Member Blog: The Conservative Argument for Banking and 280E Reform

Why philanthropy can be the most effective weapon in the fight for banking and 280E reform

by Kevin J White, Founder, Corporate Compassion, LLC DBA CannaMakeADifference

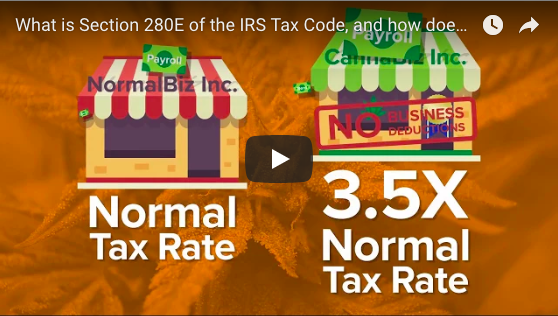

In a recent announcement by the IRS, they may allow deductions through Section 471, but it is still unclear this impact as of this writing is still unclear, so with that said, I am proposing this argument because of the impact needed TODAY to help in the economic recovery effort, given it is an election year, as well.

Before I begin, please do not construe my argument as a Republican argument for legalization. When I say conservative, I am speaking from a purely fundamental belief and values perspective, not a contemporary political ideology. There is hypocrisy on both sides and I recognize this fact.

Having a nonprofit background, most of my life has been spent hovering on the political lines, mostly policy, not parties. Liberals are traditionally more aligned with causes than conservatives, although conservatives have traditionally been more fiscally supportive of charitable causes. Why are conservatives more fiscally supportive of charitable causes? Conservative values.

The most undervalued weapon in the fight for legalization

In the fight for legalization, there appears to be a definite challenge from conservatives.

I came into this industry four years ago and noticed a disconnect between the arguments from the industry and the conservative response. Although support is growing from conservatives, most of the arguments being discussed for legalization seem to be falling on deaf ears.

Why is that? It is because the current arguments for legalization are being fed to conservatives in a language which they do not understand and are hearing as a direct challenge to their values.

The values and language of the right are fundamentally different from the left in most ways. One value which is, in my opinion, grossly undervalued by the industry is philanthropy.

Timing is everything

The health and economic ramifications of COVID-19 have caused us to look at the government and our nonprofit sector for help. The political discourse of our governments, from local to federal, unfortunately, is not helping to meet the needs of individuals or communities and thus someone has to step up. Something I haven’t heard many conversations about is our community-based nonprofits and how they are working to address the needs around COVID-19 and the economic challenges COVID-19 has manifested. Nonprofits, which are on the front line of meeting communities’ needs, from animals to veterans and every population in between, are fighting a battle from a deficit position.

The COVID-19 pandemic has cut into nonprofits’ resources while increasing demand for their services.

According to the Stanford Social Innovation Review’s “Giving With Impact Podcast,” our community nonprofits, especially 501(c)(3) nonprofits, are being “…asked to do more with less money and reduced staff while taking on an expanding client population, and all of this at the same time that revenues from services have dried up and donations from their traditional fundraising activities have declined. Some have had to lay off staff and cut salaries and others have had to cut programs.” This is according to Amir Pasic, the Eugene R. Tempel Dean at the Lilly Family School of Philanthropy at Indiana University and a professor of philanthropic studies. He also highlights that although disasters cause a spike in giving, which the pandemic did, in a recession, which seems to be a by-product of the political response to COVID-19, he states, “…we see the opposite effect… It took many years, several years, for individual giving, in particular, to recover. So in recessions giving does go down, simply because the resources that we have available go down, as well.”

Amir also states in the podcast that “…over 60% of nonprofits are anticipating significant decreases in terms of their fundraising ability. And I think many of them will be in crisis further, depending, in part, also, in terms of how federal help continues or does not continue going forward… So there is certainly a sense of crisis and pressure for many nonprofits because their services are increasingly… many of them in the human services, increasingly in need, and yet there is the sense that their sources of revenue are going to be under severe pressure at the same time.”

In the same podcast, Mary Jovanovich, Senior Manager for Relationship Management at Schwab Charitable, states that clients involved with their donor-advised fund are actually giving 50% more at this time. Looking at this in the most simplistic way, those who can give more are giving more, but giving is being done by fewer people and thus still creating a deficit.

Together we CANNA make a difference!

Of course, those companies and people who are doing extremely well are the usual suspects. But what about a flourishing industry? One which is new and growing, and has been growing through a pandemic? An industry that is doing better than most industries and has the reach and means to impact the communities which they serve and beyond? What would be holding them back from coming to the rescue of the communities they serve and ultimately helping the entire nation?

Well, not to put too fine a point on it, but taxes!

If you are a company with an effective tax rate of between 60 and 70%, you might need to hold on to your profit in order to make sure you and your employees survive in case something else is looming on the horizon. Say an election?

Imagine a time when the cannabis community comes together to elevate those nonprofits which are providing the most impact on our economic and social recovery. The world is watching and in awe of the support being provided to tens of thousands of deserving nonprofit 501c3’s and the Senate is watching as thousands of the nonprofits in their states are participating, which is a statement that they are willing to accept support from the cannabis industry. This is the way you sway minds and hearts.

The Conservative Argument for 280E Reform

Conservatives believe in free markets and thus less regulation, in the belief that the growth of companies and the economy will thrive and ultimately self-regulate as much as it can with limited governmental intervention. This needs to be applied to the cannabis industry as well. But not just for the reasons you may think. 280E reform needs to take place NOW so that philanthropy can be elevated and help address COVID-19 and economic recovery challenges.

The effective tax rate is high specifically due to the IRS code 280E, which does not allow cannabis companies to write off typical business expenses, things like marketing, depreciation on equipment, and other expenses including charitable donations to 501c3 nonprofits! Just imagine what could be done if a cannabis company, many of which are already giving without the tax advantage, was given a tax incentive to donate? Everyone understands the taxes imposed by the states and municipalities for the legal purchase drive the cost of cannabis up. So the margins are fairly thin when compared to that of other companies that do not have to abide by 280E. 280E is government regulation. Conservatives tend to be for free markets. If, as we all know, even my fundamentalist Christian friends know, that cannabis will be federally legal eventually, why not take this opportunity to deregulate this industry allowing it to assist in addressing community resource deficits at a time when it is needed most? This argument also addresses the fundamental hierarchy, which conservatives believe should be the path of assistance, self, family, church, community, local government, and finally state government, in that order.

I do not mention the federal government, because another value of conservatism is small government and that the federal government is there to protect the inalienable rights of humans as well as the right to property. Traditional conservatives believe in a helping hand, but only a temporary one as they understand many might not have all the support systems in place mentioned previously.

So the argument for 280E reform, in the context of nonprofits and helping with the health and economic crises stemming for COVID-19, addresses the conservative values of human rights, property rights, individual responsibility, free markets, lower taxes, and deregulation of businesses.

The Conservative Argument for Banking Reform

Now, imagine that 280E was reformed or no longer applicable to LEGAL cannabis companies. There is still a problem. Even if 280E was rescinded for the cannabis industry, banks may still not allow them the same banking services because it would in effect still be federally illegal. If this is the case, even if a company chose to donate to a willing charity, the charity would fall under these very same banking laws and thus might not be able to deposit funds from the cannabis industry into their bank accounts, running a risk that their accounts could still be closed for accepting money from a federally illegal activity. So truly, banking and 280E reform are not just a cannabis industry issue, but a nonprofit sector issue, which needs to be addressed sooner than later!

Now, we all know many charities will still not accept the funds offered from cannabis companies due to many factors, however, many of those most impacted by the pandemic and economic decline, such as those focused on food, housing, homelessness, veterans, mental health, senior citizens, and others, could benefit from receiving funds from cannabis companies as their own resources are diminishing. Therefore, the fight for our nation’s recovery needs to include banking and 280E reform for an industry which can make a difference for many!

Because TOGETHER WE CANNA MAKE A DIFFERENCE (If given the opportunity)!

Founder of Corporate Compassion, LLC and DBA CannaMakeADifference, Kevin J White is a social entrepreneur, nonprofit evangelist, volunteer activist, community engagement advocate, tennis player, golfer, BUCKEYE, and Avid shoe wearer. Kevin began his journey into social entrepreneurship after a 20+ year career in the nonprofit sector. Having started his career as a direct care counselor for at-risk children he advanced through the nonprofit sector, eventually moving to Colorado for a job with a major animal welfare nonprofit, overseeing 4 departments and over 100 staff and volunteers, eventually creating his own nonprofit 501(c)(3) public charity. With a strong background in nonprofit management and resource management, he began his cannabis journey through his Colorado-based, 501c3 nonprofit, having to identify the benefits and challenges of accepting support from the cannabis industry. He realized that there were some challenges for both sectors and decided to further his social entrepreneurship by consulting with cannabis companies looking to strengthen and develop their cause-marketing and philanthropic goals. This was the birth of CannaMakeADifference.

Founder of Corporate Compassion, LLC and DBA CannaMakeADifference, Kevin J White is a social entrepreneur, nonprofit evangelist, volunteer activist, community engagement advocate, tennis player, golfer, BUCKEYE, and Avid shoe wearer. Kevin began his journey into social entrepreneurship after a 20+ year career in the nonprofit sector. Having started his career as a direct care counselor for at-risk children he advanced through the nonprofit sector, eventually moving to Colorado for a job with a major animal welfare nonprofit, overseeing 4 departments and over 100 staff and volunteers, eventually creating his own nonprofit 501(c)(3) public charity. With a strong background in nonprofit management and resource management, he began his cannabis journey through his Colorado-based, 501c3 nonprofit, having to identify the benefits and challenges of accepting support from the cannabis industry. He realized that there were some challenges for both sectors and decided to further his social entrepreneurship by consulting with cannabis companies looking to strengthen and develop their cause-marketing and philanthropic goals. This was the birth of CannaMakeADifference.

CannaMakeADifference is a strategic consulting company created to assist purpose-driven cannabis companies with meeting their cause-marketing and philanthropic goals. He has co-authored two white-papers, one for cannabis companies and one for nonprofits, highlighting the benefits and challenges of working with each other.

He also founded the Women of 420 Charity Calendar, highlighting causes supported by pro-cannabis women.

Kevin also hosts a podcast called Together We CANNA Make A Difference which highlights philanthropy in the industry and companies making a difference from the cannabis sector. You can download the podcast on most major podcast platforms including Google Podcasts and Apple Podcasts.