative technology company with a broad solutions portfolio that encompasses security, intelligence, and operations. The company’s flagship product, Security Center, is an open-architecture platform that unifies IP-based video surveillance, access control, automatic license plate recognition (ALPR), communications, and analytics. Genetec also develops cloud-based solutions and services designed to improve security, and contribute new levels of operational intelligence for governments, enterprises, transport, and the communities in which we live. Founded in 1997, and headquartered in Montréal, Canada, Genetec serves its global customers via an extensive network of resellers, integrators, certified channel partners, and consultants in over 80 countries.

By Charles J. Messina, Esq., Jennifer Roselle, Esq. and Donald W. Clarke, Esq. of Genova Burns LLC

After several failed attempts, and seemingly the result of catching significant political heat as of late, Governor Cuomo is allowing the adult-use cannabis industry to blaze forward in New York.

With Gov. Cuomo’s signature, the bill (S.854-A), known as the “Marihuana Regulation and Taxation Act” (MRTA), establishes the legislative foundation upon which a regulatory infrastructure will be built to host a network of licensed operators to cultivate, process, distribute, sell, and host cannabis consumers. In addition to regulating adult use of cannabis, MRTA also amends the state’s existing medical use law (the New York Compassionate Care Act) and provides, among other things, rules for hemp, CBD, and other cannabis extracts.

First, adults may personally possess up to 3 ounces of plant cannabis (and 24 grams of “concentrated cannabis”) without being prosecuted or arrested. In addition to decriminalization, the law also expunges convictions based on conduct which is now authorized under MRTA.

Unlike New Jersey’s recently approved cannabis legislation, consumption of cannabis will be permitted in the same (or similar) places as vaping and cigarettes. Also, New Yorkers will be able to grow their own cannabis. Although “home grow” will be delayed for months until after more rules are promulgated and retail sales commence, a household will be able to grow a maximum of up to twelve plants (six mature, and six immature), with a five-pound possession limit for adults.

Throughout MRTA, there is a heavy focus on social and economic equity. This is integrated in the application process, apportionment of tax revenue, and adjustments made to the penal code. Certain applicants can qualify as a “social and economic equity applicant” to help the Office of Cannabis Management reach its goal of awarding 50% of licenses to minority or woman-owned business enterprises, distressed farmers, or service-disabled veterans.

Similar to New Jersey, the law’s terms will be supplemented by not-yet-created regulations. The regulatory framework will be created by a cannabis Advisory Board and carried out by the newly established Office of Cannabis Management (OCM). The OCM will be an independent office operating as part of the New York State Liquor Authority. It will have a five-member board, with three members appointed by the Governor and one appointed by each house.

Because much of the regulatory licensing framework does not yet exist, there is no established start date. Reports suggest sales could commence as early as December 2022. Home-growers for recreational use must wait no less than 18 months after the initial retail sales to plant their seeds. The tiered licensing structure prohibits those upstream in the production process from selling to the general public.

The available licenses include:

*Cultivator License—includes the agricultural production of cannabis and minimal processing and preparation.

*Processor License—includes blending, extracting, infusing, packaging, and preparing cannabis for sale. There is a limit of one license per processor, but each license can authorize multiple locations.

*Distributor License—authorizes the acquisition, possession, distribution, and sale of cannabis from a licensed cultivator or processor to retail dispensaries and on-site consumption sites.

*Retail Dispensary License—authorizes the sale of cannabis to consumers, with a limit of three retail dispensary licenses per person. A retail licensee may not also hold a Cultivator, Processor, Microbusiness, Cooperative, or Distributor License.

*Cooperative License—authorizes the acquisition, possession, cultivation, processing, distribution, and sale from the licensed premises of the cooperative to distributors, on-site consumption sites, and retail dispensaries, but not directly to consumers.

*Microbusiness License—authorizes limited cultivation, processing, distribution, delivery, and dispensing of the licensee’s own adult use cannabis and cannabis products. A microbusiness licensee may not hold any other license, and may only distribute its own products to dispensaries.

*Delivery License—authorizes the delivery of products by licensees independent of another license.

*Nursery License—authorizes the production, sale, and distribution of clones, immature plants, seeds, and other agricultural products used specifically for the planting, propagation, and cultivation of cannabis by cultivators, cooperatives, and microbusinesses.

*On-Site Consumption License—authorizes the establishment of a location for the on-site consumption of cannabis.

MRTA places the tax on cannabis based upon the amount of the chemical compound that delivers effects to users (THC). There will be a 9% state tax at the retail level. A local excise tax will be 4% of the retail price. Counties will receive 25% of the local retail tax revenue, and 75% will go to the municipality. Municipalities can, however, enact legislation to opt out of permitting retail dispensaries or on-site consumption licenses within its borders.

MRTA mandates that 40% of the estimated $350 million in tax revenues will go to community grants and reinvestment, and 20% will go to drug treatment and education. The final 40% is earmarked for schools as of now.

Employers have no legal obligation to permit adult-use cannabis in their workplace. In addition, while offsite usage is protected, the law includes provisions that allow employers to take action against employees who are impaired at work if their performance is lessened, or the employee’s conduct interferes with the ability to provide a safe and healthy workplace. Employers may likewise act to comply with local, state, or federal laws or allow conduct that would result in loss of a federal contract or federal funding.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Jennifer Roselle is Counsel with Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

Donald W. Clarke is Counsel at Genova Burns LLC and a member of the firm’s Bankruptcy, Reorganization and Creditors Rights and Cannabis Law Groups. He has extensive experience with complex restructuring matters and a comprehensive understanding of federal, state, and local laws, including regulatory requirements, across all industries. This experience has enabled Mr. Clarke to assist clients with their navigation of such regulatory schemes outside of bankruptcy, including in the space of cannabis law.

For over 30 years, Genova Burns LLC has partnered with companies, businesses, trade associations, and government entities, from around the globe, on matters in New Jersey and the greater northeast corridor between New York City and Washington, D.C. We distinguish ourselves with unparalleled responsiveness and provide an array of exceptional legal services across multiple practice areas with the quality expected of big law, but absent the big law economics by embracing technology and offering out of the box problem-solving advice and pragmatic solutions.

Given Genova Burns’ significant experience representing clients in the cannabis, hemp and CBD industries from the earliest stages of development in the region, the firm is uniquely qualified to advise investors, cultivators, processors, distributors, retailers and ancillary businesses.

By Michelle Rutter Friberg, NCIA’s Deputy Director of Government Relations

Last week was an historic one for cannabis policy around the nation. The second largest adult-use market, New York, successfully legalized cannabis and has already been signed into law by Governor Andrew Cuomo (D). New Mexico’s legislature also passed adult-use legislation which awaits Governor Michelle Lujan Grisham’s (D) signature shortly. Lastly, Virginia Governor Ralph Northam (D) signaled that he wants the state’s new adult-use cannabis laws to go into effect sooner than originally anticipated. Keep reading below for a brief summary of what’s happening in each of those states, and what it means for federal policy.

Last week, New York became the 16th state to approve a law creating a regulated adult-use cannabis market when Gov. Cuomo signed the Marijuana Revenue and Taxation Act (MRTA). This legislation would make possession of up to three ounces and limited home cultivation legal and will automatically expunge convictions for behavior that is legal under the new law. Notably, the new law also allows for cannabis consumption almost everywhere that tobacco consumption is allowed.

Equity was at the forefront of New York’s bill: forty percent of tax revenue will be directed toward communities disproportionately impacted by cannabis prohibition, and provisions in the MRTA seek to award half of all business licenses to social equity applicants. The importance of this can’t be overstated: nearly 60,000 people – the majority of whom are people of color – are arrested for marijuana violations in New York every year, the effects of which can permanently damage their ability to obtain employment, housing, and education, among other collateral consequences.

A 2020 report by Arcview Market Research and BDSA projected that the New York cannabis market will be worth more than $1.6 billion by 2025. The state plans to tax cannabis at 9% at the state level with an additional 4% made available to cities and counties, and with additional incremental taxes levied based on the type of product and the amount of THC contained in them.

New Mexico is now poised to become the 17th state to legalize adult-use cannabis upon Gov. Lujan Grisham’s signature. The legislature advanced two measures to the governor’s desk: the first legalizes and regulates cannabis possession, production, and sales for adults over the age of 21, while the second facilitates the automatic review and expungement of the records of those convicted of low-level marijuana offenses.

The state’s Cannabis Regulation Act allows for the possession of up to two ounces of cannabis for adults 21 and over, permits the home cultivation of up to six plants, and, unlike New York’s legislation, prevents local governments from opting out of retail sales. Legal retail sales are scheduled to begin in New Mexico on April 1st, 2022 (no jokes here!).

Marijuana Business Daily projects an adult-use cannabis market in New Mexico could generate $350 million in annual store sales by its fourth year of operation.

You’ll remember that back at the end of February, Virginia’s General Assembly convened a special session where they passed adult-use cannabis legislation. The legislation detailed the regulatory and market structures for the state, outlined social equity provisions, repealed criminal penalties for the plant, and, perhaps most importantly, is subject to a second review and vote by the Assembly in 2022. Lawmakers also established a January 1, 2024 enactment date for the law, however, much of this is now in flux thanks to Gov. Northam.

Last week, Northam asked the General Assembly to speed up the legalization of marijuana in the state, making it lawful for an adult to possess up to one ounce on July 1, 2021, instead of waiting until early 2024. Additionally, Northam has proposed a quicker route for expunging marijuana-related incidents from criminal records and allowing home cultivation of up to four plants per household also as of July 1, 2021.

The Governor’s request is in the form of a proposed amendment to the legalization bill the General Assembly passed last month. It’s also important to note that Northam’s proposals include changes to several other aspects of the legislation. One would empower the Cannabis Control Authority — the new regulatory agency that will be created to oversee the industry in the state — to suspend the licenses of businesses that don’t allow workers to organize, pay less than a prevailing wage, or classify more than 10 percent of workers as independent contractors.