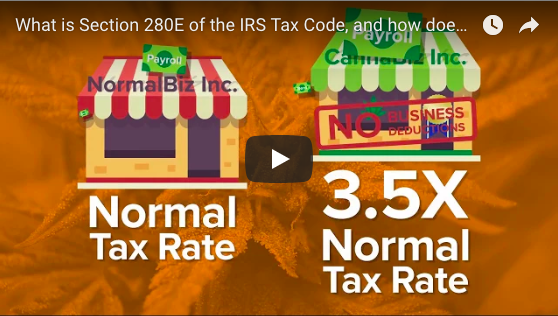

As tax season officially concludes, many cannabis businesses are feeling the burden of Section 280E, which can have the effect of taxing direct-to-plant businesses at a rate up to 3.5 times higher than other businesses. This unfair provision in the federal tax code affects the entire industry’s growth potential.

Watch this video below to learn more about Section 280E. Find out more about the solution: The Small Business Tax Equity Act which would allow for the fair and equal treatment of cannabis businesses.

Follow NCIA

Newsletter

Facebook

Twitter

LinkedIn

Instagram

–