Committee Blog: The Asset We Wish We Knew Before 2020 – HACCP

by Trevor Morones, Darwin Mallard, Liz Geisleman

by Trevor Morones, Darwin Mallard, Liz Geisleman

NCIA’s Cannabis Manufacturing Committee

Read on for insight and guidance for the vitally important topic of preventing, eliminating, or reducing microbial growth in cannabis edibles and packaging.

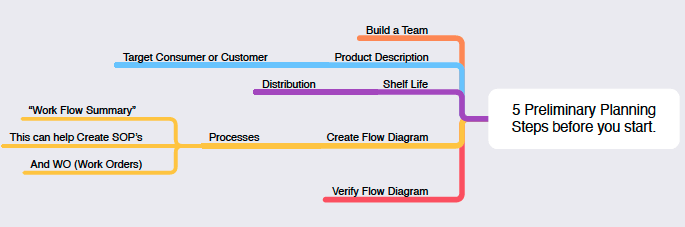

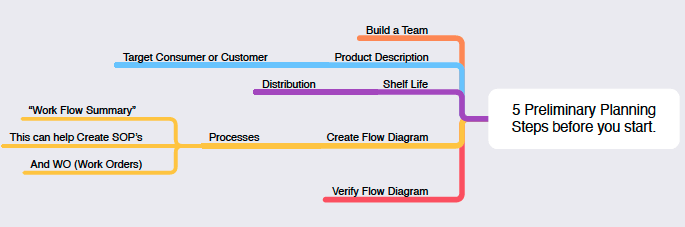

It all starts with the HACCP (Hazard Analysis Critical Control Point) Principles. Gather your team to share the five preliminary steps of HACCP and develop a plan (figure 1). This management system was launched by Pillsbury along with NASA and the U.S. Army for food safety in space exploration in the 1960’s. Quality, safety and efficacy is obtainable and sustainable with the HACCP discipline.

The objective is to PREVENT packaging from being a failure point and inhibit microbial growth in edible products. We know moisture (water activity), temperature, pH, and oxygen levels are primary microbial growth drivers.

HACCP is an asset, not an expense. Food is medicine for some, and cannabis products are medicine for many. Resin cannabis products (RCP) must be safe, consistent, and reliable products continuously. To generate those results, learn the HACCP mindset. Practice being an advocate with HACCP discipline displaying the actions written in the programs. It’s a system for cannabis safety that encourages operations to have Emergency and Business Continuity plans before disruptive events occur, e.g., natural disasters, pandemics, etc.

- Resin cannabis product – Any product, whether finished or a work in progress, containing or comprised of cannabis flowers or resins or both and includes, but is not limited to, the cannabis flowers and resins themselves, extracts/concentrates/derivatives thereof, and preparations therefrom.

- And can be further classified as Adult-Use or Medicinal-Use and subclassified as Topical-Use.

Creating such a plan is important because exposure to microbes may result in allergic symptoms such as sneezing, coughing, wheezing, nasal congestion, and watery or itchy eyes. Consumers using cannabis products as medicine, such as cancer patients on chemotherapy, are even more susceptible to harm caused by microbes. Thus, it is critical to ensure your products do not have microbial growth.

This is not only a health concern, but the financial impacts can be detrimental. How much did the February 2021 Canadian infused gummy recall cost? More than 330,000 packages of THC infused gummies, worth approximately 8.2 million Canadian dollars, were lost. Overhead costs go above and beyond. The global cannabis industry must learn from industry events such as this.

Effective HACCP management system ensures control. Empower your team through education and training on discipline of HACCP. Take the infused gummy recall from February 2021 as an example where cross-contamination, improper employee hygiene, and package permeability were failure points that led to loss of control. Lack of control during transport of the initially sterile packaging also contributes to contamination. Personal clothing worn by team members or visitors are also known sources of pathogenic fungus.

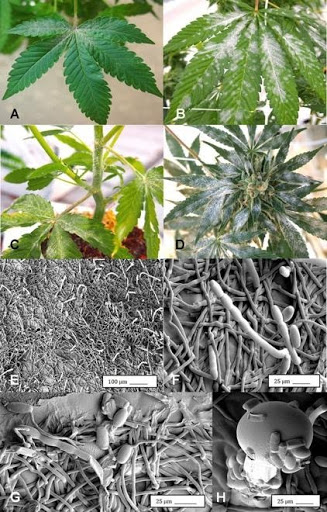

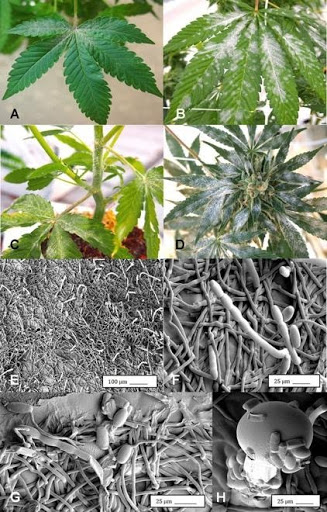

Best practice is to address preventive controls and reducing/mitigating risks. For example, consider installing two-way humidistatic control devices in packaging, such as desiccant packs, to maintain water activity (Aw) in acceptable ranges to mitigate microbial growth. Reducing moisture prevents powdery mildew caused by Golovinomyces Cichoracearum (figure 2).

A great resource to mitigate risks can be found in the ASTM D37; Standard Guide for Cleaning and Disinfection at a Cannabis Cultivation Center; Aw ASTM Standards for Cannabis Flower: D8196 – Standard Practice for Determining Water Activity in Cannabis Flower; and D8197 – Standard Specification for Maintaining Acceptable Water Activity Range for Dry Cannabis Flower.

Sanitary environments are critical from seed to sale.

Figure 2, Right. Powdery mildew development on leaves, stems, and flower buds of Cannabis sativa, caused by Golovinomyces cichoracearum. 2

Use the principles of HACCP to guide and maintain the integrity of your work. Each principle builds on the next to create a solid foundation to build and operate a safe and consistent management system. Establish storage conditions in your control and transport; determine the temperature and humidity for each product type (gummies do not tolerate heat, and certain ingredients are sensitive to humidity which could change the potency). This includes evaluating the stability of each of the ingredients when in final product form (how long do they remain potent).

Depending on the ingredients used, i.e., the formulation, gummies can take on or reject water. Most typically let out the water, then that water has nowhere to go (trapped in the packaging), and the product molds. This is why commercially produced gummies are coated in wax, literally to trap the water inside the product. Inadequate gummy formulations lead to water permeability; change in cannabinoid content is the least of the concerns.

General chapter 659 on Packaging and Storage requirements published by the USP (United States Pharmacopeia and the National Formulary, USP–NF) is a great resource. Though not all cannabis products may be for the medical market, using the standards of excellence from the USP is the best way to minimize product failure and help ensure consumer safety. Packaging 659 states that packaging materials must not interact physically or chemically with a packaged article in a manner that causes its safety, identity, strength, quality, or purity to fail to conform to established requirements.

Empower your cross-functional team to apply and implement HACCP through your organization. In doing so, you will have the discipline and tools to mitigate risks and prevent costly downtime. Your consumers benefit by having safer, consistent, and quality products. Finally, collect the data and share the story. We all need to drive improvement and produce safe consistent products for our consumers. HACCP systems are a tried-and-true tool to achieve this.

Please note that prerequisite programs such as current Good Manufacturing Practices (cGMPs) are an essential foundation for the development and implementation of successful HACCP plans. This article is intended to level up your current manufacturing processes and mitigate your exposure to potential recall or unsafe products in the marketplace.

For resources on how to establish an effective HACCP system and other quality management related tools, consider adopting the best practices defined in ASTM D8250 – Standard Practice for Applying a Hazard Analysis Critical Control Points (HACCP) System for Cannabis Consumable Products and/or following the guidelines provided in ASTM D8222 – Standard Guide for Establishing a Quality Management System (QMS) for Consumer Use Cannabis/Hemp Products and ASTM D8229 Standard Guide for Corrective Action and Preventive Action (CAPA) for the Cannabis Industry.

Committee Blog: Why Insurance Companies Should Cover Medical Cannabis Now

by Carol Welch & Jim Gerencser

by Carol Welch & Jim Gerencser

NCIA’s Risk Management & Insurance Committee

Cannabis was legalized for medical use in California in 1996. Since then, 47 states, the District of Columbia, and three territories (Puerto Rico, Guam, and CNMI) have legalized some form of cannabis, leaving only three states with no legal use. Thirty-six states have an effective medical use law in place. The main reason insurance companies haven’t had to consider providing coverage for patients is because federally cannabis is still listed as a Schedule 1 drug. Even though the likelihood of cannabis being legalized nationally seems bound to happen within the next few years, insurance companies should start planning to incorporate new cannabis policies into their plans now.

Here are five great reasons to cover medical cannabis:

SAVES MONEY

Science has proven that cannabis helps over 60% of epilepsy patients decrease the frequency and severity of seizures. Cannabis products should cost less than traditional epilepsy medications, especially when taking into account the added prescriptions often needed to combat the side effects of currently available prescription drugs.

Compared to the traditional cost of cancer treatment, patients opting to skip conventional treatments for cannabis could save their insurance companies thousands in initial cancer treatment, and potentially will have less recurrence and costly maintenance prescriptions.

Insurance companies are paying billions in healthcare costs to include doctor visits, lab tests, hospital admissions and prescriptions for conditions that cannabis has shown to improve dramatically. Chronic pain, depression and PTSD are all treatable with cannabis, and cannabis is much less dangerous than the opioids that are commonly prescribed in chronic pain cases.

SAVES LIVES

There are no known deaths reported from cannabis consumption alone. According to the CDC, there were 70,630 deaths due to drug overdose in 2019. In addition, there are estimates of over 1.5 million hospitalizations per year from adverse drug reactions that don’t cause death but are still costly to many people. Insurance companies can avoid some of the negative PR, potential litigation and upset related to deaths caused by pharmaceuticals, while providing patients with a solution that works for many conditions.

Research is increasingly showing that certain strains and compounds within the cannabis plant can have a significant positive effect on several conditions. For instance, breast cancer responds very well to FECO (full extract cannabis oil), with lab tests showing how cannabis causes cancer cell death. More study is still needed, and that is currently being conducted in Israel where there are fewer legal barriers to research.

REDUCES MEDICARE SPENDING

Data from all prescriptions filled by Medicare Part D enrollees from 2010-2013 showed a significant decrease in prescriptions being filled for symptoms for which cannabis could serve as an alternative treatment. Overall reduction in Medicare spending in states that implemented medical marijuana laws were estimated to be $165.2 million per year (2013). This one difference alone could mean billions in savings for insurance companies in the coming years.

IMPROVES SATISFACTION RATINGS

Let’s face it, insurance is a competitive business. Several large health insurers cover most of the country and will likely be the last to jump on board to cover medical cannabis. But for the smaller, regional or state-specific insurers out there, adding cannabis to the coverage lineup in legal states can provide a competitive advantage with employers and group plans.

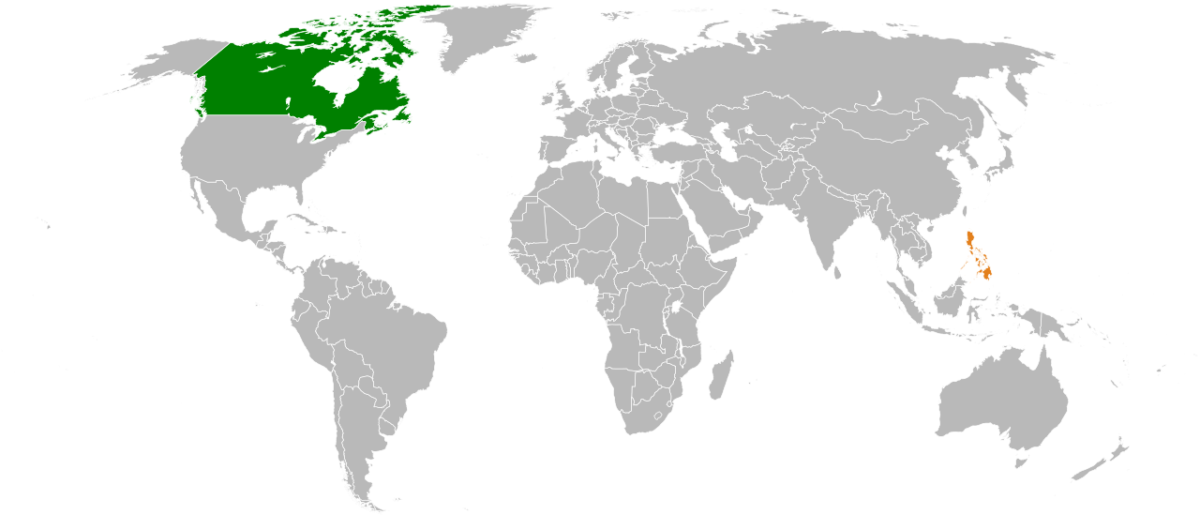

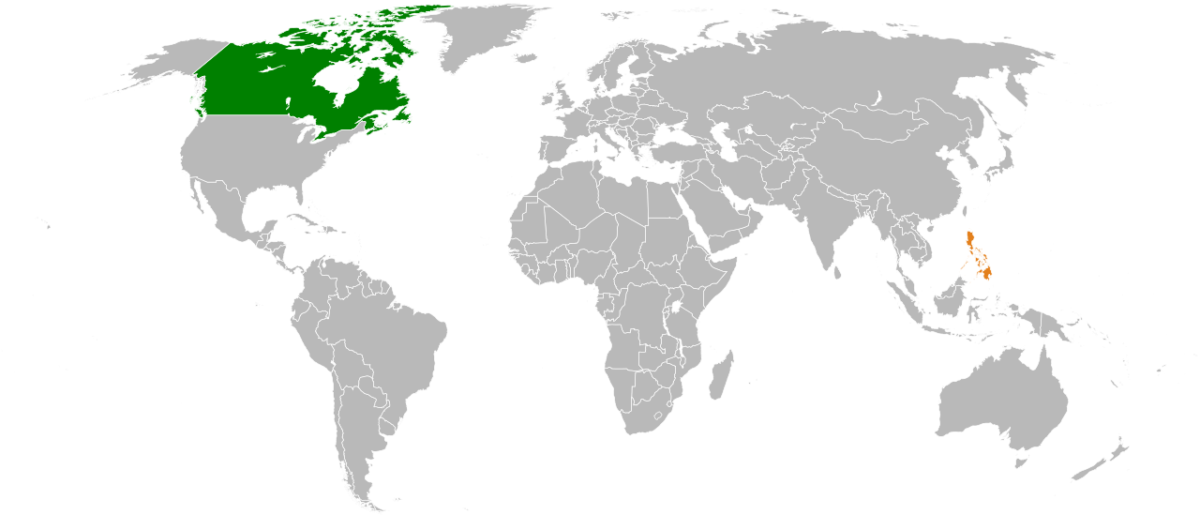

Medical cannabis is listed as an eligible expense in many Canadian companies’ HSAs and is listed as an eligible medical expense by the Canada Revenue Agency. Since our northern neighbors are starting to cover it, hopefully that will encourage U.S. insurers to do the same.

IT’S THE RIGHT THING TO DO

Cancer is the #2 leading cause of death in the United States and can cost several thousand dollars for treatment. Using cannabis as a complementary treatment to traditional cancer therapies could decrease the cost of treating cancer to the patient, to the insurance companies and in the end to all of the people across the United States that contribute to Medicare and Medicaid.

If you would like to take action, contact your legislators to push for the federal legalization of cannabis or sign this petition calling on all U.S. insurers to step up and cover medical marijuana for their patients. Here’s a link to the Care2 petition: Health Insurance Companies Should Cover Medical Marijuana Now.

Committee Blog: Interstate Cannabis Commerce Will Benefit Public Safety, Consumer Choice, and Patient Access (Part 2)

By Sean Donahoe, Founder and CEO, Sungrown Developments Inc.

Member of NCIA’s State Regulations Committee

In Northern California’s legendary cannabis growing region of Mendocino, the elected county sheriff was recently a competitor at a homebrew festival, jovially pouring samples of his “Pretty Sour Powerful Sider” (jokingly referring to the “Public Safety Power Shutoffs” recently implemented by the electricity utility PG&E to prevent wildfires.) While this relaxed scene of neighbors bonding in the wake of shared inconveniences was not exceptional in itself, here, Sheriff Allman was posing for selfies with licensed (but possibly a few unlicensed) cannabis cultivators sharing the liquid bounties of harvest for the benefit of a local nonprofit.

For nearly a decade, the elected officials and staff of Mendocino county have worked together to normalize the local cannabis farmers by providing a pathway for medical cannabis cultivation permits, long before the state established a licensing system. This public policy process brought once-outlaw cannabis growers into conformance with every regulation of modern life: from building code standards to streambed alteration regulations to the quantification of gross receipts for tax collection. Bringing regulators onto these farms has curtailed previous practices that may have threatened consumer safety: pesticide and other chemicals are now tracked and regulated, while every gram can now be tracked back to its very plot of origin (in case of a safety recall or other concerns post-harvest.) This has been unquestionably difficult for and disruptive to many heritage and small farmers, but it has also allowed in these regions for simple scenes of social bonding and neighbors trusting neighbors again, as participants in the illicit sector were normalized into first their local county’s community then into a system of state license and next (hopefully soon) into a web of regulated interstate commerce. The process of bringing every farm into the regulated supply chain is far from complete, of course, and there are still illicit operators producing for consumers in urban areas in the state and beyond.

Rather than dwell on the incomplete success of California’s ongoing efforts to bring order to the world’s largest cannabis marketplace, it is essential to focus on the quality of life benefits from every cannabis operation successfully brought over from the traditional market to the regulated sector. Each licensed operation makes for one more safe workplace, one more source for lab-tested products for consumers and patients, and one more farm abiding by environmental regulations while providing stable employment and economic sustainability in rural communities. Under the previous medical cannabis paradigm, while there was certainly an abundance of responsible operators, there was virtually zero guidance from the state on matters of workplace safety, manufacturing standards, or environmental compliance. We are now several years into a robust legislative and administrative rulemaking process that has established a (mostly) clear set of rules of the road for commercial cannabis activities. It has unquestionably been a bumpy road for many of the legacy farmers to comply with new regulatory standards, but we are nonetheless able to say that there are now thousands of well-regulated cannabis farms in California (and southern Oregon) eager to sell their clean and craft quality products in a hopeful system of interstate commerce.

Has every cannabis farm in California transitioned? Of course not, but neither have the illicit cannabis economies been entirely supplanted by adult-use cannabis retailers in Colorado and Washington. Sensible and sustainable cannabis policy reform is a process, not a simple flipping of a switch from “illegal” to “legal,” and Americans should be realistic about the progressive and iterative nature of this process. This process, like most evolutionary processes, has already experienced several inflection points, transformative moments that noticeably shifted public opinion or opened up new frontiers in policy reform. While the earlier era of medical cannabis state laws certainly created a base of public opinion and laws, it was questionably the passage of adult-use ballot measures in Colorado and Washington which brought onto the global stage and accelerated the awareness that adult consumers could buy cannabis in clean, responsible retail locations rather than furtive or even dangerous transactions in the illicit marketplace

Throughout this policy process, we have established that licensed retail options can be scaled without negatively affecting public safety and are highly efficient competitive enterprises, offering consumers ample product selection and low prices. In both Colorado and Washington states (but also in later states) we have seen imbalances for some time as market forces, regulatory factors and new cultivation capacity coming online have all helped to create price fluctuations, product shortages, and other supply disruptions. These disruptions were not unique to these early states and will likely continue in every market as new in-state regulated options come online in fits and starts (but when interstate commerce becomes possible we should expect significant price fluctuations unlike any seen to date.) During these fiscally trying periods, we have often seen cannabis operators attempt to cut corners on compliance to make ends meet, which can lead to compromised consumer safety and public safety. The goals of consumer availability and cost competitiveness should be foremost in the minds of policymakers crafting cannabis policy reform nationwide, most notably in the anticipated markets of the Northeast. As these next anticipated adult-use states are designing the framework of their retail and distribution systems, strong consideration should be taken on the potential benefits of quickly and effectively scaling their programs by incorporating interstate commerce as soon as (politically) possible.

The Interstate Commerce Conversation

As the serious policy conversations about compliant interstate cannabis commerce begin, it is helpful to study how in our proverbial laboratories of democracy we can see that decreasing retail friction and shifting consumers from the illicit marketplace benefits crime reduction efforts and improves overall public safety. We should also note that retail cannabis sales have continued to grow in Colorado and Washington, even after the initial novelty and the surge of tourism waned, while legal sales have supplanted illicit sales. These early-adopting states have created models that are addressing consumer demand as national interest in cannabis for wellness and adult-use purposes are soaring and the cultural normalizing continues to occur on a global scale. Interest is high, consumer demand is real, and evidence shows that our drug reform policies should be crafted to bring every cannabis consumer transaction into the regulated supply chain in order to fulfill the demand while benefiting from increases in public safety. Interstate commerce could provide not only safer products but also a greater variety of quality and highly competitive offerings. For medical patients and wellness-oriented consumers, interstate commerce may be the only viable means of access for certain formulated cannabis products or cultivars, especially in smaller state markets.

In addition to the above benefits, regulated interstate cannabis commerce system could provide a more robust and differentiated production and distribution network combined with the ability to rapidly scale retail sales and address insufficient cultivation capacity in new adult-use markets. Cannabis consumers are price sensitive and illicit market retail options continue to entice consumers in states with functional adult-use programs such as California (or Canada), where there is an insufficient amount of licensed retail options to address total consumer demand. With the beginning of adult-use sales in Illinois and larger adult-use states yet to come, it is frankly a bit difficult to envision how total consumer demand will be able to be fulfilled in any near term by relying on licensed cannabis cultivated in-state alone.

The Safe Vaping Discussion

While moving to allow interstate commerce will best position licensed operators to compete with the prices available to consumers in the illicit sector, moving towards a borderless system of production and distribution will also increase safety and access for patients and consumers. Most prominent is the recent nationwide discussion on vaping and vaping-related issues, where tainted products and resultant injuries have been found in the unregulated, illicit sector (or in a very few instances from licensed but arguably under-regulated sources.) Notably, NCIA’s Policy Council established a Safe Vaping Task Force to work on these issues and has released a more comprehensive document advocating for the expansion of a regulatory approach for the safe manufacturing and distribution of cannabis products, whether vape cartridges or otherwise.

The issue of vaping extends to broader issues of product safety including educational campaigns, quality assurance, and testing programs, supply chain integrity, track and trace, and other reporting systems, and (when all else fails) a capable and sophisticated product safety recall system and these are all necessary components of a well-regulated marketplace. These consumer safety programs have already been carefully designed and stress-tested in Colorado and California and the insights from these systems and those in other states should be incorporated into the crafting of interstate cannabis policy (which will require significant harmonization of Certificates of Analysis and testing standards, packaging and labeling standards, etc., again all of which will benefit patients and consumers by offering greater predictability and reliability of their preferred products.)

Multi-State Coordination

In various forums, we have begun to see state regulators liaise with each other and we hope to see more coordination in the future and potentially an earnestness in harmonizing standards where statutorily possible. This multi-state coordination on product safety standards would be accelerated as part of the regulatory coordination efforts that are likely necessary for interstate commerce and, again, consumers and patients will benefit from safer cannabis and cannabis products, and we see NCIA as the critical player in this coming national conversation. In conclusion, moving to a system of regulated interstate cannabis commerce will have tangible benefits for the general public, for consumers and patients and I encourage forward-thinking members of the industry to participate and help manifest a system of interstate cannabis commerce with NCIA, its Allied Associations and other industry groups.

After studying Russian affairs and working as a political consultant, Sean Donahoe co-founded the California Cannabis Industry Association. He served as its Deputy Director through 2014 when he transitioned to consulting for investors and operators, communicating with public stakeholders, serving on local government committees, and advising industry trade groups. He holds an MSc in Government from the London School of Economics and is CEO of Sungrown Developments Inc., an advisory firm and holding company in Oakland, California.

After studying Russian affairs and working as a political consultant, Sean Donahoe co-founded the California Cannabis Industry Association. He served as its Deputy Director through 2014 when he transitioned to consulting for investors and operators, communicating with public stakeholders, serving on local government committees, and advising industry trade groups. He holds an MSc in Government from the London School of Economics and is CEO of Sungrown Developments Inc., an advisory firm and holding company in Oakland, California.

Top Five Memorable Marijuana Moments In 2018

by Michelle Rutter, NCIA Government Relations Manager

As 2018 draws to a close, our Government Relations team in Washington, D.C. is feeling especially thankful this year – both for all of our members, and for all of the strides forward that cannabis policy made this year! Before 2019 begins, let’s take a look back on marijuana’s top five most memorable moments of 2018:

Cannabis wins big at the ballot box

There’s no doubt about it: America experienced a green wave on election night as voters all over the country cast their votes in favor of reforming cannabis laws and electing candidates that share those values. Voters in Michigan cast their votes for the legalization of adult-use cannabis, increasing momentum of our movement. At the same time, voters in Missouri and Utah were successful in legalizing medical cannabis, becoming the 32nd and 33rd states to do so, and despite significant hurdles. In addition to the ballot initiatives that were passed, Democrats took control of the House of Representatives, while Republicans maintained their control of the Senate. While this development surely means that cannabis policy will progress further than ever in the House in 2019, it also means that anything passed through that chamber will face significant hurdles in the more conservative Senate.

Shake-up at the Department of Justice and the rescission of the Cole Memo

On January 4, then-Attorney General Jeff Sessions announced the Department of Justice’s decision to rescind the “Cole Memo” and two additional memos related to marijuana enforcement policy. These memos, issued in 2013 and 2014, helped to clarify the Department’s response to state-legal cannabis activity. The rescission of the memo has not resulted in any major change in enforcement policy, rather, this continues to be a matter of prosecutorial discretion. On November 6, the day after the midterm election, Jeff Sessions resigned as Attorney General at the President’s request.

Congressional banking and 280E bills gain record co-sponsorship

As the momentum for cannabis reform grows, so has the number of cosponsors on marijuana bills in Congress. Most notable is legislation that would provide safe harbor to financial institutions that choose to service the cannabis industry. At the end of the 114th Congress in 2016, the House’s Marijuana Businesses Access to Banking Act had 39 cosponsors, while the Senate version had just 10. As we finish the 115th Congress, the House’s SAFE Banking Act (H.R. 2215) has 95 cosponsors, while the Senate version (S. 1152) has 20. That’s nearly a quarter of the House of Representatives and a fifth of the entire Senate! Bills to reform IRC Section 280E have seen a similar spike. At the end of 2016, the House’s Small Business Tax Equity Act had a mere 18 cosponsors, while the Senate version had four. Today, the Small Business Tax Equity Act (H.R. 1810) has 46 cosponsors, while the Senate’s version (S. 777) has six.

Canada implements adult-use cannabis laws

In October, Canada’s laws making marijuana legal for adults went into effect and licensed retail stores opened throughout the country. This move made Canada the second country in the world, after Uruguay, to formally legalize the recreational use of the plant. Canada is the first G7 and G20 nation to do so. Federal prohibition has effectively locked American cannabis companies out of legitimate financial markets and, in doing so, has provided a significant advantage to publicly traded Canadian firms. Changes to federal law are needed to enable American small businesses to compete on the emerging multi-billion-dollar global cannabis market. Without legislative action, U.S. cannabis entrepreneurs will miss out on opportunities to develop innovative new products, attract global investment funding, and expand their reach to capitalize on expanding international business opportunities.

NCIA’s 8th Annual Cannabis Industry Lobby Days

This year, 225 cannabis industry professionals descended on Washington, D.C. to lobby congressional offices on some of the issues they and their businesses are facing. In total, NCIA members met with nearly 300 offices on Capitol Hill! The cannabis industry has seen exponential growth in the mainstream support for regulated cannabis markets from both sides of the political aisle. This progress is a direct result of the uncountable number of personal stories told by our members each year at our annual Lobby Days events in Washington, D.C., so don’t forget to mark your calendars for May 21-23, 2019, so that you can join us for our largest event yet!

The 116th Congress will arrive in Washington, D.C. in January. With the change in leadership in the House of Representatives and the momentum at our backs, 2019 is shaping up to be one of the cannabis industry’s best years yet. Our Government Relations team looks forward to all of the opportunities we will be faced with in the new year, and we wish you a very happy holiday season!

Member Blog: First Blush And Branding Need To Go Hand In Hand

by Gary Paulin, Lightning Labels

Budding cannabis companies: Pay attention to labels from the get-go

Cannabis companies starting up in states where recreational and medicinal marijuana are just being legalized need to pay close attention to their label branding from the get-go. Too often, this critical part of a successful cannabis business becomes an afterthought — which can lead to major problems in compliance, competitive positioning and credibility in the marketplace.

As the cannabis industry expands in the U.S. and now Canada, it’s also maturing. Gone are the days when a purveyor could hang out a shingle and open their doors to teeming masses of buyers without any substantive concern about packaging and labeling beyond early-day regulatory compliance.

With the industry maturing, so is the sophistication of entities charged with compliance. As more is learned about all aspects of the industry — from edibles to raw cannabis — requirements being placed on purveyors are getting more complex. Plus, there are municipal and state regulations that may cross over one another.

Competitive Positioning

It’s never too soon to get into the branding game, and distinctive labels that grab attention and share important information accurately are key to making a name for yourself.

A Forbes article earlier this year made the case: “Tim Calkins, Clinical Professor of Marketing at Kellogg School of Management at Northwestern University, foresees a highly competitive environment… an outburst of marketing and branding innovation… ‘We will see very creative brand-building activities in the years to come. I anticipate that marketing investment will grow exponentially as companies work to carve out a leading position and capture value in an emerging market…It isn’t often that you see an entirely new market emerge on the scene, especially one where brands will play a key role. Many people first experienced cannabis as a[n] unbranded plastic bag. This is not likely to be the future state. Cannabis will become a market dominated by strong, vibrant brands.’”

Compliance

In their startup enthusiasm, purveyors may miss something on the label compliance scene. It’s easy to do, but can be very hard to fix. Products have had to be recalled, companies have been fined or even shut down for running afoul of regulations. Labels, as a product’s “front door,” are especially susceptible.

A Manufacturing.net report reinforces the point: “Often, cannabis products require specialized labels for traceability and stating suggested medical applications. State laws still vary greatly, and companies should be careful to know and have tools to track their compliance in all states and countries that they do business.”

Bottom line, newcomers to the industry need to be as diligent about their labeling and packaging as they had to be to get license approval. Anything less may result in more headaches than they can imagine.

Credibility in the Marketplace

In Colorado’s early days of cannabis legalization, some labeling and packaging looked — to put it mildly — homespun. The look and feel of that early-day branding pales in comparison to the much more sophisticated label and packaging branding typically seen today.

But for industry newbies, there can still be a temptation to move ahead on operations at lightning speed, with branding, packaging and labeling lagging behind.

Ultimately, that may stifle credibility, giving competitors an opportunity to get a leg up. Ontario, Canada’s experience so far showcases how label problems can hamper credibility. Their online marketplace is the only “game in town” so far; there are no brick-and-mortar establishments. But, in a competitive marketplace, purveyor missteps can cause reputation damage as well as regulatory repercussions.

Notes a Civilized.life article, “Ontario Cannabis Store Faces Backlash Over Improperly Labeled Products… When Peter Lyon logged on to the OCS website on October 17, he did so with the intention of buying a strain high in THC — the compound in marijuana that gets you high. However, that is not what he got… Not only is the error in the product labeling upsetting for customers who won’t be getting what they paid for, cannabis retailers have a legal obligation to ensure that their labelling is accurate. Otherwise someone looking to unwind with a low-THC strain could wind up having a panic attack because the product they bought is way too potent.”

The first blush of entering a new marketplace deserves branding, labeling and packaging that measure up.

Gary Paulin is Director of Sales and Client Services for Lightning Labels, a Denver-based label printer that has been offering state-of-the-art affordable, full-color custom labels and custom stickers of all shapes and sizes to cannabis purveyors for more than a decade. They offer many options for materials and laminates and special effects to achieve digital short-run requirements (50 minimum) on up to 15 million labels, plus Lightning fast delivery. For more information and to place orders online, visit LightningLabels.com. For the latest in packaging news and labeling promotional offers, find Lightning Labels on, Facebook, Instagram, Twitter (@LightningLabels), Pinterest, Google+ and LinkedIn.

Gary Paulin is Director of Sales and Client Services for Lightning Labels, a Denver-based label printer that has been offering state-of-the-art affordable, full-color custom labels and custom stickers of all shapes and sizes to cannabis purveyors for more than a decade. They offer many options for materials and laminates and special effects to achieve digital short-run requirements (50 minimum) on up to 15 million labels, plus Lightning fast delivery. For more information and to place orders online, visit LightningLabels.com. For the latest in packaging news and labeling promotional offers, find Lightning Labels on, Facebook, Instagram, Twitter (@LightningLabels), Pinterest, Google+ and LinkedIn.

Canada Legalizes Cannabis – When Will The U.S. Follow?

by Rachelle Lynn Gordon, NCIA Editorial Staff

On June 19, Canada became the first G7 nation and second in the world after Uruguay to fully legalize cannabis for adult use, paving the way for what is estimated to be a CAD$9.2 billion dollar industry by 2025. Canadian Prime Minister Justin Trudeau Tweeted in response to the move:

On June 19, Canada became the first G7 nation and second in the world after Uruguay to fully legalize cannabis for adult use, paving the way for what is estimated to be a CAD$9.2 billion dollar industry by 2025. Canadian Prime Minister Justin Trudeau Tweeted in response to the move:

“It’s been too easy for our kids to get marijuana – and for criminals to reap the profits. Today, we change that. Our plan to legalize & regulate marijuana just passed the Senate. #PromiseKept”

The passing of the iconic Bill C-45, also known as the Cannabis Act, was met with raucous applause from the across the globe and sent marijuana stocks soaring. Provinces and territories now have until October 17 to develop and implement their own regulations for the sale of cannabis products; according to the federal statute, adults will be able to carry and share up to 30 grams of marijuana in public and cultivate up to four plants at home.

But when will the United States follow suit and become a part of the multi-billion dollar global cannabis market?

High Time for Federal Legalization

“With leading policymakers on both sides of the aisle calling for reform, there has never been more momentum behind the effort to replace criminal marijuana markets with regulated businesses, but we still have a long way to go.” says Aaron Smith, executive director for the National Cannabis Industry Association (NCIA).

Despite the fact that 29 states, as well as Guam, Puerto Rico, and the District of Columbia, have legalized cannabis for medical and/or adult-use, the plant is still illegal at the federal level. This has led to immense headaches for business owners within the legal space who only wish for their companies to thrive but are hindered by lack of access to traditional banking and fundraising opportunities and stuck operating within individual state lines.

Lawmakers from legal states have heard their constituents’ voices loud and clear and have joined together to develop the STATES Act, short for “Strengthening the Tenth Amendment Through Entrusting States.” Introduced by Senators Elizabeth Warren (D-MA) and Corey Gardner (R-CO), the bill aims to protect states that choose to legalize cannabis by creating an exemption to the U.S. Controlled Substances Act, and would remove industrial hemp from the Controlled Substances Act entirely. The bill would also allow banks to work with cannabis businesses more easily. Representatives David Joyce (R-OH) and Earl Blumenauer (D-OR) have already introduced a companion bill in the House.

When asked about the STATES Act by reporters, President Trump replied that he would more than likely support the measure, stating: “I support Sen. Gardner, I know exactly what he’s doing. We’re looking at it. But I probably will end up supporting that, yes.”

Full Legalization Needed for Market to Thrive

Adopting a federalist approach on the issue of cannabis law reform will certainly mean that individual states will be allowed to flourish, but it stops short of the immense financial opportunities that federal legalization could bring.

“The cannabis industry is vibrant and expanding rapidly, but until the threat of federal interference is removed, our economic potential is limited,” said Aaron Smith, NCIA. “Lack of access to financial services, exorbitant tax pressures, and the absence of interstate and international commerce are all problems that we can fix by turning up the pressure on Congress.”

U.S.-based companies and investors are missing out on huge financial investment opportunities due to cannabis’ current status as a Schedule I controlled substance. According to a recent white paper released by NCIA’s Policy Council, as of February 2018, 39 of the 89 federally-licensed producers (LPs) of cannabis in Canada were publicly traded, raising a total of $1.2 billion CAD in January 2018 alone. On June 20th, it was announced that Tilray would be joining Cronos Group as the second Canadian LP listed on the U.S.-based NASDAQ; behemoth Canopy Growth is listed on the NYSE.

In late 2017, Canopy announced the sale of nearly 10 percent of its stock to U.S.-based alcohol giant Constellation Brands (known for Corona and SVEDKA vodka) for a cool $191 million dollars. Now that cannabis is legal in Canada, there are certain to be even bigger deals fastly approaching that U.S. operators are missing out on.

Impressive Advancements are Being Made – Just Not in America

The United States is also being left behind in terms of research and development and intellectual property within the cannabis space. In countries such as Israel, where the federal government appropriates money to researching marijuana, rapid advancements are being made that could be groundbreaking – and have global effects. In 2017, there were more than 110 clinical trials involving cannabis in Israel – far more than any other developed nation. It was also recently revealed that China now holds around half of the IP related to hemp in the world. This puts Americans at a disadvantage as the rest of the world competes to create innovative and life-altering cannabis medicines and technology.

“R&D requires access to capital and federal and academic support,” explains Frank Lane, President of Cannabis Financial Network. “These remain elusive in the U.S. because cannabis remains federally illegal. The U.S. is slowly allowing more University backed cannabis research but at a much slower pace then Israel, Canada and have allowed research on a federal level for years. The U.S. will be playing catch up as medical cannabis continue to be adopted globally.

Exports Expected to Rule Canadian Market

While legal domestic sales won’t begin for several months, some Canadian LPs have already been exporting cannabis products to several countries that have approved the plant for medical purposes. It was announced last October that Cronos Group had reached a deal to put their products in over 12,000 pharmacies across Germany, where the government is choosing to use their own socialised healthcare systems to handle the distribution of cannabis product to patients. Obtaining these lucrative government contracts means big money for exporters, and unfortunately for entrepreneurs from the U.S. looking to cash in may be too late by the time legalization occurs.

“Many European and Latin American countries are approving cannabis for medical use,” Lane adds. “These are billion dollar markets that countries like Canada and Uruguay are seizing because they have federally legalized cannabis and become adept at developing pharmaceutical grade products.”

U.S. Canna-Businesses Must Double Down on Reform Efforts

Until the federal government ceases to consider cannabis a Schedule I narcotic, American businesses will continue to lag behind and miss out on multi-billion dollar opportunities. Therefore, it is more important than ever that the industry continue to communicate with policymakers in order to create impactful change – before it’s too late.

Attending events such as the NCIA Quarterly Cannabis Caucus series is a perfect way to engage with local politicians and fellow entrepreneurs while also staying up to date on the latest legalization developments.

Read more about how the U.S. is falling behind in the global cannabis market in this report produced by NCIA’s Policy Council.

by Trevor Morones, Darwin Mallard, Liz Geisleman

by Trevor Morones, Darwin Mallard, Liz Geisleman

by Carol Welch & Jim Gerencser

by Carol Welch & Jim Gerencser

After studying Russian affairs and working as a political consultant, Sean Donahoe co-founded the California Cannabis Industry Association. He served as its Deputy Director through 2014 when he transitioned to consulting for investors and operators, communicating with public stakeholders, serving on local government committees, and advising industry trade groups. He holds an MSc in Government from the London School of Economics and is CEO of Sungrown Developments Inc., an advisory firm and holding company in Oakland, California.

After studying Russian affairs and working as a political consultant, Sean Donahoe co-founded the California Cannabis Industry Association. He served as its Deputy Director through 2014 when he transitioned to consulting for investors and operators, communicating with public stakeholders, serving on local government committees, and advising industry trade groups. He holds an MSc in Government from the London School of Economics and is CEO of Sungrown Developments Inc., an advisory firm and holding company in Oakland, California.

On June 19, Canada

On June 19, Canada