Video: NCIA Today – Thursday, April 20, 2023

It’s the 4/20 Cannabis Industry Update!

Join NCIA Director of Communication Bethany Moore for an update on what’s going on with NCIA and our members.

It’s the 4/20 Cannabis Industry Update!

Join NCIA Director of Communication Bethany Moore for an update on what’s going on with NCIA and our members.

by Sevana Janian, Green Plus CPA

by Sevana Janian, Green Plus CPA

Member of NCIA’s Cannabis Cultivation Committee

Managing finances and complying with complex regulations in the highly regulated cannabis market can be challenging for business owners. For this reason, it’s crucial to have a competent cannabis accountant. In this article, we will discuss four major reasons why a good accountant is essential in the cannabis market, grouped into distinct categories.

Having specialized professionals, such as a cannabis accountant, can bring a wealth of knowledge and expertise to your business. They understand the unique challenges and regulations associated with the cannabis industry and can provide guidance and support to help you make informed decisions and navigate potential risks. By leveraging their expertise, you can ensure the success and stability of your business in this rapidly evolving industry.

Accountant who has experience working in volatile and new industries is well-equipped to handle the risks that come with operating in such environments. By regularly identifying and measuring these risks, the accountant can help mitigate them and ensure the stability and success of a business.

At the early stages of starting a business, it’s critical to bring on board a competent cannabis accountant and attorney. Don’t let the simplicity of creating an entity mislead you into missing out on getting proper counsel on the appropriate entity type. Stay attentive to accounting and legal concerns and make informed decisions. If the chosen entity type does not align with your business goals, a knowledgeable cannabis accountant will discuss the potential consequences of each option. This will enable you to make an informed decision.

Given the ongoing discourse surrounding entity type and its status as a commonly asked question, I deemed it worthwhile to introduce this information. It should be noted that a Limited Liability Company (LLC) is not officially classified as a tax entity by the IRS. The taxation of an LLC can vary and may be classified as a single-member LLC, a corporation, or a partnership.

One of the biggest risks in the cannabis industry is the risk of failure and the accumulation of a large tax debt. The cannabis industry is heavily regulated and taxed, which can present significant financial challenges for businesses operating in this field. In order to mitigate this risk, it is important for cannabis businesses to have a strong understanding of the tax laws and regulations applicable to their operations, and to have a robust system in place for tracking and reporting their financial transactions. Working with a knowledgeable and experienced cannabis accountant can help ensure that tax laws are applied correctly and that businesses stay in compliance with the regulations, reducing the risk of financial failure and tax debt. The establishment and enhancement of robust internal controls, coupled with diligent monitoring, can also significantly contribute to mitigating potential risks as well.

It is noteworthy that individuals who own cannabis businesses are known for taking risks. As a result, it is essential to have accountants and attorneys who are skilled in evaluating and reducing these risks. Selecting your advisory team carefully is of utmost importance.

It is necessary for the business owner and accountant to have a clear and transparent understanding of each other’s needs and goals, in order to create a win-win situation. The highly regulated and complex cannabis market can be challenging, and having an accountant who is passionate and aligned with the business owner’s mission and vision can help smooth the business cycle and avoid conflicts. An accountant’s mission is to help their clients manage their financial resources effectively and efficiently. This involves tracking the financial performance of the business, providing advice on financial decisions, and ensuring compliance with legal and regulatory requirements. In order to carry out this mission effectively, an accountant needs to have a deep understanding of the business owner’s goals, objectives, and overall strategy.

When a cannabis accountant’s mission is aligned with a business owner’s, they can work together to achieve common goals. This alignment helps the accountant understand the business owner’s financial needs, which enables them to provide more targeted advice and recommendations. It also helps the business owner understand the importance of financial management and how it can contribute to the success of their business. It also helps the business owner feel more confident in their accountant’s advice and recommendations, which can lead to collaborative and effective working relationships and more successful outcomes.

The cannabis industry is new and constantly evolving, and it is important to have an accountant who is trained and up-to-date with the latest developments. Many CPA firms are now specializing in the cannabis industry, giving business owners more options to choose from. A cannabis accountant should be familiar with 280E of the Internal Revenue Code, which can be a monster in terms of tax for the industry. They should also have knowledge of cost accounting and inventory management, which are crucial for producing accurate financial statements. Cannabis accountants with a background in manufacturing industry can bring their expertise to the industry and be of even greater value.

The use of the word “trained” is intentional in highlighting the fact that the cannabis industry is new and constantly evolving. Even though accounting firms with decades of experience are doing their best, when they have a high volume of clients, they may not be able to provide timely service and may lack time for innovation and data analysis. There are many cannabis think-tank groups and programs that can give trained accountants the same advantages, or even more, as experienced ones, as technology has revolutionized all industries, including accounting.

A knowledgeable cannabis accountant should be able to provide financial statements and analyze them to help the business understand its financial position and take actionable steps towards its goals. They should be able to simplify complex financial analysis and provide key performance indicators and ratios that can help the business stay on track. They also have the responsibility of managing cash flow, which is key for the success of any business, especially in a competitive market. Many businesses fail because they run out of cash, not profit.

An insightful analysis takes the information one step further and presents the data in context in a way that identifies the necessary actions to be taken to maintain or improve the organization’s operations. Reports that allow managers to do their jobs better and make better decisions will be highly valued.

In a competitive market, the role of accountants and CFOs becomes increasingly important.

Ultimately, conducting business is a spiritual pursuit that involves the right mindset, effective communication, and teamwork. A business will flourish and make a positive impact if it brings together a team with a strong cultural alignment and a growth mindset.

We have great respect for those who work in the cannabis industry, as they often put their lives or licenses on the line. Let us strive for greater compliance and work towards creating a better world for all.

Sevana Janian is a Certified Public Accountant in California with more than 17 years of experience in tax and accounting. She is a member of the Cultivation Committee of the National Cannabis Industry Association (NCIA) for the year 2023. She is also a member of AICPA and CalCPA organizations. Sevana enjoys traveling with her family and playing the piano during her leisure time. She is committed to networking with others to expand her personal and professional knowledge. Sevana is passionate about inspiring and motivating the younger generation to succeed.

Sevana Janian is a Certified Public Accountant in California with more than 17 years of experience in tax and accounting. She is a member of the Cultivation Committee of the National Cannabis Industry Association (NCIA) for the year 2023. She is also a member of AICPA and CalCPA organizations. Sevana enjoys traveling with her family and playing the piano during her leisure time. She is committed to networking with others to expand her personal and professional knowledge. Sevana is passionate about inspiring and motivating the younger generation to succeed.

Green Plus CPA aims to offer a world-class automated tax and accounting solution nationwide for CEOs and business owners in the cannabis industry who seek accurate financial statements. Established in 2022, we are deeply interested in the medicinal properties of the cannabis plant and firmly believe in its potential to heal. We are enthusiastic about supporting and serving this industry that has been overlooked.

By Nolan Shutler, Director and State and Local Tax Practice Leader, MGO CPA

Operators and investors have long suspected that the IRS targets cannabis businesses for tax audits. And after last year’s disclosures from the agency (requested and published by MJBizDaily) we now know the reason is relatively simple: the IRS gets back 2X or more per hour of audit examination when compared to mainstream industries.

Now, with the Inflation Reduction Act’s infusion of $80 billion in funding over the next 10 years to ramp up enforcement activities, the IRS’ focus on cannabis companies is likely to intensify. Even if Federal legalization and/or descheduling of cannabis occurs, current and prior year’s returns will still be subject to IRC 280E, and the problems causing the high assessments aren’t going to go away overnight. Therefore, cannabis operators and investors are wise to level-up their tax compliance capabilities.

In this article, MGO CPA, lists out the stages of an IRS audit and provides key things to think about.

There is a lot you can do before you get audited that will ease the process and help you arrive at a desirable conclusion. The good news is that “audit preparation” is really just implementing accounting and documentation best practices that will prove useful to the efficient administration of your business – even if you never get audited.

When you get the dreaded letter from the IRS the most important thing is not to panic! You’ll want to respond immediately and get your organization on track to meet the IRS’ requests.

Once the audit begins in earnest, be as responsive and collaborative as possible. Establishing rapport and demonstrating “good faith” intention are essential to securing an optimal conclusion to the audit.

As the audit proceeds your cannabis accountant and/or lawyer will have a good idea about the likely outcome. Stay in regular communication and be collaborative to ensure “good faith” consideration.

If the audit is completed and you feel the outcome is unmanageable or unfair, you may engage the appeals or tax court process.

In the end, both you and the IRS are seeking a quick end to the audit process. By being up-front and collaborative you can save yourself a lot of wasted time (read: fees, penalties, and interest) and heartache. Being adversarial or pursuing frivolous or unsubstantiated arguments will just make your path more difficult.

As the cannabis industry evolves, and compliance functions become more sophisticated, hopefully, the IRS’ assessments and interest will wane. But in the meantime, remember that the IRS can still audit 2019 tax returns for another year (or longer, under certain circumstances). There may be significant risk tied up in an audit of those prior years (especially if you recently acquired the business). We highly recommend working with a dedicated cannabis accountant to proactively implement best practices retroactively and going-forward that will help you avoid getting audited in the first place. But in the unfortunate event of an audit, those same efforts will be helpful in securing an optimal outcome.

To see a more detailed, step-by-step approach to navigating an audit, download the MGO Cannabis IRS Audit Survival Guide.

Nolan Shutler, JD, is a director in MGO’s tax group focusing on tax controversy representation and general state and local tax (SALT) consulting. He also has experience in indirect tax, tax planning, corporate tax compliance, and real estate transactions for public, private, and closely held businesses. Nolan has the ability to leverage tax and business management acumen to understand and forge paths to optimal outcomes.

Nolan Shutler, JD, is a director in MGO’s tax group focusing on tax controversy representation and general state and local tax (SALT) consulting. He also has experience in indirect tax, tax planning, corporate tax compliance, and real estate transactions for public, private, and closely held businesses. Nolan has the ability to leverage tax and business management acumen to understand and forge paths to optimal outcomes.

MGO has a dedicated cannabis accounting, audit, tax, and business advisory practice built to help cannabis operations survive and thrive in a competitive marketplace.

We help cannabis organizations of all sizes — from multi-state operators to pre-revenue startups — in every vertical and every market, establish optimal accounting processes, manage tax and regulatory compliance, perform audits to raise capital or engage in M&A, and everything else an operator needs to succeed.

The discussion about the future of cannabis legalization is ongoing, to say the least. Recently, Cannabis Regulators Association (CANNRA) held a two-day conference in early June to gather Marijuana government regulators, trade associations, and businesses. The Cannabis Regulators Association (CANNRA) is a national nonpartisan organization of government cannabis regulators that provides policymakers and regulatory agencies with the resources to make informed decisions when considering whether and how to legalize and regulate cannabis.

Representatives from NCIA participated in the conference – NCIA Board Members Khurshid Khoja (Chair Emeritus) and Michael Cooper (Board Secretary), and we caught up with them in this blog interview to better understand the goals and outcomes of the event.

MC: The conference was an opportunity for regulators from around the nation to hear directly from stakeholders on the current and future challenges that face these markets and different models of regulation to tackle them.

MC: The conference was an opportunity for regulators from around the nation to hear directly from stakeholders on the current and future challenges that face these markets and different models of regulation to tackle them.

KK: I’ll add that our own goals, as the current Policy Co-chairs for NCIA, were to better understand the priorities of state and local cannabis regulators across the country, and anticipate future developments in cannabis policy early on, so we could take that back to the NCIA membership and the staff – especially Michelle Rutter Friberg, Mike Correia, and Maddy Grant from our amazing government relations team.

KK: Michael and I each spoke on a panel. The other speakers included reps from federal trade associations, lobbyists, vendors, and ancillary companies who were helping to underwrite the event (along with NCIA). Given that CANNRA is a non-profit that doesn’t receive any funding from their member jurisdictions, and has a single paid full-time staff member, I thought they were still able to obtain a fairly diverse and interesting set of speakers at the end of the day – including NCIA Board and Committee alums Ean Seeb, Steve DeAngelo, Amber Senter and David Vaillencourt (representing the Colorado Governor’s Office, LPP, Supernova Women and ASTM, respectively), as well as folks from Code for America, Americans for Safe Access, and the Minority Cannabis Business Association, U.S. Pharmacopeia, NIDA, the CDC, and the Alcohol and Tobacco Tax and Trade Bureau, representatives of the pharmaceutical, hemp, tobacco and logistics industries, and public health officials.

MC: No licensed businesses were invited. Instead, organizations that represent industry members were invited. As a result, we felt it was crucial to inform these discussions with the perspective of the multitude of small and medium-sized businesses otherwise known as Main Street Cannabis that have built this industry and continue to serve as its engine.

KK: Sadly, we did not have an opportunity to hear from members of the Coalition of Cannabis Regulators of Color. I can’t speak to why that was, but it was unfortunate for us nonetheless. And while we had some public health officials there, I know that CANNRA Executive Director Dr. Schauer would have preferred to see more of them in attendance.

KK: We covered a ton, given the time we had, including the federal political and policy landscape; interstate commerce; the impact of taxes on the success of the regulated market; social equity and social justice; preventing youth access; regulation of novel, intoxicating and hemp-based cannabinoids; the prospects for uniform state regulations; technological solutions to improve compliance and regulatory oversight; and delivery models.

MC: There really are a wide variety of perspectives on how best to regulate this industry. We felt it was essential that NCIA give a voice to Main Street Cannabis, the small businesses that so many adult-use consumers and medical patients rely upon. We emphasized, for example, that these are often businesses that cannot simply operate in the red indefinitely, but provide essential diversity (in the background and life experience of operators as well as in product selection and choice). NCIA wants to make sure that the future of cannabis isn’t simply the McDonalds and Burger Kings of cannabis. There are times when consumers want that, but there are also times when they want something unique and different. And it’s crucial that policy not destroy the small and medium-sized, frequently social equity-owned, businesses that provide those choices.

MC: There are a ton of different perspectives and approaches to cannabis, and that’s no surprise to anyone who has followed these issues closely because the tensions are very clear in the policy debates that are ongoing.

As the voice for the industry, we sought to urge an approach grounded in reality. Americans want these products. That’s clear from the ballot box and public polling. The question should be about how to encourage Americans to purchase regulated, tested versions of these products.

KK: There was definitely stuff we didn’t agree with – some of it from folks that we otherwise largely agree with. For example, our good friend Steve Hawkins of the USCC shocked a few of us in the audience when he seemed to indicate some receptivity to re-scheduling cannabis on an interim basis, rather than moving to de-scheduling immediately. I think that while rescheduling may benefit scientific research and pharmaceutical development, it could ring the death knell for Main Street Cannabis businesses. NCIA has consistently advocated for de-scheduling rather than re-scheduling.

KK: I think there’s a growing recognition that addressing social equity solely through preferential licensing and business ownership for the few isn’t enough and that the licensing agencies and regulators that execute social equity policies have a very limited (and often underfunded) arsenal to comprehensively redress the harm caused by federal, state and local governments prosecuting the war on drugs. In my remarks, I said it was time for us to start discussing additional forms of targeted reparation and had a number of regulators approach me afterward to continue the discussion. Candidly, I expected my remarks to fall on deaf ears. They didn’t. That was very encouraging.

MC: There was definite progress. At the end of the day, these cannabis regulators are working hard to try to get this right. But in such a new area, and with so many competing perspectives and voices, their job isn’t easy. We were heartened to see the level of engagement from regulators on these points, including follow-ups to get more information on some of the pain points we identified for small and equity businesses in the industry.

It was definitely rewarding to provide NCIA and our members’ perspectives in a forum like this, and we’re looking forward to continuing to further strengthen NCIA’s relationship with CANNRA and regulators around the country.

by Aaron Smith, NCIA’s CEO and Co-founder

by Aaron Smith, NCIA’s CEO and Co-founder

History was made today as Senate Majority Leader Chuck Schumer (D-NY) along with Senators Ron Wyden (D-OR) and Cory Booker (D-NJ) introduced the Cannabis Administration and Opportunity Act which would finally remove cannabis from the federal Controlled Substances Act and begin the process of federal regulation.

For the last year, NCIA has been working behind the scenes to ensure this landmark legislation not only ends prohibition but also creates an environment where small and medium-sized businesses can thrive under national legalization. These businesses – who we now call “Main Street Cannabis” – are the heart of our industry and we’re proud to have been giving them a seat at the table in our nation’s halls of power for over 12 years.

We will continue working with our allies in the Senate to advance this bill and advocate for some necessary amendments to better ensure that small, equity, and women-owned businesses (in particular) are well-positioned to thrive after the end of federal prohibition.

We would not be where we are today if not for your support which has allowed us to effectively represent the interests of small businesses like yours in the halls of Congress and in the court of national public opinion.

I hope you’ll join us in making national legalization a reality by making your voice heard at our upcoming 10th Annual Cannabis Industry Lobby Days in Washington, D.C. September 13 & 14!

Thanks to your membership, NCIA’s government relations staff represents Main Street Cannabis in D.C. every day but Lobby Days is your chance to show up and tell your unique story to our nation’s lawmakers, firsthand.

Lobby Days is also the best opportunity to connect with your fellow industry leaders who are truly invested in the future of cannabis and sensible national policy. Please register today so you don’t miss out on making history with us! Reach out to my colleague Madeline Grant to learn more about how you can be as impactful as possible at this year’s Lobby Days.

Thanks, as always, to all NCIA members for their support of the cannabis industry. If your company is not yet a member of NCIA, now’s the time to join and have your voice heard in the halls of Congress.

Watch this video update with Aaron Smith and Michelle Rutter Friberg:

By Sadaf Naushad, NCIA Intern

By Sadaf Naushad, NCIA Intern

As the cannabis industry progresses nationwide, the public demands Congress to pass major cannabis reforms. After months of opposition met among Congress members, a breath of fresh air awaits cannabis advocates, lobbyists, and consumers.

Last Thursday, two crucial congressmen revealed objectives to establish an extensive package of incremental cannabis proposals.

While Senate Majority Leader Chuck Schumer (D-NY) expects to file the final version of the Cannabis Administration and Opportunity Act (CAOA) sometime this summer, lawmakers are using the draft language as a guide to propose an alternative backup bill in creating a cannabis “omnibus” package.

With the wide-ranging package garnering support across Democratic and Republican lawmakers, industry insiders have high hopes that both chambers could come together to endorse an effective, bipartisan bill by the end of this year.

Recently, a number of Congress members have discussed the possibility of creating a new cannabis bill that would comprise several incremental measures, including provisions focusing on banking, access to medical cannabis for veterans, research expansion, access to SBA programs, drug sentencing reformations, and more.

Lead sponsor of the Secure and Fair Enforcement (SAFE) Banking Act, Rep. Ed Perlmutter (D-CO) is hoping to incorporate protection for financial institutions operating with state-legal cannabis businesses in a potential package. According to Rep. Perlmutter, members also have interest in including Rep. Dave Joyce’s (R-OH) Harnessing Opportunities by Pursuing Expungement (HOPE) Act, a bill designed to expunge prior marijuana convictions. Additionally, lawmakers are deliberating over granting cannabis businesses access to SBA loans and services that are obtainable to every other industry, a reform initially advocated by Sen. Jacky Rosen (D-NV).

These four concerns –- veterans, research, expungements, and banking – constitute a small portion of the package’s considerations.

Congress will also potentially consider including a non-cannabis item as part of the wider deal, known as the EQUAL Act, which looks to alleviate racial disparities within the criminal justice system by eliminating the federal sentencing disparity between crack and powder cocaine.

Leader Schumer, however, faces the requirement of having a 60-vote threshold to pass legislation. Although the chamber comprises a slim majority of Democrats with the vast majority of GOP members opposing numerous past bills, the 60-vote requirement may be attainable. In contrast to Schumer’s CAOA, indications are that the incremental package has more broad bipartisan support.

Though members have not reached an official deal as these major reforms remain under deliberation, Congress members are not abandoning their efforts to push for a broader-based CAOA bill.

Currently in the bicameral conference committee remains the large-scale manufacturing bill, known as the America COMPETES Act. Leader Schumer has rejected attempts to integrate the SAFE Banking Act as currently written into the COMPETES Act, alleging that it may weaken the ability to approve a slightly larger cannabis reform package. Having passed the House six times, industry insiders feel certain that the Senate will authorize the SAFE Banking Act later this year.

Altogether, the above-mentioned legislation would come up short in federally descheduling cannabis; however, these provisions may acquire the support necessary to reach U.S. President Biden’s desk.

by Jennifer Spanos, CannaBusiness ERP

As we approach the end of Q1 2022 and prepare to enter Q2, it’s become clear that this is going to be an important year for the cannabis industry. Cannabis business professionals and investors looking for signs of growth or stagnation in the industry will certainly be interested to see how things unfold. With that in mind, CannaBusiness ERP has put together a list of the top cannabis trends for 2022, and those trends appear to be pointing to more growth. However, it’s clear that difficulties for the cannabis sector are still imminent.

It almost goes without saying that the cannabis industry is complex and not without its fair share of challenges as the most highly regulated industry on the market. For businesses looking to grow, keeping up with complicated and evolving regulations can be stressful enough on a business in and of itself. Cannabis cultivators, processors, and consultants can look to cannabis industry trends to inform their operational decisions.

Support for legalization in the USA continues to rise. In fact, a 2021 Gallup poll found that 68% of Americans are in favor of legalizing cannabis. Not only is this a record number of supporters, but this percentage also reflects a growing sentiment among Americans regarding the use of legal cannabis.

The changing tide towards legalization is clear – more states passed legislation to legalize cannabis either medicinally or recreationally in 2021, with several more introducing legalization bills in 2022. Because states operate independently of each other, every state will have its own policies as well as regulatory and compliance requirements, which can make things very confusing for cannabis businesses, especially multi-state operators (MSOs).

The National Cannabis Industry Association (NCIA) provides a map with state-by-state policies, which is one helpful tool for businesses looking to capitalize on expansion opportunities made possible as more states legalize cannabis. CannaBusiness ERP’s Guide to Expanding Into New Markets is another great resource for MSOs that provides state-by-state information, including Nevada, New York and Pennsylvania, and useful advice to consider when expanding into new cannabis markets.

Leading cannabis business experts are predicting strong sales growth this year due to the growth in legalized markets for cannabis. In fact, legal cannabis sales reached $19.5 billion in 2020, and experts are projecting sales to reach $30 billion in 2022. Washington State alone, which legalized cannabis ten years ago in 2012, is expected to generate $1.5 billion in sales, up from $1.2 billion sales in 2020. But Washington’s projected sales are small when you compare them to California’s projected sales of $7.6 billion. And as more states legalize cannabis, more sales will surely follow.

Another contributing factor to increased cannabis sales is related to increased demand and a growing number of product types. More consumers are learning why cannabis can be beneficial to them, including more restful sleep, lowering stress, lessening pain symptoms, and recreational use. Additionally, with so many products on the market, cannabis consumers have many options to choose from, ranging from edibles to tinctures to topical ointments and more.

Cannabis experts are predicting a growth in cannabis consumption lounges – the cannabis equivalent of a bar or restaurant that allows consumers to use cannabis on-site. According to the Cannabis Industry Journal, the popularity of these lounges is growing because they provide consumers with a legal and safe space to consume cannabis. Just as with alcohol, the lounges are regulated according to laws set by each state.

Increasing sales means cannabis businesses are at a critical junction and need to scale operations to meet the growing demand. One way cannabis growers and processors can capitalize on the demand is by streamlining the business end-to-end with cloud-based cannabis business management software. Otherwise known as Cannabis Cloud ERP, it manages production, cultivation, compliance, inventory, financials and traceability, sales, purchasing, and more, all in one system that lives in the Cloud.

Under U.S. Federal Law in the Controlled Substances Act, cannabis is still considered a Schedule I substance. However, as the number of states legalizing cannabis either recreationally, medicinally or both has increased, so too has broader support for federalization in the U.S. government. In fact, there are several bills in the U.S. congressional houses that may positively impact the cannabis industry, especially with banking challenges.

Due to the Schedule I federal classification of cannabis, many banks will not work with cannabis companies, creating tedious banking hurdles that are difficult to solve. The National Law Review writes, “Yet, in comparison to other industries, legitimate licensed cannabis-related businesses remain hobbled by the difficulties they face in accessing traditional banking and financial services – largely due to the fact that ‘marijuana’ is still considered illegal on the federal level under the Controlled Substances Act (“CSA”). Currently, financial institutions (including federally insured banks) are hesitant, and oftentimes unwilling, to work with cannabis-related businesses due to fear of reprisal from federal banking regulators.”

Congressional representatives have introduced a decent amount of bills geared towards making much-needed changes to banking processes for cannabis, such as the SAFE Banking Act of 2021, passed by the U.S. House of Representatives in April 2021. It is currently awaiting action in the U.S. Senate with broad support from both sides of the aisle. If it passes both chambers of Congress, the act will allow cannabis companies to have business-critical access to banking and financial services and would reduce their need to operate as cash-only businesses and remove yearly challenges with tax accounting and reconciliation.

In addition to the SAFE Banking Act, there are other bills like U.S. Senate Majority Leader Chuck Schumer’s Cannabis Administration and Opportunity Act (CAOA), which is a push for federal cannabis legalization as well as an equity play. If passed, it is a measure towards ensuring small businesses and minority-owned businesses have access to financial services.

However, even with the tide of public opinion and legal momentum shifting in the industry’s favor, there remains a challenge with the U.S. tax code. Due to IRS Code Section 280E, if a business is trafficking certain controlled substances, like cannabis, that business is unable to deduct business expenses on their taxes. California has taken steps to address this by signing bills that help cannabis businesses overcome this code, but this is still a prohibitive factor for cannabis companies across the U.S.

Fortunately, cannabis companies that invest in a comprehensive Cannabis Cloud ERP solution with a reputable and experienced industry partner are better able to handle any hurdles that come their way.

Merger and Acquisition (M&A) activity has been steady in the industry and 2022 will see even more M&A activity. According to MJBizDaily’s article, “Marijuana M&A sizzled in 2021 and is poised for a hot 2022. Marijuana merger and acquisition activity proceeded at a torrid pace in 2021 – and could accelerate in 2022 – thanks to lower interest costs and pressure on larger companies to expand their footprints and boost revenue.”

Citing prominent cannabis acquisitions in 2021, such as Jazz Pharmaceuticals’ acquisition of GW Pharma (for $7.2 billion) and Trulieve’s acquisition of Harvest Health (for $2.1 billion), it is apparent that M&A is not going to slow down. According to Business of Cannabis, several deals are already taking place in 2022. Massachusetts-based Curaleaf acquired Arizona-based Bloom Dispensaries for $211 million, adding a total of 13 Arizona dispensaries and 121 dispensaries nationwide to Curaleaf’s portfolio.

For cannabis companies dealing in M&As and becoming Multi-state Operators (MSOs), it is essential to have a comprehensive, full-suite Cannabis Cloud ERP system that can run all the companies in one system. It is a crucial ingredient to manage their M&A transactions and handle their financial statements, compliance, business transactions, and more.

Most important of all, cannabis companies need to choose the right cannabis ERP.

Jennifer Spanos is the VP of Product and Vertical Strategy at CannaBusiness ERP. She has 14+ years of experience in cannabis and food manufacturing software and operations, working to maximize the efficiency and profitability of customers’ businesses.

Jennifer Spanos is the VP of Product and Vertical Strategy at CannaBusiness ERP. She has 14+ years of experience in cannabis and food manufacturing software and operations, working to maximize the efficiency and profitability of customers’ businesses.

CannaBusiness ERP: The Right Cannabis Business Management Software. Cannabis companies can grow their business with an ERP solution designed for the cannabis industry and for MSOs expanding into new markets. Learn how CannaBusiness ERP can set businesses on the right path. Manage financials, operations, quality, compliance, traceability, customers and more.

CannaBusiness ERP is cannabis business management software that is built-in Sage X3 and configured by NexTec industry experts to deliver a complete cannabis business solution. Our specialization in developing solutions for the cannabis cultivation and processing industry has resulted in some of the most respected companies around the world managing their day-to-day operation using CannaBusiness ERP.

To learn more about the fast-paced movement in cannabis legalization and how Cannabis Cloud ERP software can help your company keep pace, reach out to us. We’d love to show you what CannaBusiness ERP can do for your business.

by Madeline Grant, NCIA’s Government Relations Manager

by Madeline Grant, NCIA’s Government Relations Manager

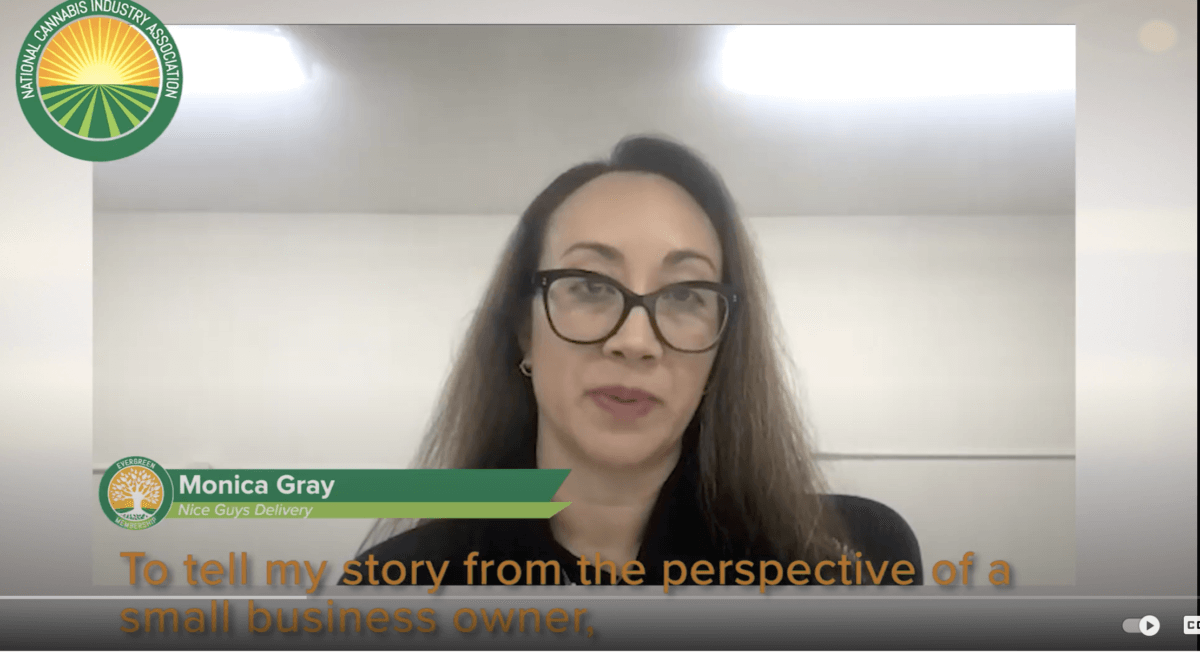

The National Cannabis Industry Association (NCIA) held its very first Virtual Mini Lobby Days with NCIA’s Evergreen Roundtable members. Before the pandemic and closure of our Nation’s Capital, the Government Relations team planned an in-person annual fly-in every spring, the Annual Cannabis Industry Lobby Days, for all NCIA members. For our first Virtual Mini Lobby Days, it was important to facilitate conversations between our Roundtable and Capitol Hill offices. The Evergreen membership tier is for leading businesses looking to make a meaningful investment in shaping policy for the cannabis industry. Evergreen members receive exclusive access to private briefings from members of Congress, inside information from NCIA’s government relations team, and many more opportunities to participate in the national conversation around cannabis policy.

The NCIA team, Monica Gray with Nice Guys Delivery, Khurshid Khoja with Greenbridge Corporate Counsel, and Christina Hollenback with The People’s Ecosystem meeting with Congressman Dave Joyce (OH-14), a co-chair of the Congressional Cannabis Caucus.

As we hopped on our zoom calls, our main focus was education. The Evergreen Roundtable was able to share stories from their personal experiences in the cannabis industry and directly relate these experiences to the importance of cannabis policy reform. The dichotomy around incremental versus comprehensive cannabis policy reform was a central focus in discussion. As around thirty meetings took place throughout the week, the Government Relations team and Evergreen Roundtable caught up with friends, gained valuable insight, and continued to educate Congress. We took this opportunity to show our support and gratitude for all the representatives and senators who constantly support cannabis policy reform. Furthermore, we educated congressional offices with data, testimonials, and research to highlight the necessity for cannabis policy reform at the federal level. There is no doubt that reform is needed for the cannabis community and NCIA will continue to be a resource to all congressional offices.

NCIA’s 9th Annual Cannabis Industry Lobby Days in 2019 May 21-23 2019.

As we monitor the full opening of Capitol Hill, stay tuned for updates regarding NCIA Lobby Days. The Government Relations team is looking forward to our next Mini Lobby Days later this year for all Evergreen members. If you’re interested in learning more or getting involved in our policy work please feel free to reach out to Madeline@TheCannabisIndustry.org.

NCIA’s Evergreen membership is for leading businesses looking to make a meaningful investment in shaping policy for the cannabis industry. This premium membership plan provides your company with a seat on NCIA’s Evergreen Member Roundtable, with exclusive access to private briefings from members of Congress, access to NCIA’s lobbying team, invitations to political events, special membership concierge service, and more.

by Kaveh Newmen of Edlin Gallagher Huie + Blum

The cannabis industry has grown exponentially as an increasing number of states have relaxed state law prohibitions on the use of cannabis for medical and recreational purposes. However, under federal law, cannabis remains classified as a Schedule I controlled substance under the Controlled Substances Act (CSA). This means that the production, distribution, and possession of cannabis remains illegal on the federal level.

Cannabis businesses are treated differently from many other businesses for tax purposes. Under Internal Revenue Code (IRC) §280E (“280E”), which applies to a federal income tax filing, denies deductions and credits for amounts paid or incurred in carrying on the trade or business of cannabis. Cost of goods sold is allowable because it is not considered a deduction, rather it is a reduction of gross receipts (revenue) to arrive at gross profit.

A report published in March 2020 by the U.S. Treasury Inspector General for Tax Administration examined California and found that over 50% of marijuana companies had likely underpaid the IRS under IRC§ 280E. The report confirms the IRS is preparing to increase marijuana industry audits nationwide in response.

Currently, the method by which cost of goods sold may be deducted for producers is to use IRC §471(a). This provision discusses how to clearly reflect income by using an inventory method. Therefore, cannabis producers have less of a 280E problem than retailers and distributors.

After the passage of the Tax Cuts and Jobs Act (TCJA), effective for tax years beginning January 1, 2018, a provision was passed in the IRC §471(c). There are various opinions with advisors in the industry on whether this code section and method can be used for retailers and distributors. The idea behind IRC 471(c) is that “certain small businesses” can meet the gross receipts test of this subsection for any taxable year in which the corporation’s or partnership’s average annual gross receipts do not exceed $25,000,000 for the 3-taxable-year period ending with the taxable year that precedes such taxable year. Pursuant to IRC §448(c)(1), this type of small business may be able to use a “books and records” method for deducting all costs – rather than being limited to cost of goods sold only. In other words, if one uses 471(c)(1)(B) as an accounting method, in theory, they may also be able to deduct selling expenses and all other costs that were previously not allowed as deductions.

For further discussion on this topic see the following articles: Bloomberg Tax – Cannabis Taxpayers Find Flaws in New Accounting Method Rules and The Tax Cuts and Jobs Act: A Comparison for Businesses

Each state in the U.S. is autonomous in that it has the authority to decide whether its income tax laws conform to §280E or not. On October 12, 2019, Governor Newsom signed into law AB 37, which overrides §280E through the following provision:

For each taxable year beginning on or after January 1, 2020, and before January 1, 2025, Section 280E of the Internal Revenue Code, relating to expenditures in connection with the illegal sale of drugs, shall not apply to the carrying on of any trade or business that is commercial cannabis activity by a licensee. – (CAL. REV. & TAX CODE § 17209 (2020). CAL. REV. & TAX CODE § 17209 (2020).

However, AB 37 only applies to state filings with the Franchise Tax Board and is currently only available until January 1, 2025. AB 37 has no impact on federal tax filings, which is where a majority of cannabis entities pay their income taxes with effective tax rates as high as 25% for corporate taxes and up to 37% for individuals.

The IRS has not published nationwide guidance to taxpayers and tax professionals in the cannabis industry. In addition, cash-intensive business issues unique to the cannabis industry such as IRS §280E and banking limitations will remain unresolved unless and until there is uniformity through federal legalization. As a result, compliance-related issues continue to grow and negatively affect cannabis business owners who operate legally under individual state law.

Kaveh Newmen is an associate at Edlin Gallagher Huie + Blum who handles cannabis law general litigation, and trucking and transportation matters. Kaveh was admitted to practice law by the State Bar of California in 2021. Kaveh earned his J.D. from the University of San Diego School of Law in 2020, where he was a board member of the Criminal Law Society, the Immigration Law Society, the Middle Eastern Law Student Association, and served as an intern at the school’s Immigration Clinic. He is a first-generation Iranian-American and speaks Farsi.

Kaveh Newmen is an associate at Edlin Gallagher Huie + Blum who handles cannabis law general litigation, and trucking and transportation matters. Kaveh was admitted to practice law by the State Bar of California in 2021. Kaveh earned his J.D. from the University of San Diego School of Law in 2020, where he was a board member of the Criminal Law Society, the Immigration Law Society, the Middle Eastern Law Student Association, and served as an intern at the school’s Immigration Clinic. He is a first-generation Iranian-American and speaks Farsi.

By Michelle Rutter Friberg, NCIA’s Deputy Director of Government Relations

Recent polling from Gallup showed that an astonishing 68% of Americans believe that cannabis should be legal. And while support spans age groups and party lines, cannabis is usually thought of as an issue Democrats champion – but one woman is looking to change that.

This week, freshman GOP Congresswoman Nancy Mace (SC) officially threw her hat in the cannabis reform ring with the introduction of the States Reform Act. Notably, this is the second comprehensive cannabis bill introduced by a Republican member of Congress (the other was sponsored by Rep. Dave Joyce, one of the co-chairs of the Cannabis Caucus).

NCIA applauds Rep. Mace for introducing this new and carefully thought out piece of legislation. There are many provisions in the bill that we support: low tax rates and barriers to entry, allowing states to lead – but also many areas with room for improvement like those pertaining to criminal justice and trade. NCIA will continue to work with Rep. Mace’s office to improve this bill and attempt to find common ground across political parties in order to advance cannabis policy reforms.

NCIA chief economist and his cannabis economics firm, Whitney Economics, are collaborating with NCIA to conduct a national survey of businesses and stakeholders in the U.S. cannabis industry. Below, please find a link to the Survey of U.S. Cannabis Industry Sentiment and Business Conditions. It examines the key issues facing the industry including what you are experiencing when doing business in the industry. The survey seeks to investigate what is working and what can be improved from the perspective of businesses and stakeholders in the cannabis industry.

The goal of the survey is to tabulate ancillary business and cannabis operator opinions on the state of the U.S. cannabis market. Responses are confidential and will be kept anonymous.

Your participation and insights will help policymakers understand the issues that face the industry from your perspective. The survey takes between 4–5 minutes to complete. Please complete the survey by Sunday, October 31.

The initial analysis will be made available to all participants later this fall.

If you have any questions regarding the survey, please contact Beau Whitney from Whitney Economics at Beau@whitneyeconomics.com

Thank you for supporting this survey.

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every Friday here on Facebook for NCIA Today Live.

New Jersey recently passed the Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization Act (“CREAMMA”). Among other things, CREAMMA permits adults 21 years and older to consume cannabis and allows New Jersey residents to operate six types of cannabis businesses within the state. The new adult-use marketplace, as well as the already established medicinal marketplace, will be administered by the Cannabis Regulatory Commission (“the CRC”). The CRC is a panel of five appointed members who will oversee the development, regulation, and enforcement of the use and sale of all legal cannabis in New Jersey.

The CRC recently approved its first set of rules and regulations on August 19, 2021. This will enable the start of the licensing process for personal adult-use cannabis operations in New Jersey. Here are the 15 takeaways from the initial rules and regulations:

There are six different license types:

Businesses may also apply for a license to operate a cannabis testing facility or medical cannabis testing laboratory. License-holders may hold multiple licenses concurrently; however, there are limitations on the number and type of licenses that may be held concurrently.

The State only placed a cap on Class 1 licenses for cultivators. In particular, there will be a statewide cap of a total of 37 cultivators until February 22, 2023. Keep in mind that state limits aren’t the end of the inquiry; municipalities may set restrictions on the number of businesses in their jurisdiction.

In an effort to make the application fee reasonable, the CRC will require applicants to only pay 20% of the application fee at the time of application, and the remaining 80% will only be collected at the time the license is approved. The initial application cost may be as low as $100 but successful applicants should be prepared to pay additional fees ranging from a total cost of $500 – $2,000.

Yes. There are annual licensing fees, which can range from $1,000 for a microbusiness to $50,000 for a cultivator, with up to 150,000 square feet of cultivation capacity. This fee range only applies to the adult use marketplace. There is a different licensing fee schedule for the medicinal use marketplace.

Yes. The CRC will prioritize applicants who live in specifically defined economically disadvantaged areas of New Jersey or who have past convictions for cannabis offenses (“Social Equity Applicants”). It will also prioritize applications from minority-owned, woman-owned, or disabled veteran-owned businesses that are certified by the New Jersey Department of the Treasury (“Diversely Owned Businesses”). Businesses in impact zones will also take priority (“Impact Zone Businesses”).

Applicants meeting the criteria described above will have their applications reviewed before other applications, regardless of when they apply. Remember, however, that priority review doesn’t guarantee selection.

No date has been announced, but the CRC promises that it will be soon . The CRC will publish notice in the New Jersey Register announcing its intent to review applications and submissions will be reviewed, scored, and approved on a rolling basis (pun intended), subject to the required priority review for certain applicants.

Applicants will be expected to submit a detailed application that includes specific details for the proposed site for the business (which must be owned or leased), municipal approval, and zoning approval. Applicants must also submit an operating summary plan detailing the applicants’ experience, history, and knowledge of operating a cannabis business. The scoring of applicants and awarding of licenses will be based entirely on the application materials.

Don’t worry, you can apply for a “Conditional License.” A Conditional License is a provisional award that gives the holder 120 days to become fully licensed by satisfying all the requirements for full licensure, including finding an appropriate site, securing municipal approval and applying for conversion to an annual license.

Conditional License applicants must submit a separate application for each cannabis business license requested, along with a background disclosure, a business plan and a regulatory compliance plan to the CRC. At the time of the application, all owners with decision-making authority of the conditional license applicant will need to prove that they made less than $200,000 in the preceding tax year, or $400,000 if filing jointly.

Conditional License holders that convert to an annual license will not have to submit the sections of the application that, under statute, require applicants to demonstrate experience in a regulated cannabis industry. This flexible option offers an opportunity for newcomers to get into the cannabis industry.

Microbusiness licenses are for applicants who want to run a relatively small operation. Applicants may apply for a microbusiness license for any of the six license types. A microbusiness license limits the business to 10 employees; a facility of no more than 2,500 square feet; possession of no more than 1,000 plants per month; and/or a limit of 1,000 pounds of usable cannabis per month.

No. The state must award the cannabis license. Municipalities play a critical role, however, in the licensing process. For example, applicants will only be licensed by the CRC if the applicant has demonstrated support from the municipality, zoning approval, and has been verified to operate in compliance with any other local licensing requirement.

Yes. Municipalities may ban certain businesses from operating within their borders if they enact an ordinance regulating or banning cannabis businesses by August 21, 2021. Municipalities may update their ordinances at any time to remove any restrictions that they previously placed.

The CRC is authorized to inspect cannabis businesses and testing laboratories, issue notices of violations for infractions and issue fines. Standard fines can be no higher than $50,000, while fines for infractions implicating issues of public safety or betrayal of public trust can be as high as $500,000. Licenses may also be suspended or revoked. Don’t take the risk!

These 15 key points present only a quick summary of the CRC’s initial set of rules and regulations. We anticipate there will be a second set of rules released later this year, which will likely resolve issues that weren’t addressed in the initial set of rules and regulations, or CREAMMA. We expect the second set of rules and regulations to focus mainly on the needs of distribution and delivery service, and preparing for the acceptance of applications, before the Garden State is in full bloom…

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Charles J. Messina is a Partner at Genova Burns LLC and Co-Chairs the Franchise & Distribution, Agriculture and Cannabis Industry Groups. He teaches one of the region’s first cannabis law school courses and devotes much of his practice to advising canna-businesses as well as litigating various types of matters including complex contract and commercial disputes, insurance and employment defense matters, trademark and franchise issues and professional liability, TCPA and shareholder derivative actions.

Jennifer Roselle is a Partner at Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Jennifer Roselle is a Partner at Genova Burns LLC and Co-Chair of Genova Burns’ Cannabis Practice Group. She has unique experience with labor compliance planning and labor peace agreements in the cannabis marketplace. In addition to her work in the cannabis industry, Jennifer devotes much of her practice to traditional labor matters, human resources compliance and employer counseling.

Daniel Pierre is an Associate at Genova Burns and a member of the Cannabis and Labor Law Practice Groups. In addition to labor work, he likewise assists clients in the cannabis industry, from analyzing federal and state laws to ensure regulatory compliance for existing businesses to counseling entrepreneurs on licensing issues.

Daniel Pierre is an Associate at Genova Burns and a member of the Cannabis and Labor Law Practice Groups. In addition to labor work, he likewise assists clients in the cannabis industry, from analyzing federal and state laws to ensure regulatory compliance for existing businesses to counseling entrepreneurs on licensing issues.

For over 30 years, Genova Burns has partnered with companies, businesses, trade associations, and government entities, from around the globe, on matters in New Jersey and the greater northeast corridor between New York City and Washington, D.C. We distinguish ourselves with unparalleled responsiveness and provide an array of exceptional legal services across multiple practice areas with the quality expected of big law, but absent the big law economics by embracing technology and offering out of the box problem-solving advice and pragmatic solutions.

Given Genova Burns’ significant experience representing clients in the cannabis, hemp and CBD industries from the earliest stages of development in the region, the firm is uniquely qualified to advise investors, cultivators, processors, distributors, retailers and ancillary businesses.

by Claudia Della Mora, Black Legend Capital

While marijuana has been around in Mexico since the 1600s, the real story begins in the 20th century during the Prohibitionist Era. After Mexico news outlets widely reported stories of cannabis users committing violent crimes, a cannabis stigma was created, resulting in Mexico banning the production, sale, and use of cannabis in 1920, followed by a ban of exports in 1927. The movement of cannabis was first regulated by the three U.N. conventions on narcotic drugs, beginning with the Single Convention on Drugs in 1961. The prohibition gave rise to the cartel’s involvement in the illegal cannabis industry in the ’80s, and these cartels have consistently supplied the U.S. market since. After the war on drugs significantly increased violence in Mexico and gave the cartels more power than before, Mexico began to alter its stance. In 2015, the country decriminalized cannabis use, and in 2017, legalized medical cannabis containing less than 1% THC. In 2018, the Mexican Supreme Court deemed the prohibition unconstitutional, and in December 2020, the U.N. Commission on Narcotic Drugs transferred cannabis from a Schedule 4 to a Schedule 1 drug under the Single Convention. As of now, Mexico is on the edge of legalizing recreational cannabis use. This bill, “The New Federal Law on the Regulation of Cannabis,” is awaiting approval by the Senate and then only needs to be signed by the President to be passed into law.

With a population of 130 million and over 10 million regular cannabis users, Mexico will generate $1.2 billion in annual tax revenues while saving $200 million annually in law enforcement and creating thousands of new jobs. One estimate has cannabis legalization bringing up to $5 billion to the economy annually. One issue Mexico will face will be keeping the cartels from transitioning to the legal cannabis market. While those with criminal records can’t obtain any cannabis license, cartels have a deep network, and Mexican officials can’t always determine whether someone is connected to a cartel. Mexico’s legislators believe the cartel will be forced to operate legally over time as they won’t be able to compete in the illegal market and keep as much power as they currently have.

There are also many questions regarding how Mexico’s cannabis legalization will affect the U.S. market. The USMCA, formerly known as NAFTA, currently does not include cannabis, raising the question of whether Mexican producers will be able to import cannabis into the U.S. for a much lower price than the U.S. can produce domestically. However, the U.S. will likely implement trade barriers to protect domestic companies. Currently, the U.S. places trade barriers on tomatoes in Mexico, and many see similar actions being placed on cannabis.

There’s no doubt that cannabis legalization in Mexico will create investment opportunities in the U.S. It mostly comes down to whether the U.S. creates trade barriers with Mexico regarding cannabis. If they don’t, the U.S. cultivation and manufacturing sectors will be hurt badly as Mexico can produce much cheaper. The absence of trade barriers will also hurt testing labs as cultivation moves out of the country and uses testing labs in that same country. However, U.S. companies with distribution networks, retail operations, or strong brands will benefit from Mexican legalization through lower costs of goods sold. One solution that would benefit U.S. companies would be legalizing interstate commerce in the U.S. without federally legalizing cannabis. This means other countries wouldn’t export finished products or raw material with THC above 0.3% into the U.S., and the U.S. industry would develop and consolidate. Once the U.S. federally legalizes cannabis, they must create tariffs or some trade barriers against all the developing countries legalizing cannabis, or the U.S. companies will suffer.

Companies are also greatly affected by banking laws. Currently, companies touching the flower in countries where it is not federally legal cannot access regular banking and can’t list publicly on the NASDAQ or NYSE. However, Canadian companies touching the flower can list in the U.S. since it is federally legal in Canada. These laws mean companies operating in Mexico will also be able to list in the U.S publicly. However, the SAFE Banking Act recently passed the House of Representatives in April 2021 and is up for debate in the Senate. Passage of this act would grant banking access to cannabis companies touching the flower and open the door for these companies to list in the U.S publicly. This would create a large flow of money into U.S. cannabis companies and allow them to scale at a much quicker pace than previously available. One important thing to note is that the large U.S. stock exchanges are technically able to accept cannabis companies’ listings if they meet the exchange requirements. However, they don’t accept them to avoid punishment from the federal government. Therefore, as the government moves towards allowing these companies federal banking access, the main question regarding U.S. companies is raised. In absence of government pressure, will these exchanges allow U.S. companies to list and access their own public markets?

Overall, companies and investors looking to take advantage of the booming cannabis market need to stay up to date on the fast-changing cannabis legalization process in many countries. Those that truly understand it will position themselves to benefit from what is projected to be one of the fastest-growing industries over the next decade.

Ms. Della Mora is the Co-founder of BLC, a financial advisory and investment firm based in Los Angeles with satellite offices in Houston, New York, London, Hong Kong, and Melbourne. During her tenure at BLC, she successfully invested, assisted in the capitalization, and helped business develop small cap oil companies in Kentucky, Texas, Louisiana, Illinois, Colorado, California, Wyoming, North Dakota, and Alaska. She has also structured oil & gas partnerships in several U.S. states, and in Ecuador, Central America. Ms. Della Mora has been involved in many LNG (Liquid to Natural Gas) projects in the U.S., as well as many commodity trades worldwide. She has personally advised also Chinese conglomerates in their U.S. oil & gas investments.

Ms. Della Mora is the Co-founder of BLC, a financial advisory and investment firm based in Los Angeles with satellite offices in Houston, New York, London, Hong Kong, and Melbourne. During her tenure at BLC, she successfully invested, assisted in the capitalization, and helped business develop small cap oil companies in Kentucky, Texas, Louisiana, Illinois, Colorado, California, Wyoming, North Dakota, and Alaska. She has also structured oil & gas partnerships in several U.S. states, and in Ecuador, Central America. Ms. Della Mora has been involved in many LNG (Liquid to Natural Gas) projects in the U.S., as well as many commodity trades worldwide. She has personally advised also Chinese conglomerates in their U.S. oil & gas investments.

Black Legend Capital is a leading Merger & Acquisition boutique advisory firm based in California with offices worldwide. Black Legend Capital was founded in 2011 by former senior investment bankers from Merrill Lynch and Duff & Phelps. We provide M&A advisory services, structured financing, and valuation services primarily in the cannabis, technology, healthcare, and consumer products industries. Black Legend Capital’s partners have extensive advisory experience in structuring deals across Asia-Pacific, Europe, and North America.

By Michelle Rutter Friberg, NCIA’s Deputy Director of Government Relations

Last week was undoubtedly one of the most exciting weeks in federal cannabis policy ever! On July 14, Senate Majority Leader Chuck Schumer (D-NY), along with Sen. Cory Booker (D-NJ) and Senate Finance Committee Chair Ron Wyden (D-OR), unveiled long-awaited draft legislation that would remove cannabis from the schedule of controlled substances while allowing states to determine their own cannabis policies. Let’s take a look at what we know:

You’ll recall that back in February, the trio of Senators announced that they were working on a comprehensive cannabis bill. Since then, NCIA and other advocates have (im)patiently been waiting to see what shape that would take – I was calling it the best-kept secret in Washington! However, at long last, the discussion draft of the Cannabis Administration and Opportunity Act (CAOA) was released.

A discussion draft is exactly what it sounds like – prior to introducing this language as formal legislation, the Senators have shared it in this form, allowing stakeholders, the public, and others the opportunity to weigh in and provide their expertise and feedback.

As I mentioned above, the CAOA removes cannabis from the list of controlled substances, effectively legalizing it at the federal level while still allowing states to set their own policies. According to the bill’s detailed summary, it has a few goals:

“… [it will] Ensure that Americans – especially Black and Brown Americans – no longer have to fear arrest or be barred from public housing or federal financial aid for higher education for using cannabis in states where it’s legal. State-compliant cannabis businesses will finally be treated like other businesses and allowed access to essential financial services, like bank accounts and loans. Medical research will no longer be stifled.”

The bill also includes:

The discussion draft comment and feedback process will be ongoing until September 1. Until then, NCIA will be working with our board, Policy Council, committees, and our members (particularly our Evergreen members!) to solicit their expert input on some of the areas the Senators have expressed interest in. After that deadline, the Senators will take their time to review submissions and subsequently formally introduce the revised language later this year. Stay tuned via our newsletter, blog, and upcoming events to learn the latest on this and how you can actually submit your thoughts to us!

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every Friday on Facebook for NCIA Today Live.

Registration to our Midwest Cannabis Business Conference in Detroit is now open with special limited-time super early bird pricing on tickets available, head to www.MidwestCannabisBusinessConference.com today!

by Beau R Whitney, NCIA’s Chief Economist

by Beau R Whitney, NCIA’s Chief Economist

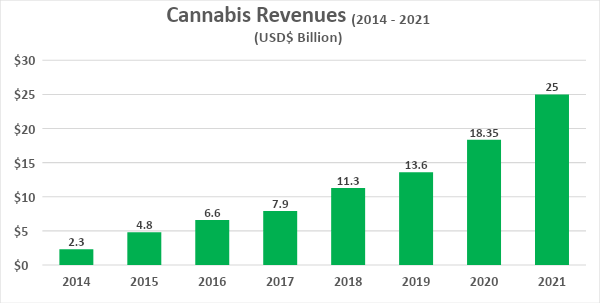

The first half of the year was a strong one for cannabis revenues. After a strong first quarter, with $5.9 billion in revenue, cannabis retailers are experiencing continued growth in Q2 with preliminary results coming in at $6.2 billion to $6.5 billion.

If this trend remains in the second half of the year, the cannabis retail sales are projected to be $24.5 to $25 billion for the year. This would reflect another cycle of 35% year-over-year growth.

Source: Whitney Economics, Leafly

While the industry has seen strong growth over the past year, this does not necessarily mean that the industry as a whole is in good shape. Retailers are struggling to make profits due in a large part to federal taxation. IRC 280E does not allow entities conducting business in federally illicit trade, such as cannabis, to write off common and ordinary deductions from their federal taxes. As a result, cannabis operators pay significantly more taxes than other businesses. This has long been an issue with the cannabis industry and organizations such as NCIA has been working tirelessly to address this, but as long as it remains a federal policy it will be negatively impacting the industry.

With over $12 billion in first-half revenues, cannabis retailers will be on the hook for $1.2 billion in federal taxes for the first half of the year alone. This is $756 million more than what “normal” businesses would pay. Cannabis retailers are forecasted to pay over $1.5 billion more in taxes in 2021 and, when combined with the rest of the supply chain, will pay over $2.2 billion in additional taxes in 2021.

| 280e Example of Impact on Retail | Normal Business | 280E Business | Comment | |

| Retail mid-Year Revenue | $12,000,000,000 | $12,000,000,000 | Based on data from Whitney Economics | |

| Cost of Goods Sold (COGS = 50%) | $6,000,000,000 | $6,000,000,000 | ||

| Ordinary and Necessary Expenses (30%) | $3,600,000,000 | $3,600,000,000 | Not allowed under 280e | |

| Real Pre-Tax Profit w/o 280e | $2,400,000,000 | $2,400,000,000 | ||

| Taxable Profit | $2,400,000,000 | $6,000,000,000 | Big difference in taxable rates | |

| Fed Tax @21% * | $504,000,000 | $1,260,000,000 | Retailers pay 150% more | |

| Effective tax rate | 21.0% | 52.5% | Some effective tax rates approach 60%-70% | |

| Net Annual Profit (Before State Tax and Debt Service) | $1,896,000,000 | $1,140,000,000 | A difference of $201,000 per year per retailer |

Source: Whitney Economics

*Assumes taxed at C-corporation rates

The effective tax rate increases significantly for retailers and in many cases exceeds 60% to 70%. The level of additional taxes that cannabis operators pay, over the course of the next five years, will increase by an average of $630 million per year for the industry if the business tax rates increase from 21% to 28%. Depending on how corporate tax policy negotiations are settled, things may go from bad to worse for cannabis retailers.

Based on sales data from 2020, there were over 7,550 licensed cannabis retailers in the U.S. with each retailer generating an average of $2.4 million per year. This is right around the amount of revenue required to be a sustainable retail business. In 2021, there have been roughly 1,000 more retailers licensed and even with an increase in sales, retailers are only forecasted to average $2.7 million per year.in sales. In fact, in 13 states, retailers are not projected to average the $2.4 million per year to remain viable. While retailers in some states may be OK, other retailers are not able to make ends meet.

IRC 280E will reduce cannabis retailers cash flow by $200,000 in 2021 and that $200,000 would go a long way in shoring up the finances and provide retailers with the breathing room they need to remain viable. 280E reform would allow retailers to pay for health care for more employees, hire more workers and expand their business. However, in the current environment, many cannabis operators will continue to struggle.

The key message here is that retailers are under duress due to 280E and policy reform in the area of federal taxes may make the difference between success and failure. The time for reform is now, before it is too late.

NCIA Deputy Director of Communications Bethany Moore checks in with what’s going on across the country with the National Cannabis Industry Association’s membership, board, allies, and staff. Join us every Friday here on Facebook for NCIA Today Live.

By Michelle Rutter Friberg, NCIA’s Deputy Director of Government Relations

While it’s become commonplace to hear cannabis come up in the halls of Congress, and increasingly so in the White House, there’s one branch of government that has been quieter on the topic: the Supreme Court (SCOTUS). However, this week, conservative Justice Clarence Thomas changed that when the court actually declined to weigh in on a 280E case.

Towards the end of 2020, a Colorado medical cannabis dispensary decided to ask the U.S. Supreme Court to review a lower-court decision that allowed the IRS to obtain business records in order to apply the 280E provision of the tax code. (Fun fact: NCIA member Jim Thorburn, of the Thorburn Law Group, was actually the counsel on record for this appeal!) According to the filings, the IRS overstepped its authority and also violated the company’s Fourth Amendment privacy rights. Some of the questions the company took to the highest court in the land:

Again, while SCOTUS declined to consider this appeal, Justice Thomas took issue with the underlying state/federal discrepancy in the country’s cannabis laws and issued a searing statement. He specifically discussed a 2005 ruling by SCOTUS in a case called Gonzales v. Raich. In this ruling, the court narrowly determined that the federal government could enforce prohibition against cannabis cultivation that took place wholly within California based on its authority to regulate interstate commerce. Check out a few excerpts from Justice Thomas’ statement below:

Just to be clear, these statements don’t change the law of the land, nor do they indicate formal policy developments. They do, however, show that the constantly shifting public perception of cannabis is affecting the way we as a society think about marijuana, which will, at some point, translate into policy. It’s no small feat that one of the most conservative justices on the Supreme Court has weighed in so substantially on this topic. Continue the momentum and join the movement with NCIA!

by Beau Whitney, NCIA’s Chief Economist

by Beau Whitney, NCIA’s Chief Economist

Supply tightness in the labor market represents a significant risk to cannabis operators heading into the summer months. With the potential of wage inflation adding to the costs of businesses, many operators that are struggling to make ends meet due to the economic stresses associated with 280E now face higher labor costs. This labor tightness and higher costs could not have come at the worst time.

The recent U.S. Bureau and Labor Statistics jobs report for May, published on Friday, June 4, 2021, indicated that there were 559,000 jobs added in the U.S. economy. This amount was lower than what analysts had predicted, but still strong nonetheless.

The report also showed that the labor force participation rates held steady which is a good sign that people are not getting too frustrated with their job search. The BLS data also indicated that there are still 9.3 million workers unemployed. Even with these higher numbers of displaced workers, this level is roughly 3.6 million workers higher than it was pre-pandemic when unemployment was at record lows. Considering that 1.1 million workers are on temporary layoff status, a remaining 2.5 million delta is a significant improvement relative to the 18.0 million workers displaced in April of 2020.

While there are differing opinions on policy on how to support the unemployed, the key point here is that the labor force is significantly tighter than what most believe and this could become a major issue for the cannabis industry.

Ever since the great recession, there have basically been more workers than jobs. As a result, employers could pick and choose who to hire and offer them lower wages. This recent job report indicates that now there are more jobs than workers, so workers now have the upper hand when it comes to supplying their labor. This is resulting in wage inflation and labor shortages.

This should be a concern for cannabis operators. Labor is one of the highest costs for operators and if wages continue to rise, this will put a squeeze on already slim margins. Reduced labor availability is already being felt across the country and could become very acute as more labor is required to handle increased retail sales and as the outdoor cultivation industry heads into harvest season. Product manufacturers and retailers are already seeing spot shortages even in states where cannabis operators receive living wages such as in Oregon and Colorado.

In reaction to these labor shortages, some MSOs are offering incentives and sign-on bonuses in order to attract workers, even for positions not requiring highly skilled workers. Unfortunately, smaller businesses may not be able to afford these types of incentives. As a result, this will continue to create competitive advantages for MSOs and to generate opportunities that favor larger firms over smaller ones.

Higher costs are not the only concern for cannabis operators. The heavy burden associated with paying higher federal business taxes due to 280E is already driving smaller operators out of the market or forcing them into consolidation with larger, well-financed firms. Smaller entities already have higher costs. The additional risks associated with labor shortages and higher wages could force more operators who are on the edge, into consolidation as well.

Operators who cannot absorb the higher costs for labor, may need to find additional areas in which to cut costs. Unfortunately, this may involve doing more with less (fewer workers), bringing in automation, or reducing product offerings (lower inventory overhead). A common area of cost-cutting is also healthcare, but in an environment of high competition for a limited labor pool, reducing benefits may not be an option.