by Susan Gunelius, Lead Analyst for Cannabiz Media

When Oregon’s recreational marijuana program launched in 2016, the state chose not to limit the number of cultivation licenses that would be awarded. It also opted not to limit the amount of cannabis that each licensed cultivator could grow. Over the first 12 months of adult-use sales, the state issued licenses and expanded the industry.

Things were going fairly smoothly until the 2017 cannabis harvest brought in more than 1 million pounds of cannabis. For a state with just 4.1 million residents who purchased one-third of that amount in 2016, it became clear quite quickly that Oregon’s cultivators had grown more cannabis than the state’s retailers could sell. As a result, prices for legal marijuana dropped.

Unfortunately, the state didn’t learn from its mistake and the 2018 harvest brought 5% more cannabis than what was harvested in 2017. An even bigger surplus caused prices to plummet further, and many licensed growers were forced to go out of business or sell their licenses to larger companies with deeper pockets at extremely deep discounts. Those big companies could withstand price drops while smaller licensees cannot.

One of the biggest problems Oregon faces as a result of its cannabis oversupply problem is exactly the opposite of what its lawmakers wanted to happen when the recreational marijuana program was developed – many growers returned to the black market where they could still sell cannabis for a profit.

Possible Solutions to Cannabis Oversupply

As prices continued to fall and the cannabis oversupply problem continued to grow, suggested solutions came from multiple sources. Three options rose to the top as the most commonly cited. First, Oregon could cap the number of cultivation licenses it granted. With a large number of applications waiting to be reviewed and licenses to be granted, the problem with growing too much marijuana was poised to get even worse.

Both Washington and Colorado had some success solving their cannabis oversupply problems when they stopped awarding new licenses. In 2017, Washington had a 60% larger supply of cannabis than it did in 2017, which caused marijuana prices to fall in 2018. Business owners were very vocal about the need for changes to the state’s canopy limits and cultivation facility sizes. The state decided to stop issuing new cultivator licenses to solve the problem.

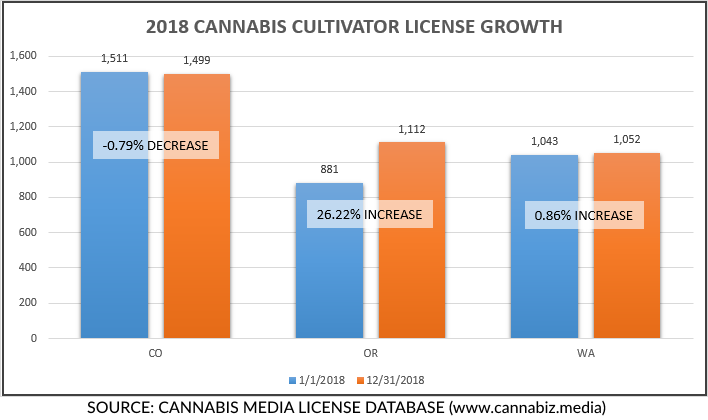

As the graph from the Cannabiz Media License Database shows, the number of active cultivation licenses in both Washington and Colorado varied by only 1% between January 1, 2018 and December 31, 2018. Contrast that to Oregon where the number of licenses grew by more than 26% during the same time period.

The Oregon Liquor Control Commission (OLCC) argues that only the state’s legislature can create a cap on the number of licenses issued in Oregon, but it did stop reviewing applications and issuing licenses in June 2018. While the OLCC claims the reason is because it had a large backlog of applications, it can also be assumed that the moratorium on issuing new licenses would help to quell the surging supply of cannabis in the state.

The second possible solution to the cannabis oversupply problem in Oregon is to reduce the canopy size for each license. In April 2018, Oregon modified cultivation licensing rules so new cultivators would have more limited canopy space for immature plants than existing cultivators.

The third suggested solution is to do nothing and let the market adjust and correct itself. For the most part, this appears to be the approach that Oregon is taking. While it did implement a rule in 2018 that required cultivators to notify the state of their harvests, which could bring an inspector to verify that the cultivator is adhering to cultivation rules, the state’s cultivators are still in a wait-and-see situation.

What’s Next in Oregon?

The OLCC has been doing research related to its oversupply problem and is expected to present its findings to the Oregon legislature this year. Many people assume placing caps on cultivation licenses will be on the table during those discussions.

In the near future, Oregon’s lawmakers will need to develop a strategy to deal with the oversupply problem, and it will likely include a combination of the suggested solutions. For example, a license or canopy cap and improving accessibility to marijuana products combined with allowing some consolidation to happen in the market should help to curb the oversupply problem.

Susan Gunelius, Lead Analyst for Cannabiz Media and author of Marijuana Licensing Reference Guide: 2017 Edition, is also President & CEO of KeySplash Creative, Inc., a marketing communications company offering, copywriting, content marketing, email marketing, social media marketing, and strategic branding services. She spent the first half of her 25-year career directing marketing programs for AT&T and HSBC. Today, her clients include household brands like Citigroup, Cox Communications, Intuit, and more as well as small businesses around the world. Susan has written 11 marketing-related books, including the highly popular Content Marketing for Dummies, 30-Minute Social Media Marketing, Kick-ass Copywriting in 10 Easy Steps, The Ultimate Guide to Email Marketing, and she is a popular marketing and branding keynote speaker. She is also a Certified Career Coach and Founder and Editor in Chief of Women on Business, an award-winning blog for business women. Susan holds a B.S. in marketing and an M.B.A in management and strategy.

Susan Gunelius, Lead Analyst for Cannabiz Media and author of Marijuana Licensing Reference Guide: 2017 Edition, is also President & CEO of KeySplash Creative, Inc., a marketing communications company offering, copywriting, content marketing, email marketing, social media marketing, and strategic branding services. She spent the first half of her 25-year career directing marketing programs for AT&T and HSBC. Today, her clients include household brands like Citigroup, Cox Communications, Intuit, and more as well as small businesses around the world. Susan has written 11 marketing-related books, including the highly popular Content Marketing for Dummies, 30-Minute Social Media Marketing, Kick-ass Copywriting in 10 Easy Steps, The Ultimate Guide to Email Marketing, and she is a popular marketing and branding keynote speaker. She is also a Certified Career Coach and Founder and Editor in Chief of Women on Business, an award-winning blog for business women. Susan holds a B.S. in marketing and an M.B.A in management and strategy.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–