Member Blog: Tax Court Decision for Harborside Health Center

by James Mann and Rachel Gillette, Attorneys at Greenspoon Marder LLP

The Tax Court’s recent decision in Harborside Health Center v. Commissioner is more bad news for the cannabis business community. The taxpayer, a prominent California dispensary, was assessed approximately an additional $30 million in tax by the IRS for the years 2007 to 2012, years in which Harborside had total revenue of approximately $102 million. Harborside lost, so it will have to pay that amount plus also pay another 20% of the tax owed in accuracy-related penalties – the Tax Court did not decide the penalty issue and left it for a later opinion. At this point, Harborside can either pay the tax (plus possibly penalties) or appeal to the Ninth Circuit Court of Appeals.

GROUNDS OF THE DECISION

The court decided against Harborside on every single argument made by its counsel. Three of the issues are straightforward:

- The doctrine of res judicata didn’t apply, so the fact that a civil forfeiture case against Harborside had been dismissed with prejudice did not prevent the IRS from assessing a tax liability.

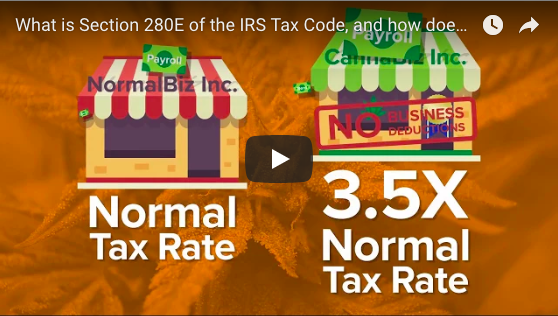

- The language in Section 280E of the Tax Code that deductions are disallowed to a trade or business that “consists of trafficking in controlled substances” applies to businesses that have more than the one activity of trafficking. Harborside argued that “consists of” means the business must ONLY be trafficking for the disallowance to apply, and the Tax Court rejected that interpretation.

- Harborside had only one trade or business so it could not deduct any expenses related to a separate trade or business. The taxpayer had argued it had multiple lines of business, but the opinion held that Harborside didn’t make significant profits from any of the other claimed lines of business so there was only one business.

MOST IMPORTANT CONSEQUENCE OF DECISION

The holding in the case that has the widest applicability to the cannabis community regards what Harborside may include in its cost of goods sold. The increase in tax owed by Harborside mostly comes from reclassifying expenses from cost of goods sold to ordinary business expenses and then denying deductions for those expenses under Tax Code Section 280E.

The taxpayer argued that the broader cost of goods sold rules under Code Section 263A applied in addition to the earlier (and narrower) definition of cost of goods sold under Section 471 However, the Tax Court endorsed the reasoning in IRS Chief Counsel Advice Memorandum 201504011 (2015) regarding the interaction of Section 263A and Section 471 with respect to cannabis-related cost of goods sold calculations. It is the IRS view that a clause of Section 263A prevents allocating indirect cannabis-related costs into cost of goods sold because the deduction for those costs would be denied under Section 280E.

Harborside contended that the Sixteenth Amendment to the Constitution compels using Section 263A rules in addition to the Section 471 cost of goods sold rules. The Tax Court was very dismissive of the argument, pointing out that “Section 471 wasn’t found unconstitutional during the many decades when it was the only means of calculating COGS [cost of goods sold], and it wouldn’t be unconstitutional now if Congress repealed Section 263A.”

It is also worth noting that the Tax Court held that Harborside was a reseller, not a producer, and that producers are subject to a different set of regulations under Section 471 that allow additional expenses to be included in cost of goods sold.

WHAT NOW?

Harborside is important because it is the first Tax Court case to squarely address the interaction between Sections 263A and 471 in the context of a cannabis business. However, there are other courts that can hear federal tax cases besides the Tax Court, and there are other arguments that can be made besides the one made by taxpayer’s counsel (even in Tax Court). While the best option for relief for cannabis taxpayers is to change the law, even if the law is changed, there will still be years of audits under the current law, so the questions raised by the Harborside decision will continue to be litigated. For further discussion, please see our blog on our website.

James B. Mann is a partner with the Tax practice group of Greenspoon Marder LLP. Mr. Mann has over 25 years of experience serving as a trusted advisor to a broad range of stakeholders in the energy and financial services industries. He counsels clients on the new changes in the tax law, as well as cannabis tax issues and cannabis tax controversy proceedings. Mr. Mann has a law degree from Harvard Law School and an MBA from Columbia University.

James B. Mann is a partner with the Tax practice group of Greenspoon Marder LLP. Mr. Mann has over 25 years of experience serving as a trusted advisor to a broad range of stakeholders in the energy and financial services industries. He counsels clients on the new changes in the tax law, as well as cannabis tax issues and cannabis tax controversy proceedings. Mr. Mann has a law degree from Harvard Law School and an MBA from Columbia University.

Rachel Gillette is among the first attorneys in the nation to dedicate her practice to the cannabis industry. Since 2010, Ms. Gillette has helped marijuana/cannabis businesses with licensing and regulatory compliance, business law and transactions, contract drafting and review, tax litigation, corporate formation, and tax matters, including audit representation. She works with startups and entrepreneurs, investors, and ancillary industry businesses to help develop the cannabis innovation ecosystem, and is a zealous advocate for the industry.

Ms. Gillette regularly represents clients before the IRS’s Examinations, Appeals, and Collections Divisions, including marijuana businesses facing the challenges of IRS adjustments under 280E. She has successfully protested local, state and federal tax deficiencies on behalf of her clients, having prevented hundreds of thousands of dollars in incorrectly assessed taxes, interest, and penalties. She can assist individual and business taxpayers in 280E proposed assessments, offers in compromise, audit examinations, innocent spouse claims, sales, use, and employment tax matters, trust fund tax penalty assessments, penalty abatement’s, and levy releases.

Ms. Gillette regularly represents clients before the IRS’s Examinations, Appeals, and Collections Divisions, including marijuana businesses facing the challenges of IRS adjustments under 280E. She has successfully protested local, state and federal tax deficiencies on behalf of her clients, having prevented hundreds of thousands of dollars in incorrectly assessed taxes, interest, and penalties. She can assist individual and business taxpayers in 280E proposed assessments, offers in compromise, audit examinations, innocent spouse claims, sales, use, and employment tax matters, trust fund tax penalty assessments, penalty abatement’s, and levy releases.

For several years, Ms. Gillette was the executive director of the Colorado state chapter of NORML, the National Organization to Reform Marijuana Laws. She was a founding member of Women Grow and the National Cannabis Bar Association. She an advocate as well as an attorney, and is committed to helping change laws – and perceptions – relating to cannabis and ensuring state licensed and legal marijuana businesses are fairly taxed and regulated.

Ms. Gillette received her Juris Doctorate from the Quinnipiac University School of Law in Hamden, Connecticut, where she served as Associate Editor of the Quinnipiac University Probate Law Journal. During law school, she interned with the New Haven Public Defender’s office, where she developed her commitment to advocacy for those facing the many challenges of the criminal justice system.