Navigating the Confusing, Crowded World of Cannabis Payments

When you’re a cannabis retail operator looking for electronic cannabis payment solutions you’re faced with a baffling array of options and it’s hard to pick out the ones you can trust and the ones that you should avoid at all costs. Every potential vendor is going to tell you that their solution is the best (trust me!) so you need to understand the basic landscape of cannabis payment solutions in order to know what questions to ask. There’s a lot of solid vendors out there that only want to help the industry but there are, sadly, those out there that prey upon a lack of familiarity with the crowded, confusing payments landscape to push solutions that are at best unsustainable and at worst fraudulent.

ACH transactions are a way for a person or a business to do direct bank money transfers.

These transactions are conducted on a computer network run by NACHA, the National Clearinghouse Association. Since these don’t run over the networks run by the credit card companies like Visa or Mastercard – known as “payment rails” – these transactions don’t violate their rules. While NACHA hasn’t officially made a statement either way about cannabis, their actions suggest they don’t have an issue processing these transactions over their network.

The downside with many ACH solutions is that they aren’t necessarily convenient for the buyer. Because a customer or patient can’t just pull out a bank card they are often required to download an app and provide banking details like account and routing numbers. This isn’t necessarily an issue from the second purchase forward, but this can be a bit of a pain for a customer or patient trying to use an app for the first time if they’re not expecting to have to go through an account onboarding process that might take several minutes. The upside to this is that there are platforms that allow the buyer to upload funds via ACH to an eWallet, which, after the initial transaction, will enable them to make instant purchases. Platforms also allow the buyer to automatically replenish their eWallet via ACH, allowing them to always have funds to make purchases. These purchases can also be combined with a store’s loyalty points program.

Questions to ask about ACH solutions:

- What does a customer or patient need to do to use the solution?

- How long does it normally take for the funds to transfer, allowing a user to make purchases?

- Are there any contactless platforms that allow a buyer to purchase the product for delivery or curbside pickup?

- Do you need additional hardware to display a single-use QR code specific to the transaction?

Cashless ATMs and PIN Debit solutions are among the most common electronic payment methods that allow customers to directly use cards.

To discuss the issues that go along with any card-based solution we need to take a step back and talk about how payments are processed. As previously mentioned, every credit card company has a set of rails used by merchants to process a sale over their network. Each transaction is sent as a packet of information that broadly contains the following information: name of business, location of business, any additional merchant information, and merchant category code (MCC).

Every transaction has to be associated with a four digit MCC used by the merchants to indicate the nature of the business and the transaction. The code that’s traditionally been used by cashless ATMs and PIN Debit solutions is 5912, reserved for pharmacies and “cannabis (where legal to do so)”. This is what’s used in Canada where credit cards are an option but it’s not an acceptable option in the US because the major credit card networks have clarified that their rails cannot be used for the purchase of marijuana. They do so by prohibiting activities associated with “controlled substances, or recreational/street drugs” (VISA) or even more broadly “any Transaction that is illegal” (Mastercard) in their operating agreements.

It’s important to note that you can’t just randomly choose an alternative MCC because miscoding constitutes fraud. You may remember a few years ago that California-based delivery company Eaze was prosecuted in 2019 for using MCC codes associated with things like “carbonated drinks, green tea, face creams and other products” in an attempt to obscure the fact that the network was being used for the direct purchase of marijuana.

It should be noted however that there are a few ATM networks out there that aren’t directly owned by the big credit card companies like NYCE, Allpoint, Star, and Moneypass. These companies have been relatively quiet regarding the use of their networks for the purchase of marijuana products, so there is an argument to be made that if card transactions are sent over those rails they’re not violating any operating rules, but anecdotally we’ve heard that some of these networks aren’t necessarily cannabis friendly and, as private companies, they’re able to change their mind (for or against) whenever they wish.

Questions to ask about Cashless ATMs and PIN Debit solutions:

- What MCC code is the payment processor using?

- What network is being used to process the transaction?

Credit cards are notoriously off-limits to cannabis because of the very public positions taken by the major card networks but that doesn’t stop companies from popping up offering credit card processing for cannabis purchases. Let’s clarify here at the outset – there is no way to directly purchase marijuana with a credit card in the United States with a credit card from American Express, Visa, Mastercard, or Discover.

So, with necessity being the mother of invention, some companies are trying out a new strategy to get credit card processing into dispensaries legally. Among them are solutions that take advantage of another MCC code: 6051. This code is associated with the purchase of “liquid and cryptocurrency assets” and some enterprising payment providers are using it to set up a structure where a customer isn’t “technically” buying marijuana. Instead they are “buying” what’s called a “stablecoin”, a form of cryptocurrency whose value is pegged 1:1 to the US dollar.

Questions to ask about cryptocurrency or stablecoin solutions:

- What MCC code is the payment processor using?

- What stablecoin is being leveraged?

- How is the stablecoin preserving its value?

- What will the offramping of funds from a crypto wallet to my DDA account look like to my bank?

Cannabis retail operators are faced with serious business and legal considerations when determining the payment processing solution provided to patients and customers. What solution will be the easiest for the customer? Is the solution compliant?

The cannabis industry’s evolving legal and regulatory landscape is challenging, especially with bad actors seeking to implement non compliant make-shift payment solutions intended to capitalize off of cannabis businesses seeking efficient and effective cannabis payment solutions. It is essential that you do your due diligence on cannabis payment solutions presented to your business to confirm that it will not cause an issue for you, the business and its patterns and customers. We hope that this article outlines considerations that will allow you to protect your business and its patients and customers.

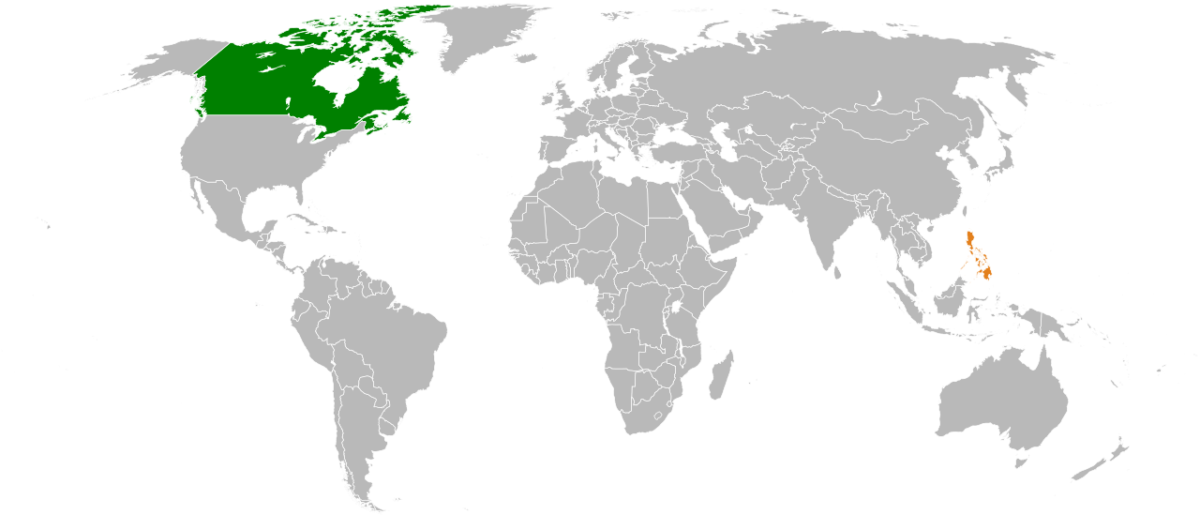

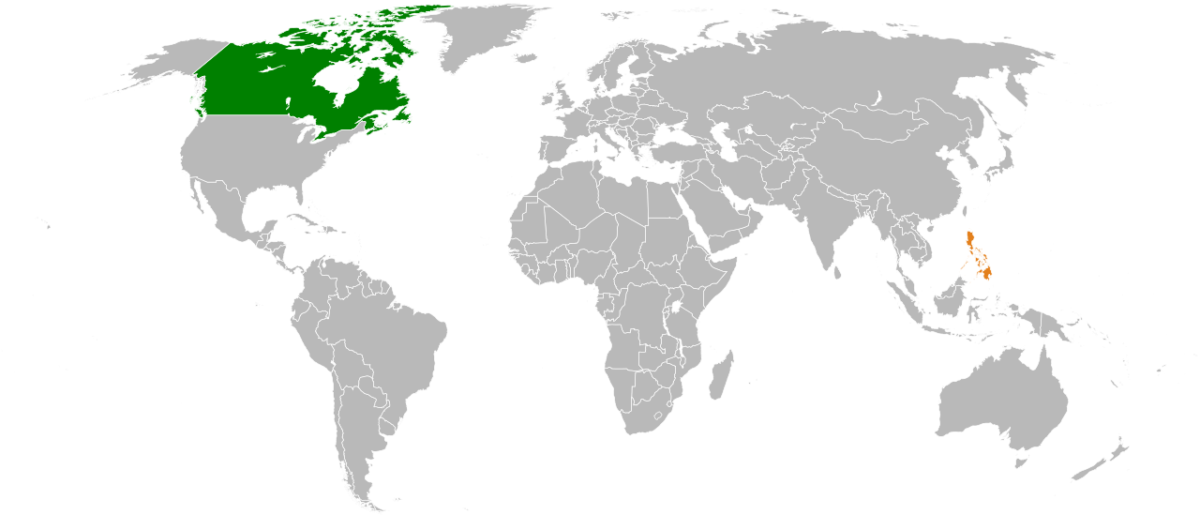

Canada Legalizes Cannabis – When Will The U.S. Follow?

by Rachelle Lynn Gordon, NCIA Editorial Staff

On June 19, Canada became the first G7 nation and second in the world after Uruguay to fully legalize cannabis for adult use, paving the way for what is estimated to be a CAD$9.2 billion dollar industry by 2025. Canadian Prime Minister Justin Trudeau Tweeted in response to the move:

On June 19, Canada became the first G7 nation and second in the world after Uruguay to fully legalize cannabis for adult use, paving the way for what is estimated to be a CAD$9.2 billion dollar industry by 2025. Canadian Prime Minister Justin Trudeau Tweeted in response to the move:

“It’s been too easy for our kids to get marijuana – and for criminals to reap the profits. Today, we change that. Our plan to legalize & regulate marijuana just passed the Senate. #PromiseKept”

The passing of the iconic Bill C-45, also known as the Cannabis Act, was met with raucous applause from the across the globe and sent marijuana stocks soaring. Provinces and territories now have until October 17 to develop and implement their own regulations for the sale of cannabis products; according to the federal statute, adults will be able to carry and share up to 30 grams of marijuana in public and cultivate up to four plants at home.

But when will the United States follow suit and become a part of the multi-billion dollar global cannabis market?

High Time for Federal Legalization

“With leading policymakers on both sides of the aisle calling for reform, there has never been more momentum behind the effort to replace criminal marijuana markets with regulated businesses, but we still have a long way to go.” says Aaron Smith, executive director for the National Cannabis Industry Association (NCIA).

Despite the fact that 29 states, as well as Guam, Puerto Rico, and the District of Columbia, have legalized cannabis for medical and/or adult-use, the plant is still illegal at the federal level. This has led to immense headaches for business owners within the legal space who only wish for their companies to thrive but are hindered by lack of access to traditional banking and fundraising opportunities and stuck operating within individual state lines.

Lawmakers from legal states have heard their constituents’ voices loud and clear and have joined together to develop the STATES Act, short for “Strengthening the Tenth Amendment Through Entrusting States.” Introduced by Senators Elizabeth Warren (D-MA) and Corey Gardner (R-CO), the bill aims to protect states that choose to legalize cannabis by creating an exemption to the U.S. Controlled Substances Act, and would remove industrial hemp from the Controlled Substances Act entirely. The bill would also allow banks to work with cannabis businesses more easily. Representatives David Joyce (R-OH) and Earl Blumenauer (D-OR) have already introduced a companion bill in the House.

When asked about the STATES Act by reporters, President Trump replied that he would more than likely support the measure, stating: “I support Sen. Gardner, I know exactly what he’s doing. We’re looking at it. But I probably will end up supporting that, yes.”

Full Legalization Needed for Market to Thrive

Adopting a federalist approach on the issue of cannabis law reform will certainly mean that individual states will be allowed to flourish, but it stops short of the immense financial opportunities that federal legalization could bring.

“The cannabis industry is vibrant and expanding rapidly, but until the threat of federal interference is removed, our economic potential is limited,” said Aaron Smith, NCIA. “Lack of access to financial services, exorbitant tax pressures, and the absence of interstate and international commerce are all problems that we can fix by turning up the pressure on Congress.”

U.S.-based companies and investors are missing out on huge financial investment opportunities due to cannabis’ current status as a Schedule I controlled substance. According to a recent white paper released by NCIA’s Policy Council, as of February 2018, 39 of the 89 federally-licensed producers (LPs) of cannabis in Canada were publicly traded, raising a total of $1.2 billion CAD in January 2018 alone. On June 20th, it was announced that Tilray would be joining Cronos Group as the second Canadian LP listed on the U.S.-based NASDAQ; behemoth Canopy Growth is listed on the NYSE.

In late 2017, Canopy announced the sale of nearly 10 percent of its stock to U.S.-based alcohol giant Constellation Brands (known for Corona and SVEDKA vodka) for a cool $191 million dollars. Now that cannabis is legal in Canada, there are certain to be even bigger deals fastly approaching that U.S. operators are missing out on.

Impressive Advancements are Being Made – Just Not in America

The United States is also being left behind in terms of research and development and intellectual property within the cannabis space. In countries such as Israel, where the federal government appropriates money to researching marijuana, rapid advancements are being made that could be groundbreaking – and have global effects. In 2017, there were more than 110 clinical trials involving cannabis in Israel – far more than any other developed nation. It was also recently revealed that China now holds around half of the IP related to hemp in the world. This puts Americans at a disadvantage as the rest of the world competes to create innovative and life-altering cannabis medicines and technology.

“R&D requires access to capital and federal and academic support,” explains Frank Lane, President of Cannabis Financial Network. “These remain elusive in the U.S. because cannabis remains federally illegal. The U.S. is slowly allowing more University backed cannabis research but at a much slower pace then Israel, Canada and have allowed research on a federal level for years. The U.S. will be playing catch up as medical cannabis continue to be adopted globally.

Exports Expected to Rule Canadian Market

While legal domestic sales won’t begin for several months, some Canadian LPs have already been exporting cannabis products to several countries that have approved the plant for medical purposes. It was announced last October that Cronos Group had reached a deal to put their products in over 12,000 pharmacies across Germany, where the government is choosing to use their own socialised healthcare systems to handle the distribution of cannabis product to patients. Obtaining these lucrative government contracts means big money for exporters, and unfortunately for entrepreneurs from the U.S. looking to cash in may be too late by the time legalization occurs.

“Many European and Latin American countries are approving cannabis for medical use,” Lane adds. “These are billion dollar markets that countries like Canada and Uruguay are seizing because they have federally legalized cannabis and become adept at developing pharmaceutical grade products.”

U.S. Canna-Businesses Must Double Down on Reform Efforts

Until the federal government ceases to consider cannabis a Schedule I narcotic, American businesses will continue to lag behind and miss out on multi-billion dollar opportunities. Therefore, it is more important than ever that the industry continue to communicate with policymakers in order to create impactful change – before it’s too late.

Attending events such as the NCIA Quarterly Cannabis Caucus series is a perfect way to engage with local politicians and fellow entrepreneurs while also staying up to date on the latest legalization developments.

Read more about how the U.S. is falling behind in the global cannabis market in this report produced by NCIA’s Policy Council.

On June 19, Canada

On June 19, Canada